Reviewed by Patrick Foot, Senior Financial Writer.

In this guide, we’re going to cover all the essentials you need to know about financial spread betting. Scroll down to get started at the beginning, or follow these links to skip to a specific section:

- What is spread betting

- How spread betting works

- The spread, bet sizes and duration

- Going long vs going short

- Leverage and margin

- Spread betting risk management

- Benefits of spread betting

What is spread betting?

Spread betting is a financial derivative that enables you to bet on the future direction of financial markets instead of taking ownership of the assets themselves. It gets its name from the spread, or the difference between the buy and sell prices you’ll pay when you trade.

There are several benefits that come with spread betting. You can utilise leverage, which means you don’t have to pay for the full value of your position – you just need a deposit called your margin. You can go long or short on 1,000s of markets across FX, stocks, indices, commodities and more. And in the UK, spread betting is completely tax free.*

How does spread betting work?

Spread betting works using bets instead of the physical buying and selling of assets. In a traditional Apple trade, for example, you’d buy Apple stock, hold it then sell it. When spread betting, you’d achieve the same result by making a bet that Apple shares will increase in price.

The further that Apple moves in your chosen direction, the more profit you make. The further it moves against you, the greater your loss.

Let’s take a closer look at three key aspects of spread betting:

Understanding the spread, bet sizes and duration

What is the spread?

The spread is the difference between the buy and sell prices listed on a market, and it is how you’ll pay to open a spread betting position. Instead of paying a commission, all the costs to trade are covered in the difference between the buy and sell prices.

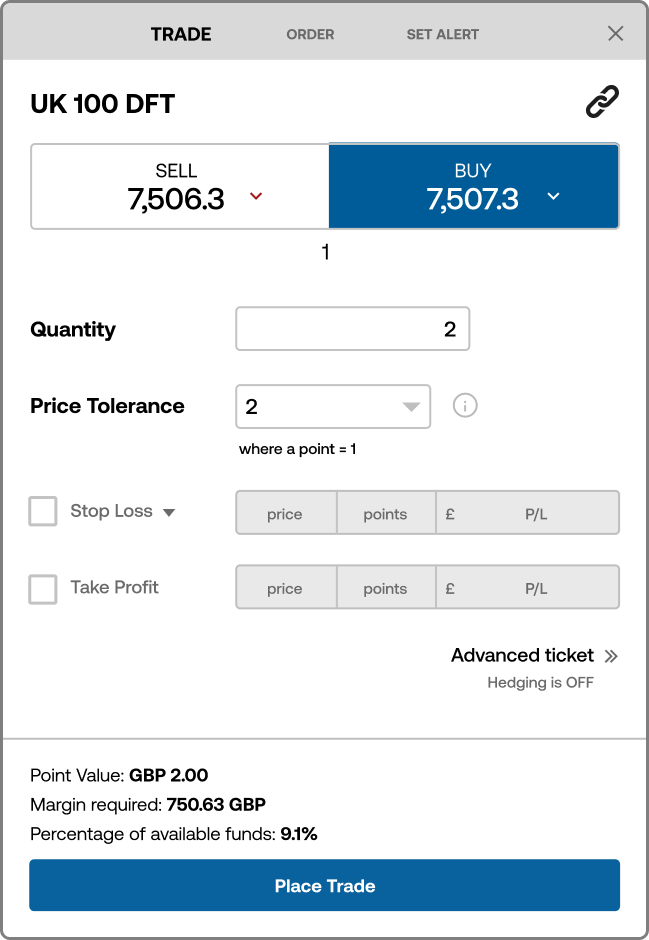

The FTSE 100, for instance, might have a spread of 1 point. This means that its buy price will be 0.5 points above its current market price, while its sell price will be 0.5 points lower. Your provider’s fees to open and close your position are all contained within that 1-point spread.

Learn more about the spread.

Bet sizes

Another key aspect to spread betting is your stake, which is also known as your bet size. Selecting a bet size lets you decide how many pounds per point to allocate to each trade, which dictates how much you’ll make or lose for every point that the market moves.

