Crude oil prices have not gone anywhere fast over the past couple of weeks. The decision by the OPEC+ group to extend production cuts for nine months failed to trigger a rally in prices, as investors remained concerned about the prospects of slower demand growth and rising output from non-OPEC producers. So, prices are finely balanced right now as investors await fresh stimulus. The stimulus could come in the form of a sharp change in US crude oil inventories. