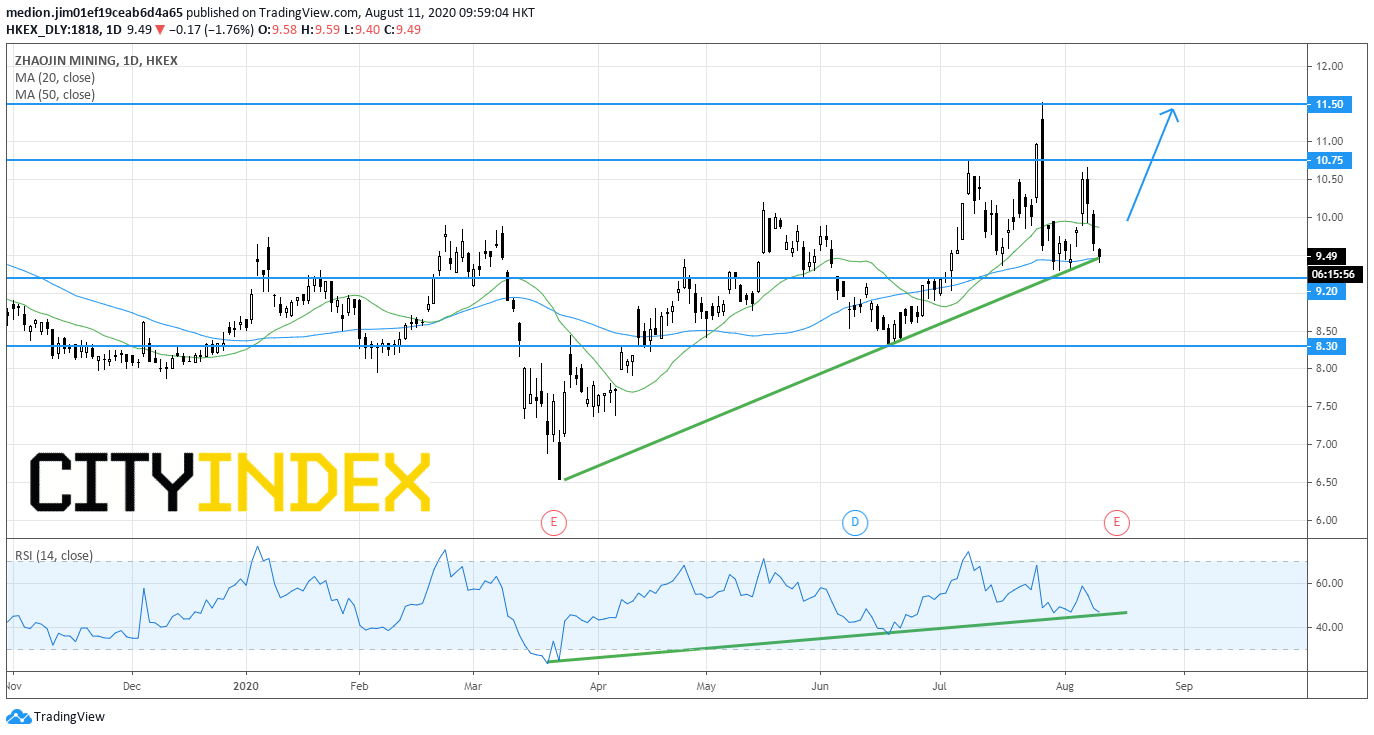

Zhaojin Mining (1818.HK): Bullish Bias Remains

Zhaojin Mining (1818.HK) rose more than 50% from March low, lifted by the rise of gold prices. Meanwhile, the Hang Seng Index is only up around 10% from March low. It suggests that Zhaojin Mining performs better than the market.

Recently, Morgan Stanley lifted the company target price by 10% to HK$11.98 and expected the gold stock sector would continue the outperformance. The bank also said gold price is expected to be higher for longer due to investor demand.

From a technical point of view, the stock is testing a rising trend line drawn from March low and the 50-day moving average. In addition, the relative strength index is also testing an ascending trend line. Therefore, cautious would be advised. Readers should focus on the price action after testing the trend line.

Bullish readers could set the nearest support level at HK$9.20 (just below the previous low and the rising trend line), while the resistance levels would be located at HK$10.75 and HK$11.50. On the other hand, a break below HK$9.20 would indicate the breakout of the rising trend line and trigger a return to the next support level at HK$8.30.

