Options trading

Options are a dynamic product which can help you take advantage of any market condition. With the ability to generate income, reduce risk, or take advantage of your market views, options can help you achieve and leverage those goals.

Choose a CFD or spread betting account to trade a range of daily, monthly and quarterly options contracts.

-

Competitive pricing

Tight spreads, live streaming on 40+ markets including FX, indices, and commodities

-

Portfolio management

Use options in your portfolio to manage your risk and benefit from offsetting margin

-

Trade any market

Profit from any market environment whether trending, range bound or inactive

Why trade options with us?

-

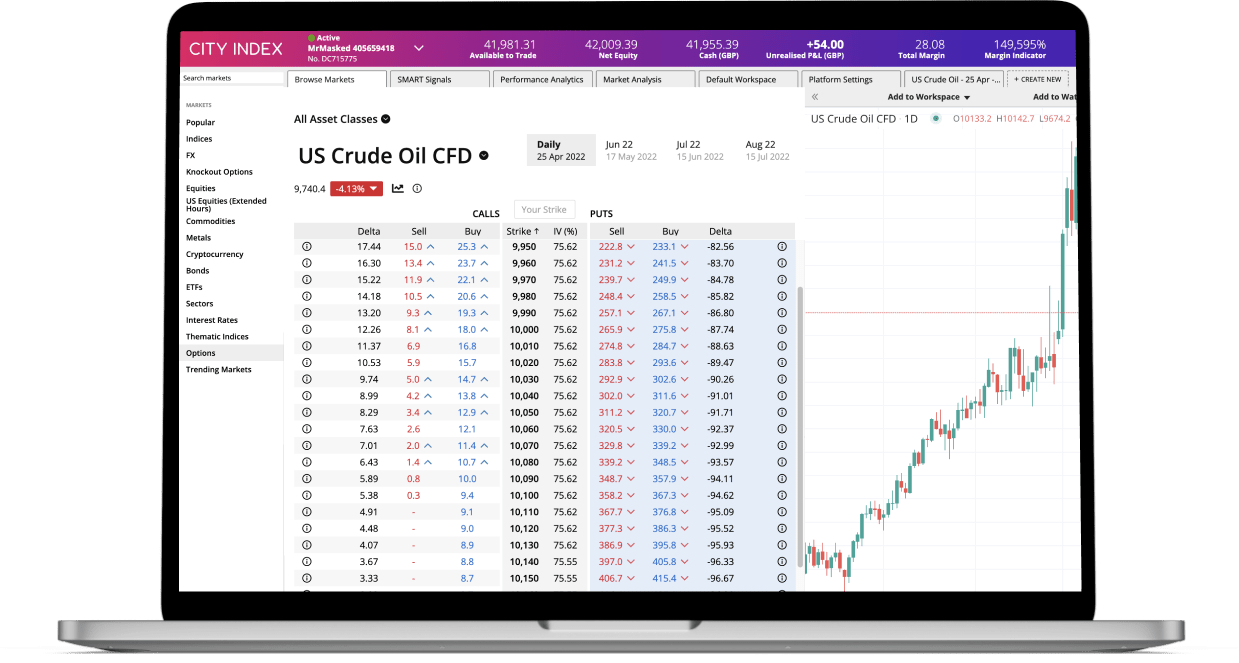

Options ladder

Access thousands of option strikes across multiple asset classes on our new intuitive options ladder within the platform. -

A globally trusted leader

Rely on our 40 years experience in the markets and backing from StoneX, a Fortune 100 company. -

Economic calendar

Benefit from our customisable economic calendar to manage your future exposure.

Options news and analysis

Latest research

Our performance in numbers

*StoneX retail trading live and demo accounts globally in the last 2 years.

City Index offers spread betting and CFD trading on options. Typically, UK traders choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*. See comparison table below.

City Index offers spread betting and CFD trading on options. Typically, UK traders choose spread betting because any profits are free from UK Capital Gains Tax (CGT)*. See comparison table below.

