Xinyi Glass (868.HK) Holds on the Upside Despite a Worsen Result

Xinyi Glass (868.HK), a glass producer, announced that 1H net income dropped 34.9% on year to 1.38 billion Hong Kong dollars on revenue of 7.13 billion Hong Kong dollars, down 4.2%.

Recently, Morgan Stanley expected Xinyi glass shares would have significant upside despite their recent rally, giving the company new overweight among other Chinese glass markers. The bank said the construction glass segment will benefit from property project completion in the second half year.

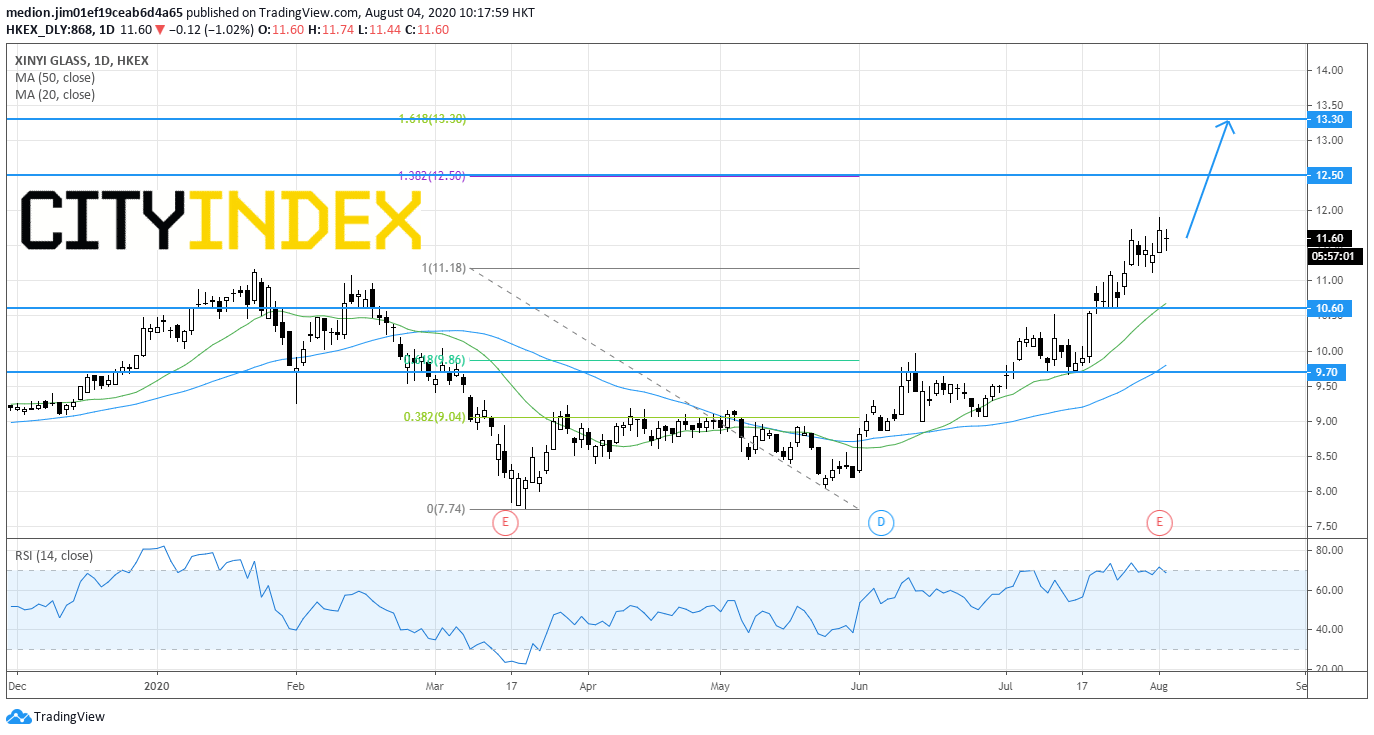

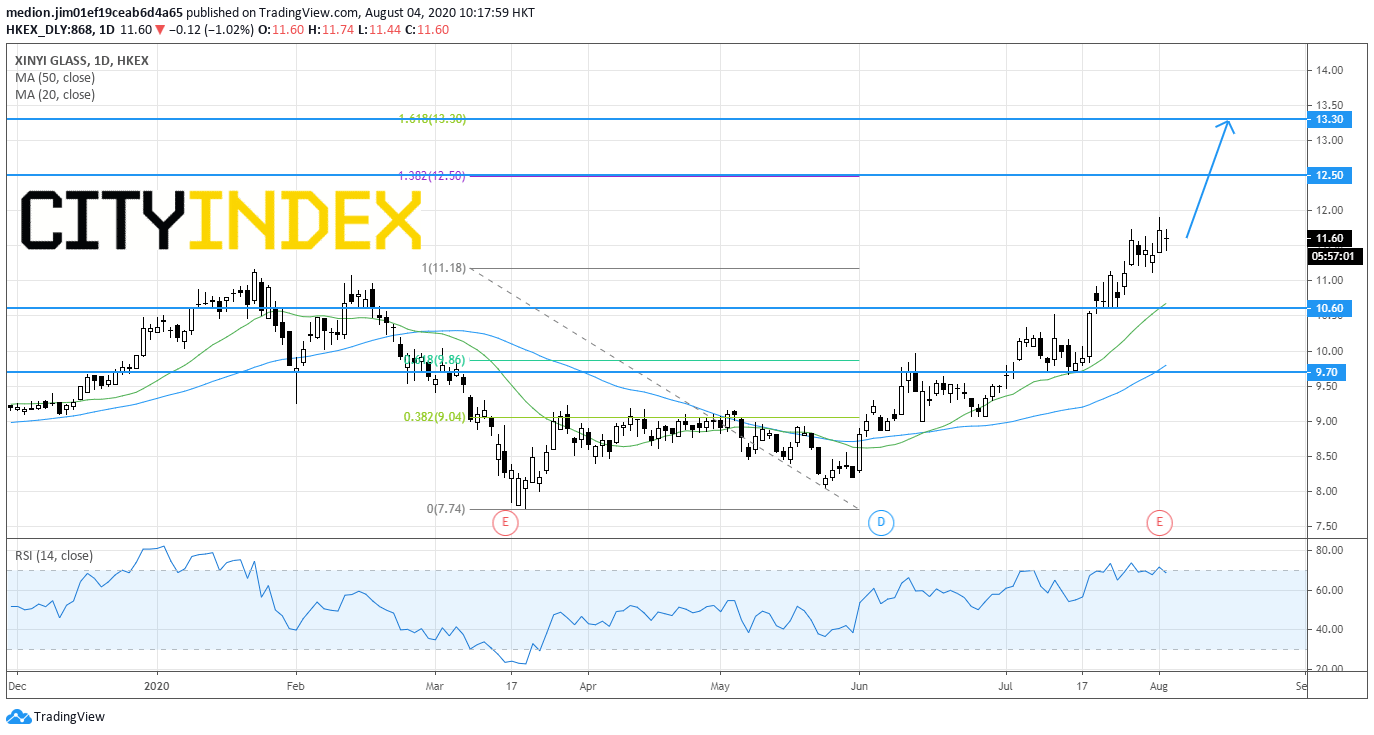

From a technical point of view, the company is holding on the upside after breaking the previous 52-week high at HK$11.16.

In fact, the stock stays above the rising 20-day moving average. The relative strength index has not shown any bearish divergence signal.

Bullish readers could set the support level at HK$ 10.6 (around 20-day moving average), while resistance levels would be located at HK$12.5 (138.2% expansion) and HK$13.3 (161.8% expansion)

Source: GAIN Capital, TradingView

Recently, Morgan Stanley expected Xinyi glass shares would have significant upside despite their recent rally, giving the company new overweight among other Chinese glass markers. The bank said the construction glass segment will benefit from property project completion in the second half year.

From a technical point of view, the company is holding on the upside after breaking the previous 52-week high at HK$11.16.

In fact, the stock stays above the rising 20-day moving average. The relative strength index has not shown any bearish divergence signal.

Bullish readers could set the support level at HK$ 10.6 (around 20-day moving average), while resistance levels would be located at HK$12.5 (138.2% expansion) and HK$13.3 (161.8% expansion)

Source: GAIN Capital, TradingView