When spread betting, your stake will be in pounds per point. If you bet £5 per point that Apple stock will go up, then you’ll earn £5 for every point of upward movement. For every point it drops, you’ll lose £5.

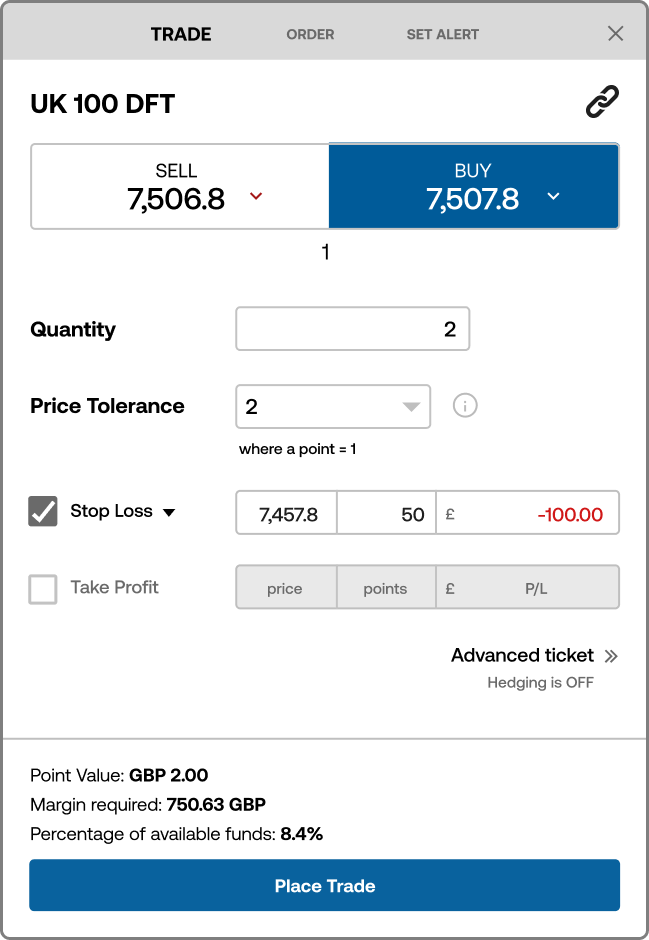

In our deal ticket above, you can see we’ve bet £2 per point.

Duration

There are two types of spread bet you can trade with City Index, depending on how long you want your position to be open for: daily funded trades (DFTs) and forwards.

- 1) DFTs have an expiry in the distant future, so you can decide when your position will close. However, each day you keep a DFT open, you’ll pay overnight financing. Learn more about the costs of spread betting.

- 2) Forwards expire on a set date, typically at the end of the quarter – although you can close your trade at any time before that as long as the market is open. You won’t pay overnight financing on a forward, but they have wider spreads instead.

Going long and going short in spread betting

Unlike traditional share dealing, with spread betting you can sell a market if you think it’s going to fall in value. In doing so, you can profit from the falling price. This is known as 'going short', and it’s the opposite of buying (going ‘long’).

When you open a spread bet, you’ll see two prices listed: the buy price and the sell price. Using this, you can choose whether you want to go long or short. If you think the value of your chosen market will go up, you click buy. If you think it will fall, you click sell.

Then, to close a spread bet, you trade in the opposite direction to when you opened it. So if you bought at the outset, you’d sell to exit – and vice versa.