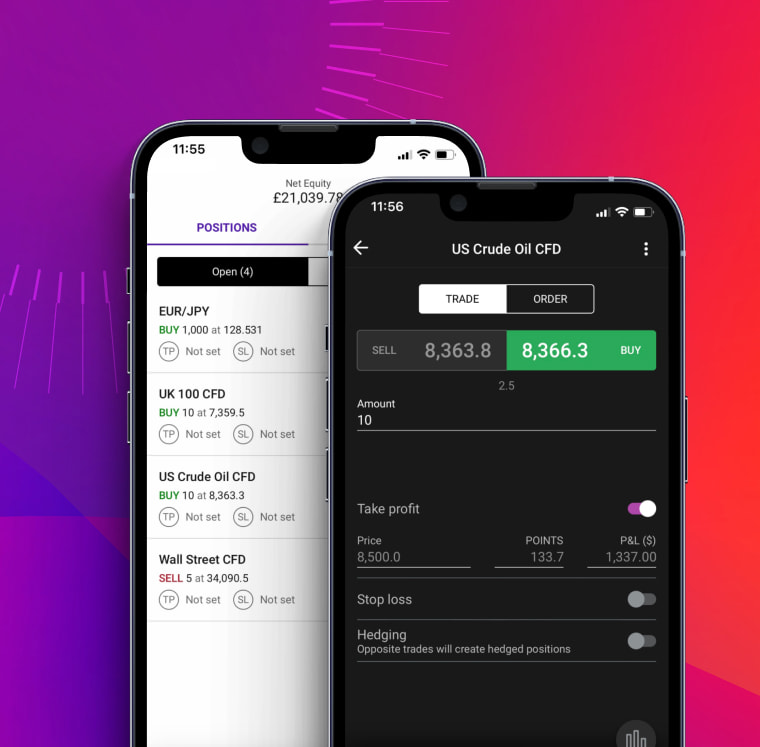

Mobile trading app

Seize trading opportunities with our most easy-to-use mobile app to date, with simple one-swipe dealing, advanced charting, and seamless execution. Available on Android and iOS.

TradingView charts

Complete with one-swipe trading, custom indicators, alerts and drawing tools.

Trading Central

Harness the power of technical analysis and access real-time trade ideas on our most popular markets.

Performance Analytics

Gain deeper insight into your trading and discover how you could improve your performance.

How to trade options

Options markets offer traders a wide range of opportunities across markets including indices, commodities, forex and metals.

At City Index you can strengthen your investment portfolio by trading options via a CFD or spread betting account with daily, monthly and quarterly contracts available. You get full access to our intuitive options ladder via the platform and mobile apps for iOS and Android.

Options trading has recently become more popular for retail traders because of the ease of access, competitive pricing on offer, and reduced risks. 2021 was a breakout year for options according to CBOE Global Markets, with a 31% increase in daily option trading volume.

What are options?

Want to trade options but don’t know where to start? Discover what options are and how to open your first position with our complete guide to options trading.

Options pricing

Options traders often refer to delta, vega, theta, gamma and rho to help assess the price of their contracts. But what do these terms mean? Discover what the Greeks are and how they impact the price of an option.

Options terminology

The options market is full of complex terms and jargon that can act as a barrier to trading for beginners. Discover the meaning of the most commonly used options terminology to help you get started.

Options FAQ

What is the strike price of an option?

The strike price of an option is the level at which you can execute it, which will dictate whether you earn a profit or loss from your position. It tells you how much you can buy or sell the underlying market for according to the terms of the option.

Buying a gold call option with a strike of $13,000, for instance, enables you to buy gold at $13,000. If gold rises above $13,000, you can execute your option and buy it for a discount. If it doesn’t, then the option is worthless.

A gold put option with the same strike, on the other hand, gives the holder the right to sell gold at $13,000. If gold is priced below $13,000, you can sell it for more than the current market price.

