Reviewed by Patrick Foot, Senior Financial Writer.

- What is leverage?

- Spread betting margin explained

- How margin works

- Margin calls

- Leverage and margin example

What is leverage?

Leverage is a tool used by traders to gain a larger market exposure without depositing extra capital. It’s key to trading several different derivatives – including futures, options and CFDs, as well as spread betting.

When you place a spread bet, you might be opening a position worth a lot of cash. Betting £10 per point long on EUR/GBP at 0.8560, for example, is the equivalent of trading £85,600.

But thanks to leverage, you won’t have to pay £85,600 to make the trade – you might only need £2850 in your account. This makes leverage a useful tool, helping individual retail traders take advantage of opportunities previously only available to institutional players.

However, leverage will also increase your risk. So it’s important to make sure you understand how much you are risking with each position and protect yourself against rapid market movement.

But before we get onto that, let’s examine the capital you will need to open a leveraged position: your margin.

Spread betting margin explained

Margin is the amount of money you are required to have in your account in order to open a leveraged position. Essentially, margin covers you against losses in your trade.

The amount you will be required to have in your account is expressed as a percentage of your total position size, and is known as the margin requirement. Different markets will have different margin requirements – with more volatile assets usually requiring larger deposits.

You can see the requirement for any City Index market on the ‘Market 360’ tab in our trading platform. All you need to get started is a live account or a demo account.

We’ll also tell you how much margin you need to open a position on the deal ticket, as soon as you’ve entered a size for your trade.

Learn more about how to start spread betting.

How margin works in spread betting

Say, for example, that you wanted to open a position worth £10,000 on a market with a 20% margin requirement. You’d need 20% of £10,000, or £2000, in your account to execute the trade.

Your profit or loss, though, would still be based on the full £10,000. Because you only deposited £2000 at the outset, your return would in effect be multiplied by five – regardless of whether you made or lost money.

If the value of your position rises to £11,000, then you’d have made £1000 by only depositing £2000. This is a 50% return, compared to just 10% if you’d had to pay the full £10,000 upfront.

What is a margin call?

A margin call is a warning that the capital in your account has dropped below the required minimum amount needed to keep your position open. When you’re on margin call, your positions are at risk of being automatically closed.

Returning to our example above, let’s imagine your £10,000 position dropped to £9000. If you had only deposited the minimum £2,000 to open the trade, then you’d only have £1,000 left, which isn’t enough to meet your margin requirement. At this point, you’d be on margin call.

This is why it's important to ensure you always have enough money in your account to cover your margin requirement – even if your positions start to move against you.

Margin calls and City Index

When you trade with City Index, your positions are at serious risk of being closed if your funds drop below 50% of the total required in your account as margin.

To ensure that doesn’t happen, keep an eye on the Total margin and Margin indicator figures at the top of your trading platform.

Total margin

The total margin figure tells you how much cash you need in your account to cover your current margin requirement. To protect yourself if markets move against you, we’d recommend maintaining at least double your current margin requirement in your account.

Margin indicator

The margin indicator tells you how your current account balance compares to your margin requirement.

If it falls below 50%, you no longer have enough funds in your account to cover your total margin. A warning symbol will be displayed next to the margin level if it drops below 80%

You have three options if you’re placed on margin call:

- Close out trades or reduce the size of positions to lower your margin requirement

