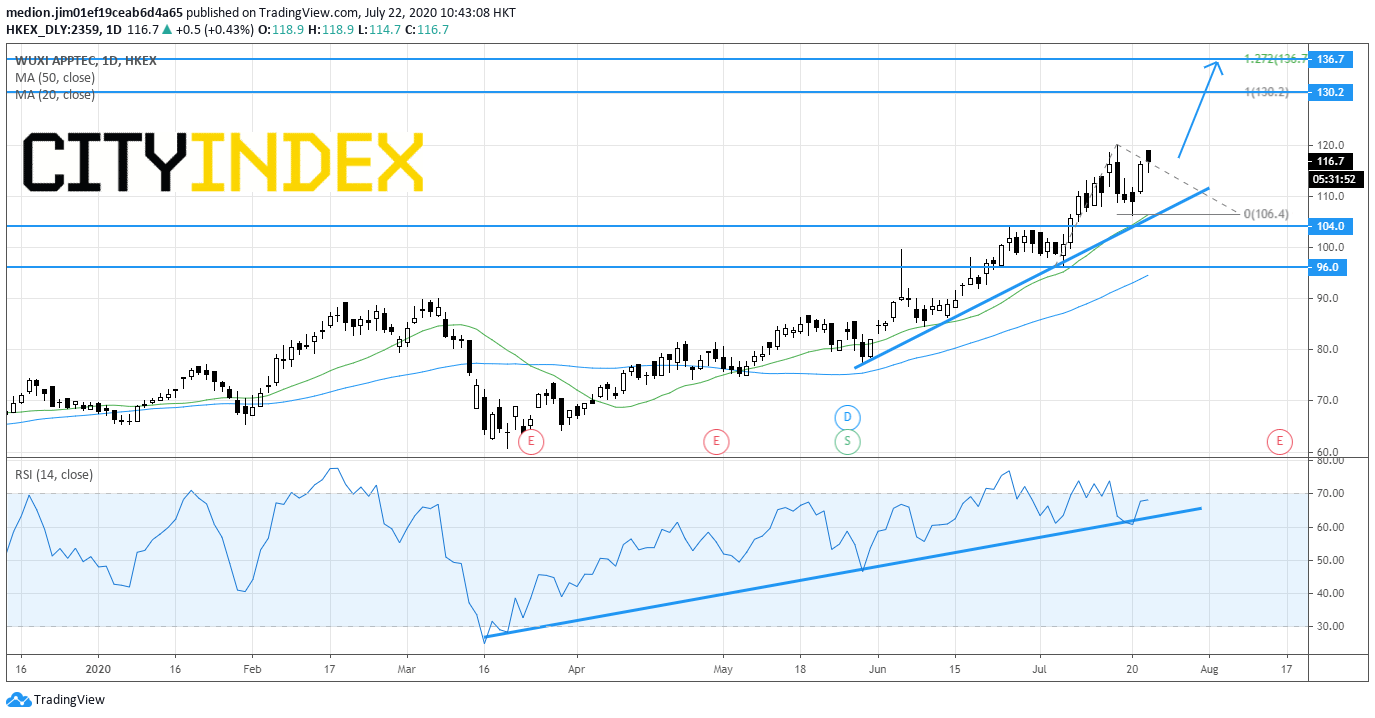

WuXi AppTec (2359.HK): Continuation of the Uptrend

WuXi AppTec (2359), a pharmaceutical company, jumped 7% yesterday as investors chased the technology stock after Nasdaq marked a new record high. After the outbreak of coronavirus, health technology is one of the strongest sectors in the Hong Kong Market.

The company soared around 85% from March low, while the Hang Seng Index was only up 18%. The performance of the company is outperforming.

Recently, the company reported that 2Q adjusted net income jumped 43.1% on year to 942 million yuan on operating revenue of 4.04 billion yuan, up 29.4%.

Besides, the company was rated "new buy" at Jefferies with target prices at HK$145.

From a technical point of view, the stock is supported by a rising trend line drawn from May on a daily chart. In addition, the RSI is also riding above the bullish trend line drawn from March. In addition, the prices have recorded a series of higher tops and higher bottoms since March low.

