Yen Weakens on Downbeat Industrial Data

The USD/JPY holds up well after the Japanese government released worse-than-expected economic data.

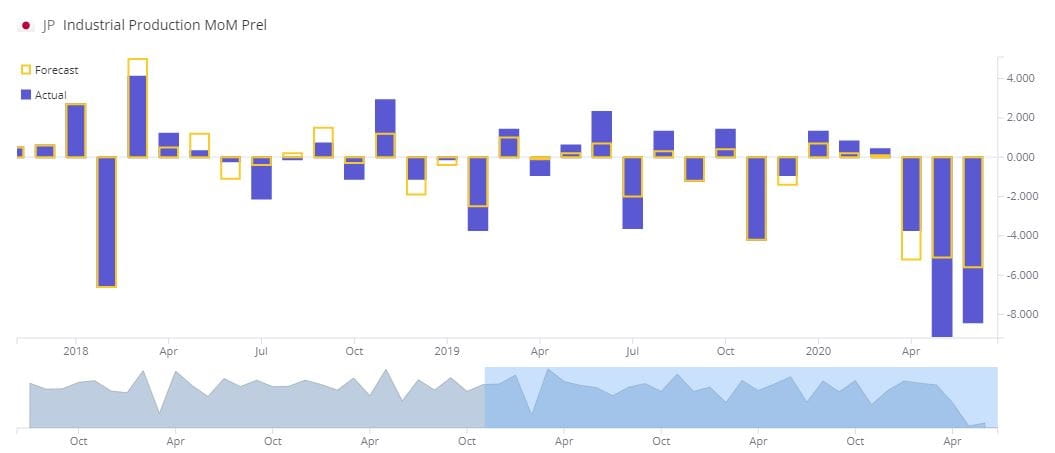

Japan's industrial production dropped 8.4% on month in May (-5.7% expected), mainly dragged by automakers cutting back production. This followed a 9.8% contraction in April. Global demand remained weak in May thanks to coronavirus-induced lockdown of various major economies, causing severe impact to Japan's export-reliant manufacturing sector.

Japan Industrial Production (month-on-month):

Source: Trading Economics

Meanwhile, the situation seemed to improve a bit in May (-8.4% vs -9.8% in April), and investors should watch closely to see if the improvement continues amid reopening of economies in the U.S. and around the world.

Also, Japan's jobless rate rose to 2.9% in May (2.8% expected) from 2.6% in April, the highest level in three years.

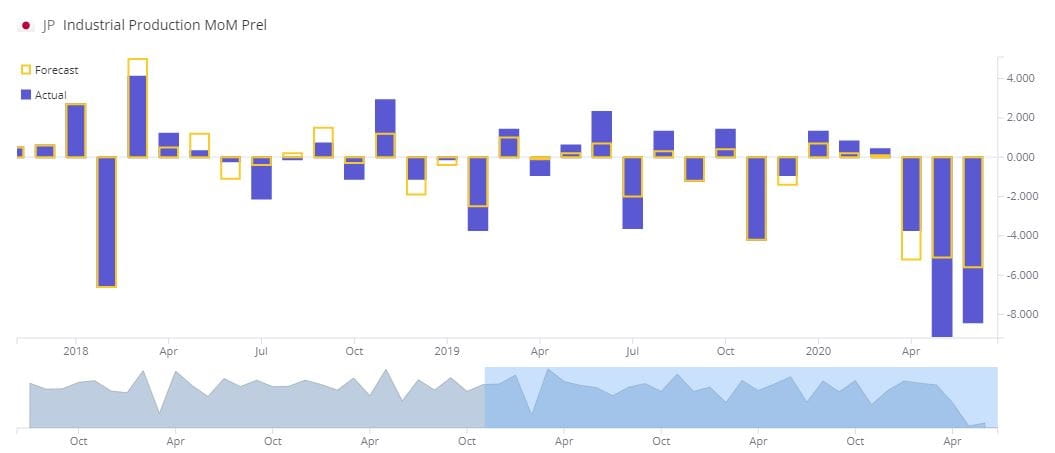

On an Intraday 30-minute Chart, USD/JPY remains on the upside after rebounding from a low of 107.04 seen yesterday.

Source: GAIN Capital, TradingView

Currently USD/JPY stays at levels above both 20-period and 50-period moving averages.

And it is striking against the Upper Bollinger Band.

Therefore, the Technical Configuration still favor a Bullish intraday bias.

Overhead Resistance at expected at 107.90 (around the high of yesterday).

In case USD/JPY breaks above 107.90, it could encounter Further Resistance at 108.25.

Bullish investors should regard the level of 107.40 (a previous price resistance) as the Key Support (Stop-loss Level).

Japan's industrial production dropped 8.4% on month in May (-5.7% expected), mainly dragged by automakers cutting back production. This followed a 9.8% contraction in April. Global demand remained weak in May thanks to coronavirus-induced lockdown of various major economies, causing severe impact to Japan's export-reliant manufacturing sector.

Japan Industrial Production (month-on-month):

Source: Trading Economics

Meanwhile, the situation seemed to improve a bit in May (-8.4% vs -9.8% in April), and investors should watch closely to see if the improvement continues amid reopening of economies in the U.S. and around the world.

Also, Japan's jobless rate rose to 2.9% in May (2.8% expected) from 2.6% in April, the highest level in three years.

On an Intraday 30-minute Chart, USD/JPY remains on the upside after rebounding from a low of 107.04 seen yesterday.

Source: GAIN Capital, TradingView

Currently USD/JPY stays at levels above both 20-period and 50-period moving averages.

And it is striking against the Upper Bollinger Band.

Therefore, the Technical Configuration still favor a Bullish intraday bias.

Overhead Resistance at expected at 107.90 (around the high of yesterday).

In case USD/JPY breaks above 107.90, it could encounter Further Resistance at 108.25.

Bullish investors should regard the level of 107.40 (a previous price resistance) as the Key Support (Stop-loss Level).