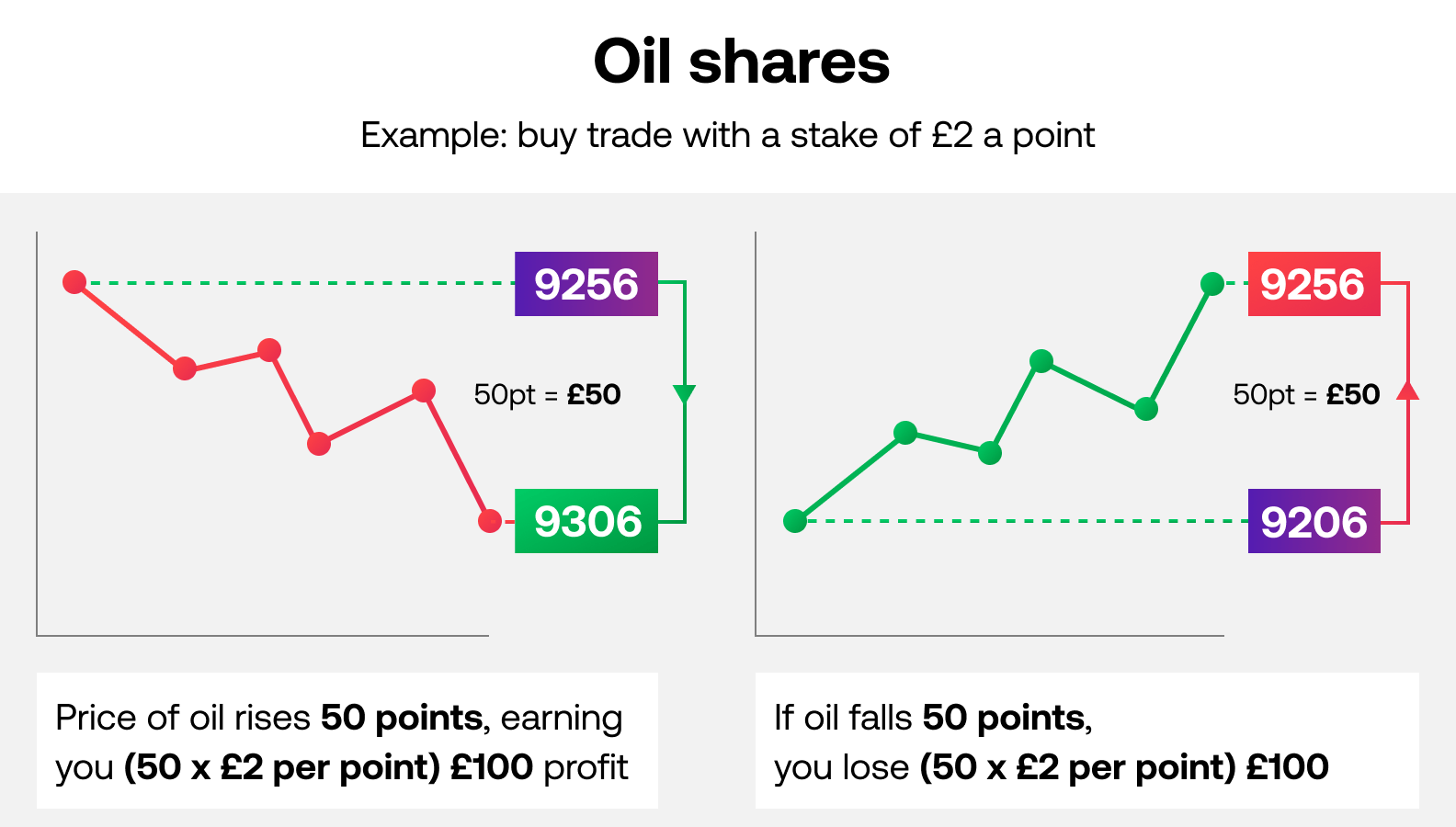

Spread betting example – buying oil

If you think that the price of oil is going to go up, then you could place a buy trade with a stake of £2 a point.

This will earn you £2 for every point the price of oil rises. However, should the price of oil fall, you would lose £2 for every point of downward movement.

You realise your profit or loss when you close your position. If oil had moved up 50 points from when you bought it, you would make (50 points x £2) £100. If it had moved down 50 points, you would lose £100.

