Xiaomi is back!

Under Donald Trump’s presidency, the US Department of Defense added Xiaomi Corp to a list which required Americans to sell their interests in the firm. However, on Monday a federal judge suspended the US investment ban, noting that the US government’s process for determining that the firm was tied to the Chinese military was “deeply flawed”.

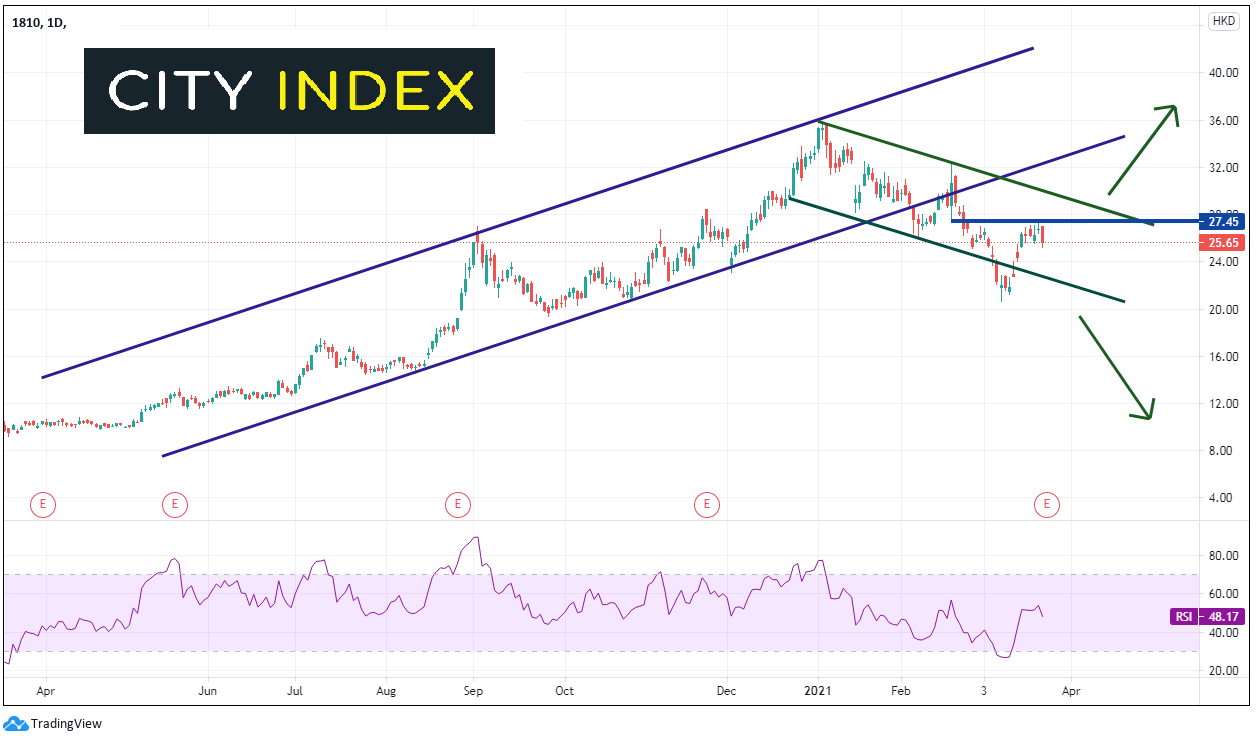

Xiaomi Corp had been trading in an orderly, upward sloping channel since March 2020 (blue). The stock put in a high of 35.90 on January 5th, near the top trendline of the channel, and began moving lower. Xiaomi broke below the bottom trendline of the upward sloping channel and began forming a downward sloping channel (green). After briefly breaking below the bottom trendline of the downward sloping channel on March 8th, price continued to near the 61.8% Fibonacci level from the March 19th, 2020 lows to the January 5th high to 20.60. The RSI had moved into oversold territory and the stock bounced back to the middle of the channel and horizontal resistance near 27.45.