Bullish readers could consider placing the nearest support level at HK$104, while the resistance levels would be located at HK$130.2 (100% measured move) and HK$136.7 (127.2% measured move).

Source: GAIN Capital, TradingView

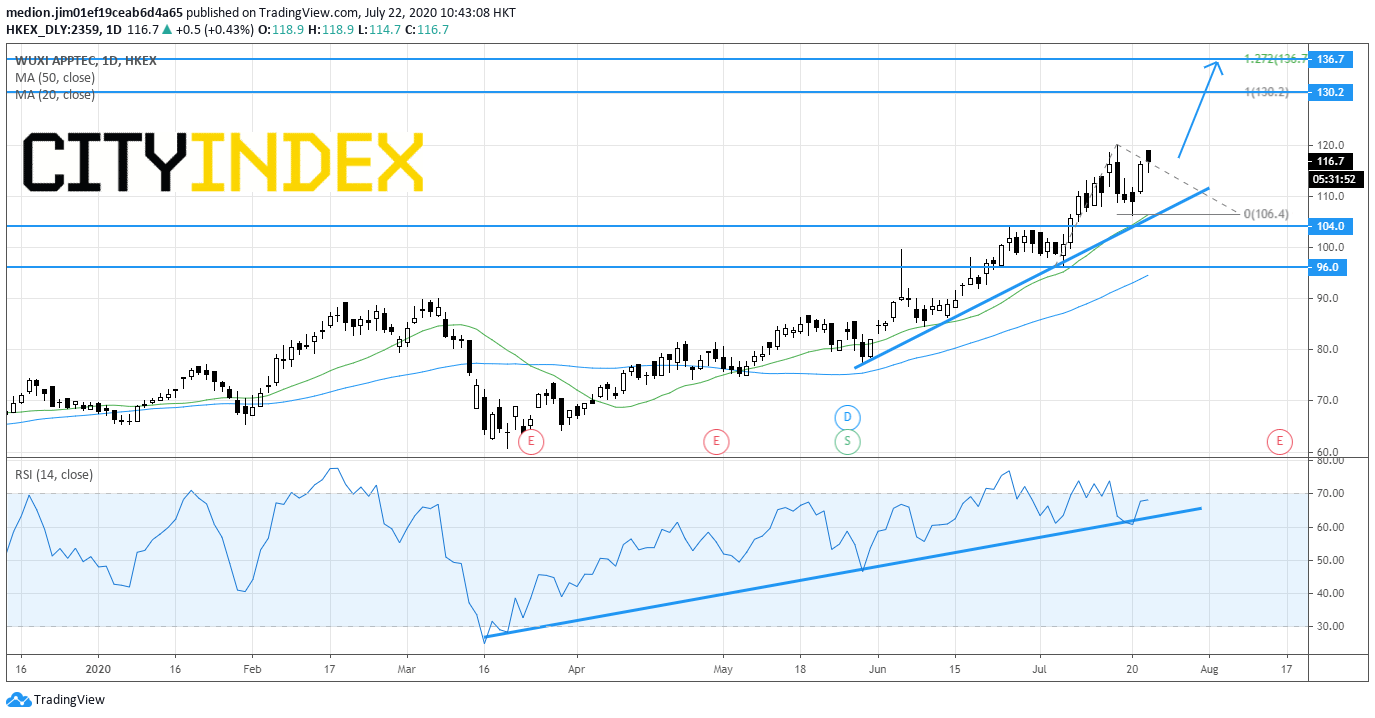

The company soared around 85% from March low, while the Hang Seng Index was only up 18%. The performance of the company is outperforming.

Recently, the company reported that 2Q adjusted net income jumped 43.1% on year to 942 million yuan on operating revenue of 4.04 billion yuan, up 29.4%.

Besides, the company was rated "new buy" at Jefferies with target prices at HK$145.

From a technical point of view, the stock is supported by a rising trend line drawn from May on a daily chart. In addition, the RSI is also riding above the bullish trend line drawn from March. In addition, the prices have recorded a series of higher tops and higher bottoms since March low.

Bullish readers could consider placing the nearest support level at HK$104, while the resistance levels would be located at HK$130.2 (100% measured move) and HK$136.7 (127.2% measured move).

Source: GAIN Capital, TradingView