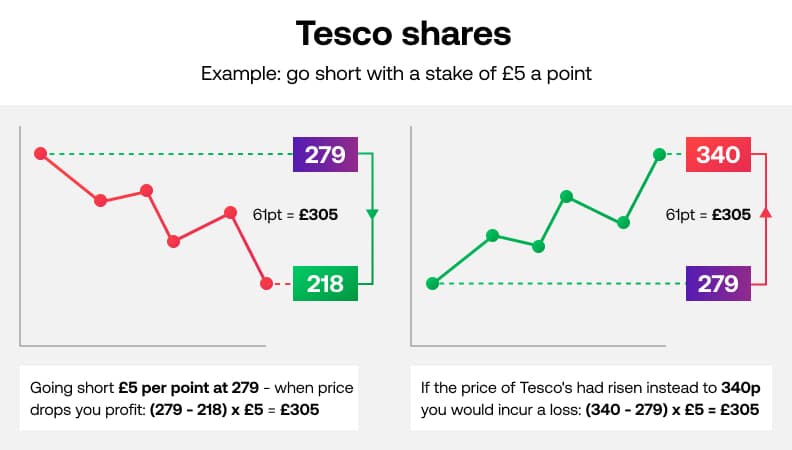

Spread betting going short example – selling Tesco

Tesco is trading at 279. You believe that the company’s share price will fall and decide to go short £5 per point at 279.

Tesco announces that it mistakenly overstated its pre-tax profits for the last six months by £250m. After two weeks, Tesco’s share price has plummeted to 218p as shareholders lose confidence in the retailer. You decide to close your trade at 218p.

Tesco stock has fallen 61 points. Your spread bet earns you £5 for every downward point of movement, so your trade would earn you (61 x 5) £305.

However, if Tesco stock had risen 61 points instead, you would lose £305. It’s also worth noting that this illustrative example does not include overnight financing charges.