Source: GAIN Capital, TradingView

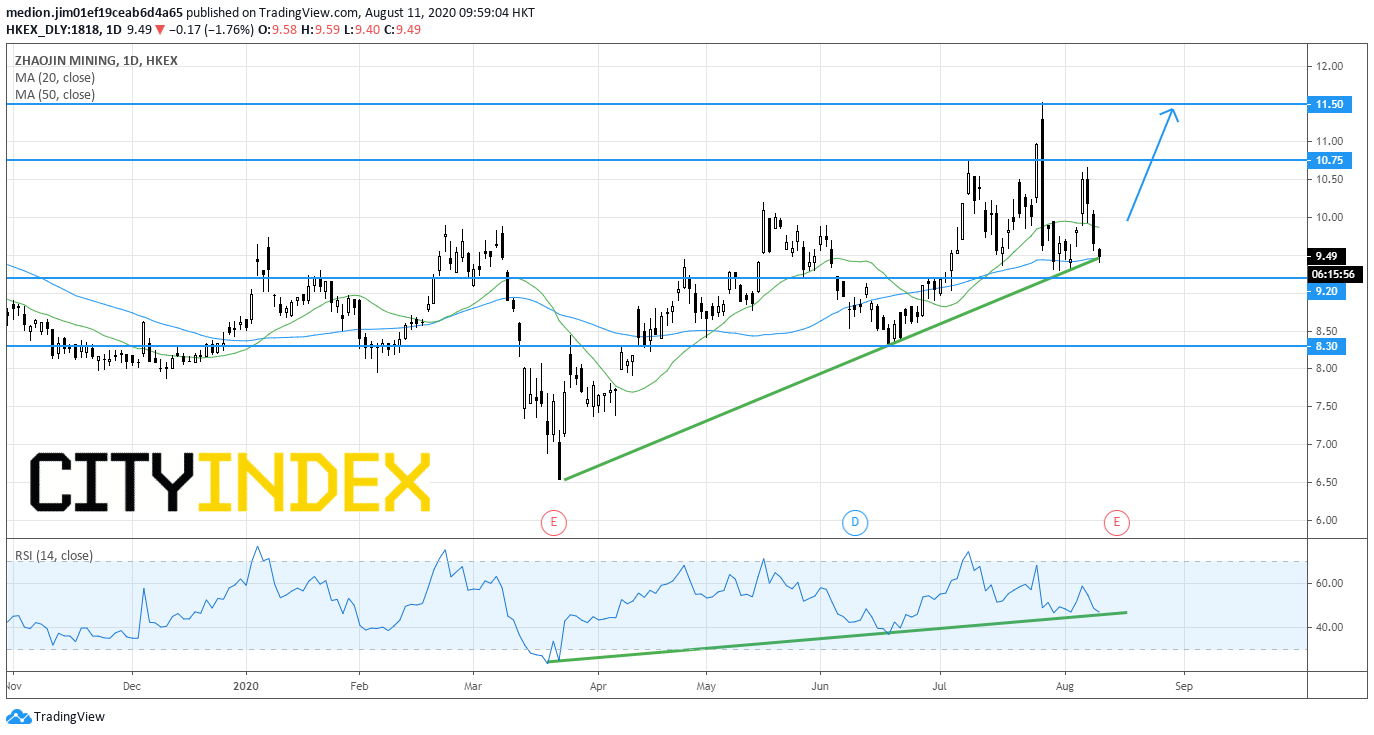

Recently, Morgan Stanley lifted the company target price by 10% to HK$11.98 and expected the gold stock sector would continue the outperformance. The bank also said gold price is expected to be higher for longer due to investor demand.

From a technical point of view, the stock is testing a rising trend line drawn from March low and the 50-day moving average. In addition, the relative strength index is also testing an ascending trend line. Therefore, cautious would be advised. Readers should focus on the price action after testing the trend line.

Bullish readers could set the nearest support level at HK$9.20 (just below the previous low and the rising trend line), while the resistance levels would be located at HK$10.75 and HK$11.50. On the other hand, a break below HK$9.20 would indicate the breakout of the rising trend line and trigger a return to the next support level at HK$8.30.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM