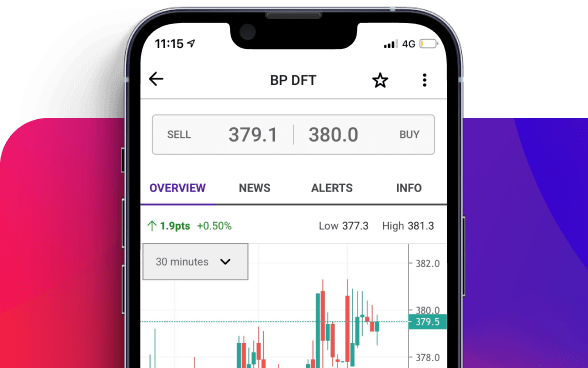

Spread betting, CFD and FX trading

From tax-free trading on spread bets* to a dedicated FX platform with an MT4 account, you can choose from an array of methods to support your trading goals. Now, Spread betting is available on TradingView.

Award-winning provider

Our range of products

Spread betting

Spread betting with City Index provides a tax-free* way to trade 8,500+ global markets.

- Tight spreads from 0.5 points on FX

- Overall Personal Wealth Provider 2021 - Online Personal Wealth Awards

- Pay no UK Capital Gains Tax or stamp duty*

CFDs

CFD trading with City Index gives you access to thousands of global markets including indices, shares, commodities and bonds.

- Competitive commission from 0.08%

- Choice of 5,000+ CFDs from one account

- Best CFD Provider 2023 - ADVFN International Financial Awards

*Spread Betting and CFD Trading are exempt from UK stamp duty. Spread betting is also exempt from UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

*Spread Betting and CFD Trading are exempt from UK stamp duty. Spread betting is also exempt from UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers a choice of over 13,500 global markets. Our spread betting and CFD accounts offer trading on:

Spread betting vs CFDs

City Index provides access to an educational hub designed for traders of all levels to learn about markets, what moves them, and how to trade them. With a comprehensive selection of articles and videos, traders can easily digest new trading techniques and brush up on their fundamentals.

Take our free, interactive course

Whether you are new to trading or want to brush up on strategy, visit our trading academy to hone your skills.

Over one million account holders* use us to trade the financial markets. Here's why.

*StoneX retail trading live and demo accounts globally in the last 2 years.