- Add more funds to your account

- Do nothing, and we'll start closing positions on your behalf

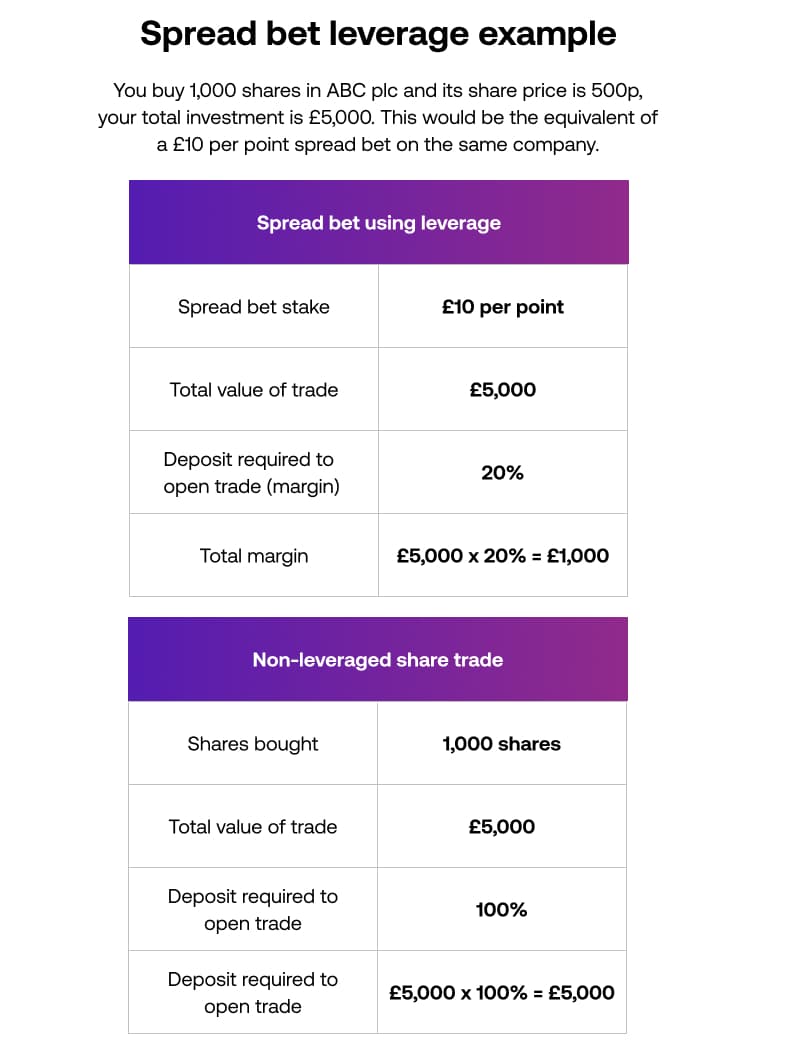

Spread betting margin example

To see how margin works in practice, let’s take a look at an example.

Say you want to bet £10 per point on ABC plc. Its share price is 500p, and its margin requirement is 20%.

The total value of your trade is (£10 x 500) £5000, so you need 20% of 5000 as margin: £1000. The equivalent when investing would be buying 1000 ABC shares, which would cost you (1000 x 500p) the full £5000.

