Shares trading

-

Competitive pricing

Trade global shares as a CFD with commissions as low as 8 basis points

-

Range of markets

Access over 4,700 global shares including IPO markets

-

Tax-free trading

Pay no UK Capital Gains Tax or Stamp Duty when spread betting

Why trade shares with us?

-

Out of hours trading

Benefit from exclusive extended hours on major US shares with a spread betting or CFD trading account. -

Low-cost trading

No market data charges – we’re committed to lowering the cost of trading, so we offer free market data on live share prices. -

Flexible trading options

Choose from a range of account types that suit you – from spread betting to CFD trading.

Live pricing

Latest shares news

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers two ways to trade shares: spread betting and CFD trading. Traders typically choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

City Index offers two ways to trade shares: spread betting and CFD trading. Traders typically choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*.

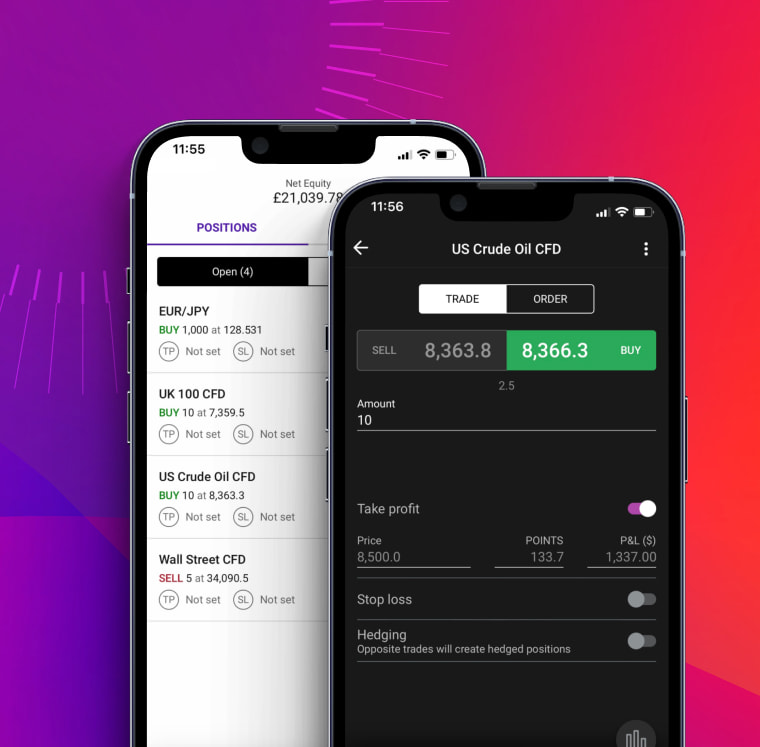

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade shares with City Index

If you believe that a share such as Vodafone will rise in price, you can place a buy trade. If the price rises, you will make a profit for every point that Vodafone moves up. If the market falls, then you will make a loss for every point the share price moves against you. Our trading platform tells you in real-time how much profit or loss you are making.

You can also trade on a falling share price. If you think Vodafone will fall in price, you sell to open the trade. Your position will stay open as long as you want it to, providing you have enough money in your account to cover the margin required to keep your trade open.

With City Index you can trade global shares as a spread bet or CFD.

How to trade shares

One of the main advantages of CFD trading and spread betting is the ability to trade on margin and utilise leverage. Learn about the benefits and risks here.

What are shares?

Shares trading involves speculating on the future price of a company’s value and performance. Discover what moves share prices and how to trade on thousands of shares markets.

What are ETFs?

Learn how to trade entire stock indices or sectors with exchange-traded funds, which are bought and sold on exchanges just like shares.

Shares FAQ

Can I buy and sell shares on the same day?

Yes, there are no minimum holding periods for shares, meaning you can buy and sell them on the same day. So if you’re interested in day trading shares, all you’ll need is a trading account with a regulated provider such as City Index.

You don’t have to stick to day trading shares, either. The high volatility and liquidity offered by both indices and forex makes both asset classes hugely popular among day traders. To try out both without risking any capital, open your free City Index demo.

Is share trading different to share dealing?