Leverage and margin in spread betting

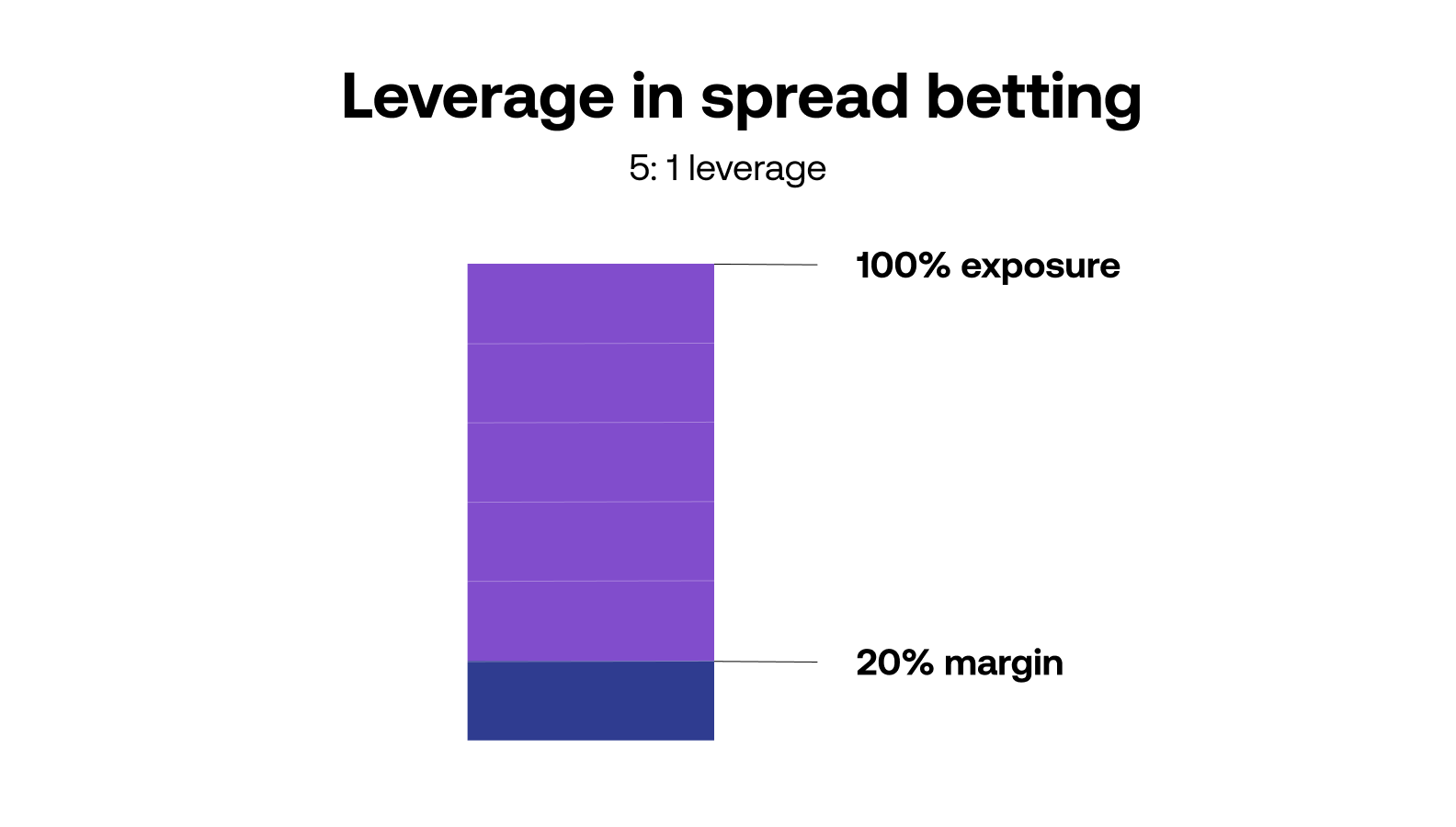

Leverage

Leverage is another important aspect of spread betting. It means you can put up a small amount of money to control a much larger amount. When spread betting on stocks, for example, you might only have to put up 20% of the total value of your position. This would mean that the market has a leverage factor of 5:1. Other markets, such as forex, may have leverage of 20:1 or higher.

Bear in mind, though, that leverage will amplify your profits and your losses – so it requires careful risk management.