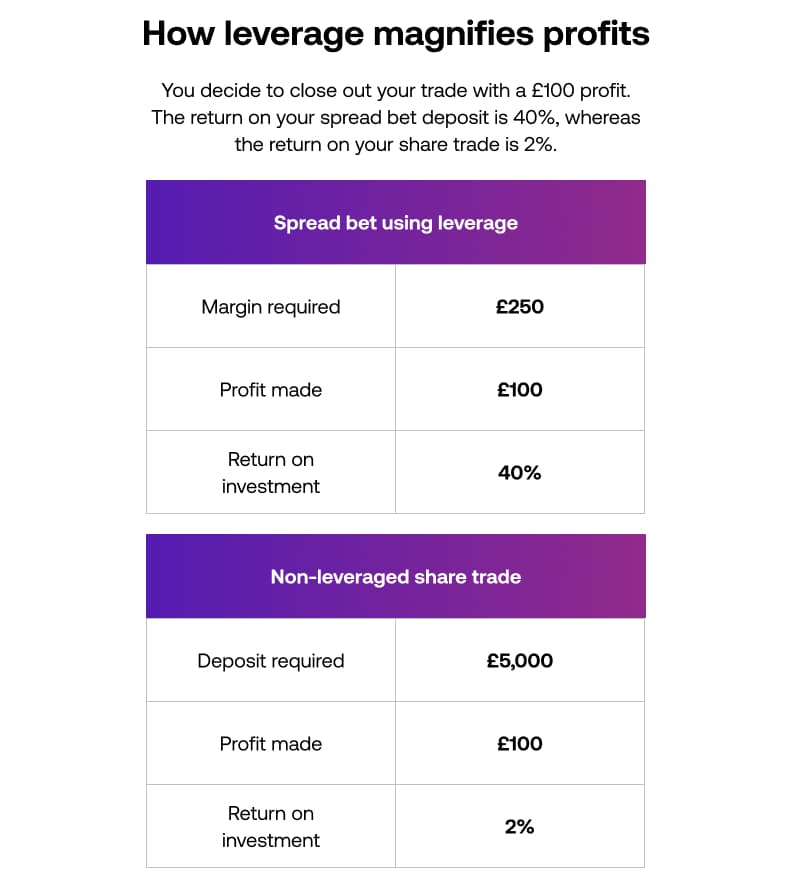

Margin magnifying profits

Your spread bet on ABC plc is successful and you decide to close out your trade with a £100 profit. You’ve made £100 from a deposit of £1000, a return of 10%.

With traditional share dealing, your profit would be the same: £100. But because you paid £5000 to open the position, it only equates to 2% of your original investment.

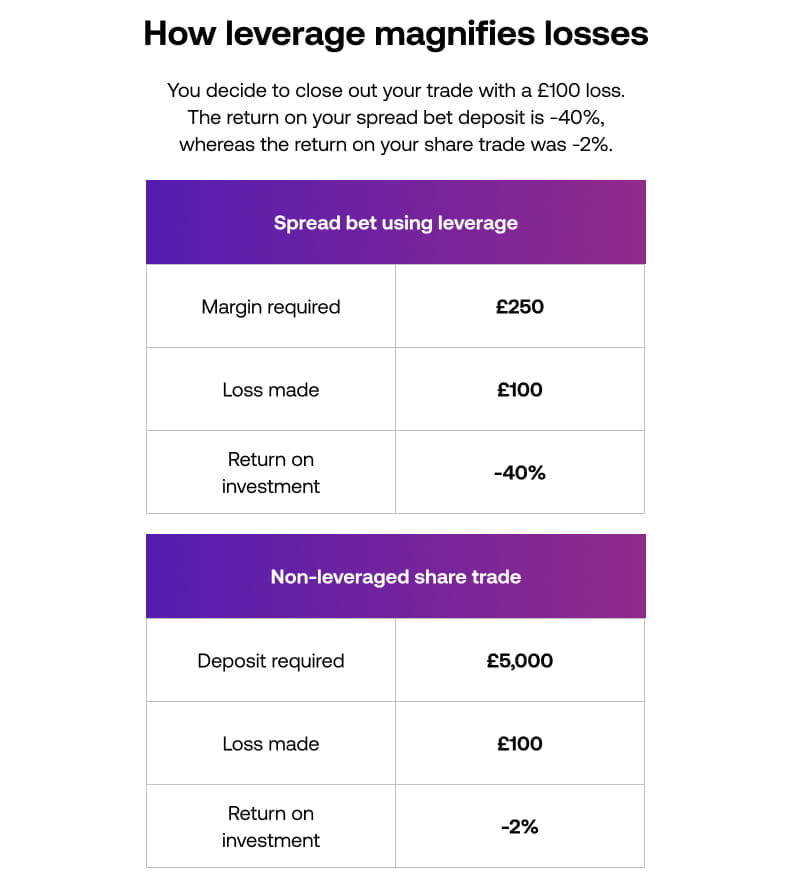

Margin magnifying losses

However, if your position had moved against you then the same effect wouldn’t work in your favour.

Say your trade in ABC plc is unsuccessful and you decide to close out your trade with a £100 loss. You’ve lost £100 from £1000, a -10% return. With investing, you’ve only lost 2%.

Want to see how leverage works for you? Open your free demo account.