The terms share trading and share dealing are often used interchangeably, but they describe two different approaches to the stock markets. Share trading is short-term speculation using leveraged products, share dealing is longer-term investing.

When you trade shares, you typically use leveraged products such as CFDs and spread betting to take a view on share prices without taking ownership of the underlying stocks themselves. So you don’t build a portfolio, but instead aim to profit from short-term price movements – which could be up or down.

Share dealing, on the other hand, is the traditional method of buying stocks outright and adding them to your portfolio. This gives you a much longer-term view, and is usually only used to take advantage of upward price movement.

Find out more about the difference between spread betting and investing.

Can you make money from shares?

Yes, you can make money from share trading. Just like any other financial market, you’ll make a profit by closing trades at a more favourable level than when you opened them. If a trade moves against you, on the other hand, you’ll make a loss.

To make consistent profits from share trading you’ll need a solid strategy and plan. We’d always recommend that beginner traders head over to the City Index Academy to learn how the markets work, then try a risk-free City Index demo to test your performance with virtual capital.

If you have more questions visit the FAQ section or start a chat with our support.

Shares explained

What are shares?

Owning shares means that you own a piece of that company and as such, you are entitled to your share of the company's earnings as well as any voting rights attached to the stock.

Companies sell shares because they want to raise money, possibly to expand their business further. They can do this by taking out a loan or issuing bonds, or by selling part of the company - this is known as “issuing stock”.

Shareholders hope that after buying stock in that company, the company’s performance will improve and the shares will be worth more in the future. Because shares provide their owners with a share in a company, they are also referred to as equities, or the equity market. This is to differentiate them from bonds, which are also issued by companies, but do not provide equity.

There are two different ways to trade shares with City Index: as a spread bet or CFD trade, which are leveraged products and mean that you do not own any of the underlying assets.

Trading shares

An Initial Public Offering (IPO) is when a company’s stock is first issued. Markets often get excited by initial public offerings, or IPOs. This represents the first time a stock is listed on the market. Shares are sold initially via subscription, where investors can apply for shares. After that, they can be bought and sold on the stock market as usual on a stock exchange.

Shares can be bought or sold on a stock exchange, via a broker. Well known stock exchanges include the New York Stock Exchange (NYSE), London Stock Exchange (LSE) and NASDAQ.

Dividends

Shares pay out dividends to their owners. This is usually done on a regular basis – e.g. quarterly. It represents a share of the company’s profits being paid back to its ultimate owners, the shareholders. Companies are not obliged to pay dividends, but many do so on a regular basis, which means their stock is also prized because of its income characteristics.

- Special dividend – a dividend paid out by companies when they are feeling particularly cash-rich, not a regular dividend.

- Share split – a company splits shares into smaller ones, frequently because they are becoming too expensive which can limit trading.

Who trades shares?

Shares can be bought and sold openly by retail investors through a stock exchange using a broker. However many shares in companies are bought by financial institutions such as banks, pension funds and institutional investors.

What affects the price of a share?

The price of a share can be affected by many things, including:

Earnings

Earnings are the profits a company makes and has to report on a regular basis. Investors look at a company’s earnings to see whether they are better or worse than expectations.

News about a company

News about new products, changes in management, change in strategy can all affect the share price.

News on external factors

News regarding the company’s industry, peers and trading conditions can all affect the supply and demand and therefore price of that stock.

Corporate actions

The life of a big company is not a smooth one, and there are a number of important events that affect the price of their shares, which traders/investors need to be aware of:

- Mergers between companies or the acquisition of one company by another.

- Directors’ dealings – when directors buy or sell their own shares in the company.

- Rights issues – issuing more shares to the market to raise more money.

- Share buy-backs – when a company starts buying back its own shares, it will reduce the number of shares available on the market.

Trading on share prices with City Index

- City Index allows its customers to trade on the price of over 4,700 shares through spread bets and CFDs.

- Spread bets and CFDs allow trading without the costs of owning the actual shares.

- Trading shares as a spread bet means that you do not pay UK stamp duty or UK Capital Gains Tax*.

*Spread Betting and CFD Trading are exempt from UK stamp duty. Spread betting is also exempt from UK Capital Gains Tax. However, tax laws are subject to change and depend on individual circumstances. Please seek independent advice if necessary.