Margin

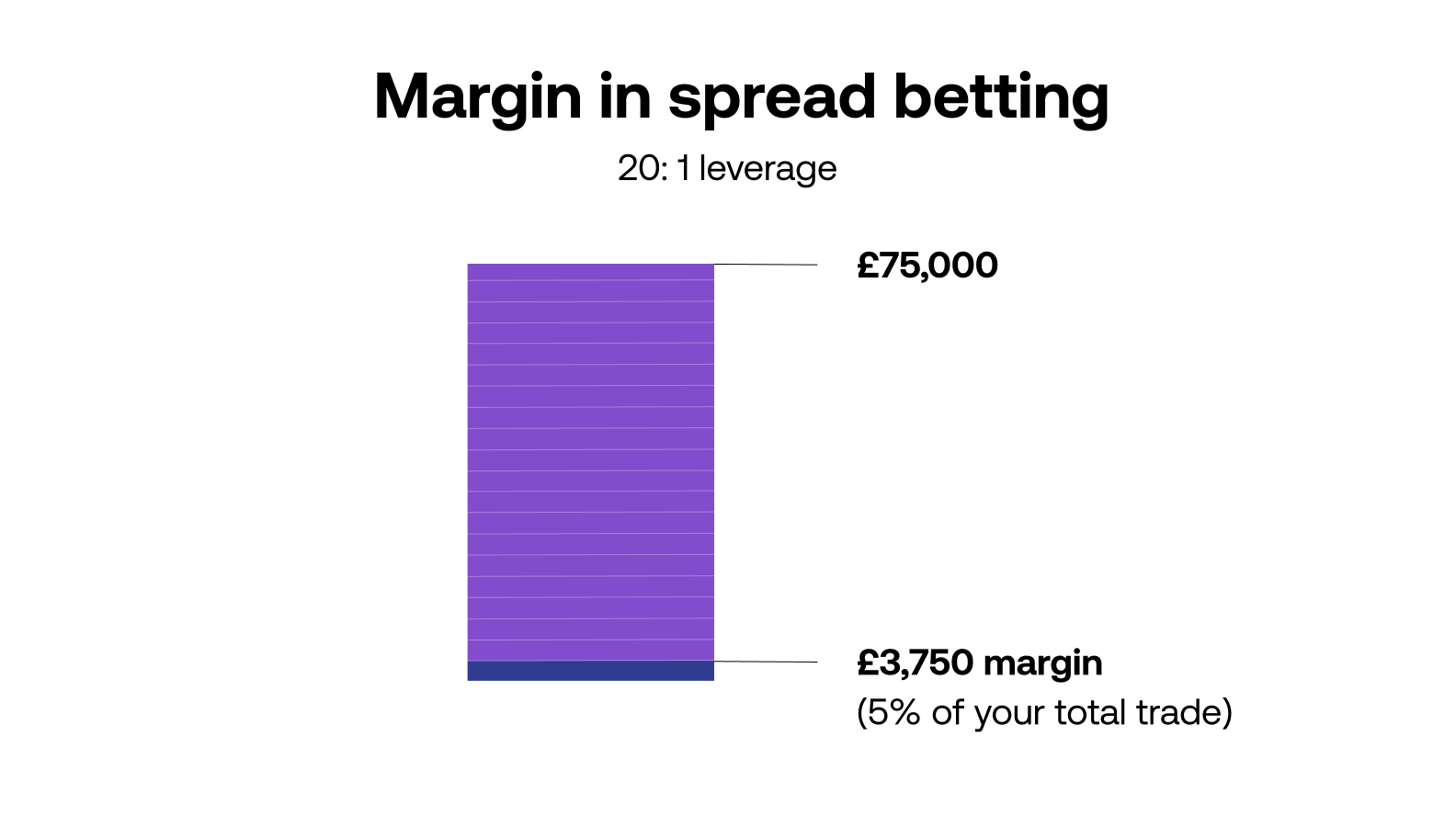

The deposit that you have to maintain in your account to keep a leveraged trade open is called your margin. When you’re trading with leverage, you’ll need to ensure that you always have sufficient margin in your account.

Say that you want to bet £10 per point on the FTSE 100 when it is trading at 7,500, with a leverage factor of 20:1. The total size of your position is (10 x 7500) £75,000, so you’d need to put up (5% of 75,000) £3,750 as margin – and ensure you always have at least 5% of your position’s full value in your account to keep it open.

Learn more about margin and leverage.

Spread betting risk management

When spread betting, it is crucial to maintain appropriate risk management. Typically, this involves identifying the risks that you may face when trading, then creating a risk management plan that sets out how to mitigate them for each position.

Stop losses are an essential tool to control risk. When you place a stop loss on an open position, you’re instructing your spread betting provider to automatically exit the trade if it moves a certain amount against you. This limits your risk by setting a maximum loss from any given position.

Learn more about spread betting risks.

The benefits of spread betting

A popular product for traders, spread betting is a way to actively participate in financial markets because it is:

- Tax efficient*

Pay no UK Stamp Duty or capital gains tax (CGT) - Commission free

Spread bets are free from commission charges - Leveraged

Use a relatively small deposit to control a larger value trade - Flexible

Trade on falling markets (going short) as well as rising markets (going long)

Plus, retail traders get negative balance protection – so you can’t lose more than you deposit.

Is spread betting right for me?

Spread betting may be ideal for investors who want the opportunity to try and make a better return for their money. However, it comes with significant risks to your capital and is not suitable for everyone. We strongly suggest trading on a demo account before you try spread betting on live markets.

Spread betting is ideal for people who want:

- To trade short-term opportunities

Spread bets are typically held open for a few days or weeks, rather than over the longer term - To make their own decisions on what to invest in

City Index provides an execution-only service. We will not advise you on what to trade or trade on your behalf - To diversify their portfolio

City Index offers over 1,000s of spread betting markets to speculate on including shares, commodities, FX and indices - To be as active or passive as they want

You can trade multiple times a day, or open just a few spread betting positions each quarter – it’s up to you

Learn more about spread betting

Want to learn more about spread betting? Explore these free resources to discover everything you need to know.

- Explore our guide to learn how to spread bet with examples

- Develop your spread betting knowledge with the City Index Trading Academy

- See our spread betting platforms in action

Alternatively, open a live trading account now – you can get started in less than five minutes.

*Spread Betting is exempt from UK stamp duty and UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.