If traders didn’t already have a reason to wake up and pay attention, maybe this realization will help: We’re currently navigating times that hundreds of future books will be written about.

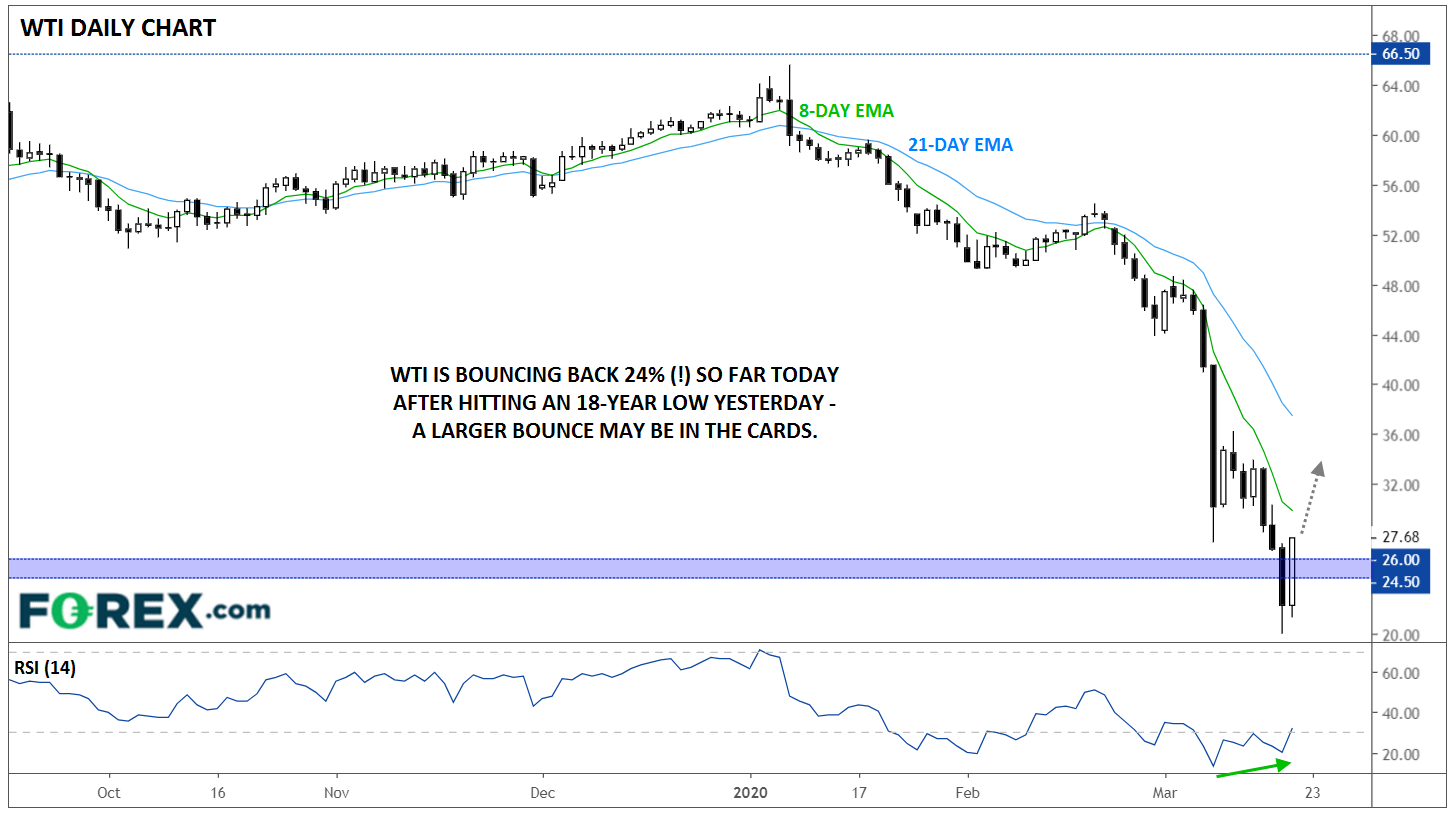

For market participants, there’s arguably no market more interesting right now than oil. After yesterday’s big drop on fears of weak demand and illiquid markets, prices are surging back a staggering 24% so far today. While oil was already bouncing back strongly along with general risk appetite, so-called “black gold” went vertical this afternoon on rumors that Russian President Putin was willing to engage Saudi Arabia in discussions about cutting production. Astute traders will note that the failure to reach an agreement over production levels led to a huge supply glut hitting the market just as demand collapsing, a perfect storm for crude bears. Hints that the Trump Administration may intervene in the whole kerfuffle have also helped boost prices.

Source: TradingView, GAIN Capital

In any event, WTI is trading back above the key long-term support zone we highlighted near 25.00. Given that the support in this area dates back decades and prices only closed below it for a single day amidst a broader panic and illiquid market conditions, this zone may still continue to put a floor under prices moving forward.

Oil traders will obviously need to a keep an eye on the headlines out of the US, Russia, and Saudi Arabia in the days to come, but the price action and rumors of hints in the fundamental supply/demand situation suggest that oil may have formed at least a near-term bottom yesterday.