How do options work?

Options work by enabling you to buy or sell a market at a predefined price, known as the option’s strike price. Buying a FTSE 100 call option with a strike of 7200, for example, means you can buy the FTSE at 7200 – whatever price the index is currently at.

To get the right to buy the FTSE at 7200, you’ll pay a premium. And each option comes with an expiry date, after which it can’t be executed and becomes worthless. If you don’t want to use your option – say, because the FTSE 100 stays well below 7200, so executing would earn you a loss – you can leave it to expire, and all you lose is your premium.

There are two types of options: calls and puts. Buying a call gives you the right to buy a market at the strike price and buying a put gives you the right to sell it.

As well as buying options, you can sell them. This means you’re giving someone else the right to:

- Buy a market from you at the strike price (if you’re selling a call)

- Sell a market to you at the strike price (if you’re selling a put)

In return, you’ll pocket the premium.

How do I trade options?

Options are bought and sold on exchanges – just like futures – so to trade them in the open market you’ll need an account with an options broker. Alternatively, you can use your City Index account to speculate on the price movements of options alongside 1000s of other markets.

With City Index, you trade options just like other markets – using CFDs or spread betting. You can get exposure to the price movements of a huge range of options, covering 20+ markets and a full chain of strikes and expiries.

You’ll be able to go long on options to profit if their premium rises, or short to profit if it falls. If the option moves against you, you’ll make a loss.

If you have more questions visit the FAQ section or start a chat with our support.

Options explained

What are options?

Options are a financial derivative instrument that gives you the right, but not the obligation, to purchase or sell an asset at a specified price, known as the strike price, before a certain expiry date.

They differ from futures because there is no obligation on behalf of a trader to take delivery of an asset when the option expires. When you buy an options contract it comes with a premium – this is the price of owning the option. The premium acts a bit like insurance, you pay for the right to exercise the option in the future.

Like futures, options have a limited shelf life – they have a date at which they expire. If your market’s price moves beyond the option’s price before it expires, then you can exercise it and buy or sell the market at a better price than what is currently available.

Options exist for a broad range of asset classes including indices and commodities.

Why use options?

Options are frequently used by investors to help them manage the risk in their portfolios.

For example, an investor with a portfolio of UK shares might buy a put option on the UK 100. This will go up in value as the UK 100 falls.

Options can be more flexible than futures. They come in both buy (call) and sell (put) versions, and you can decide whether to exercise your option or not.

Types of option contracts

There are two types of option contracts which can be bought to speculate on the direction of an asset:

Call option

This gives you the right to BUY an asset at a future price. Buyers of a call option are speculating on an increase in the price of the asset. They have the right to buy the asset at the strike price of the contract.

Put option

This gives you the right to SELL an asset at a future price. Buyers of a put option are speculating on a decline in the price of the asset. They have the right to sell the asset at the strike price of the contract.

Options trading example

On Jan 1st, the stock price of company ABC is $57 and the premium is $2 for a February 60 Call. This indicates that the expiration of the contract is the third Friday of February and the strike price is $60.

When you buy an option, it represents 100 shares, so the total price of the options contract is $2 x 100 =$200.

Loss making option

When the stock price is $57 it’s worth less than the $60 strike price. You have also paid $200 premium. If the stock price declined further to $55 in the next couple of weeks, you would choose not to exercise the option because you could buy the stock for $5 cheaper per share on the stock market. Overall, you will have lost your premium of $200.

Profit making option

If the stock price rose to $67 in 3 weeks, the options contract will have increased and you would be able to sell your option and make a profit. You would make a profit of $700 minus the $200 premium.

Exchange traded options

Options are traded in a standardised format on options exchanges. The largest options exchange in the world is the Chicago Board Options Exchange (CBOE). Options trading can also take place directly with another counterparty, this is known as over-the-counter (OTC).

Trading strategies

There are many different types of trading strategies that traders use to profit and hedge their risk. Find out about some options trading strategies.