Source: Tradingview, City Index

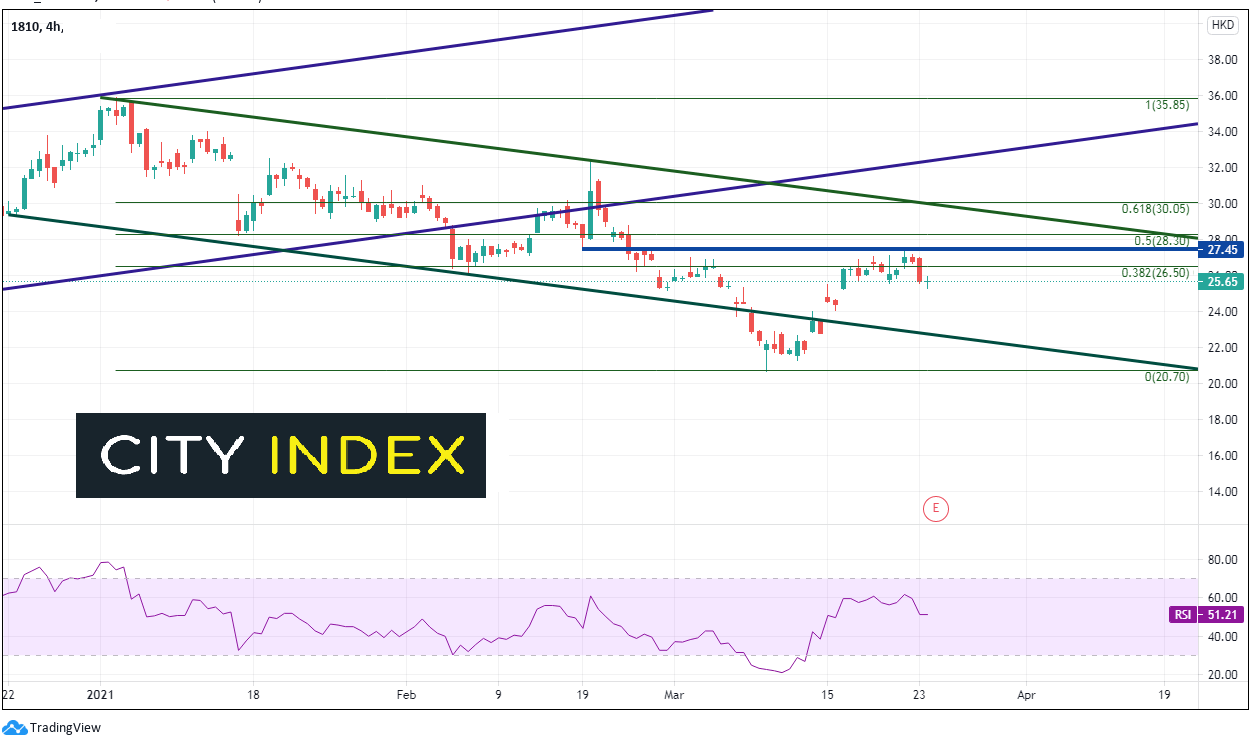

On a 240-minute timeframe, resistance is just above at the 50% retracement level from the January 5th highs to the March 9th lows, at 28.30. Above there is a confluence of resistance at the 61.8% Fibonacci retracement level from the same timeframe, the top trendline of the downward sloping channel, and the psychological round number resistance level at 30.00. First support is below at the bottom trendline of the downward sloping channel near 22.65 and then the March 9th lows at 20.70.

Source: Tradingview, City Index

Although Xiaomi Corp has been the subject of controversy in the US surrounding its involvement with the Chinese military, then stock has been trading well, within orderly channels. The bigger question now for the stock is this: Was the pullback from the January highs to the March lows just a correction within a larger trend or will Xiaomi Corp move lower towards the March 2020 lows?

Learn more about equity trading opportunities.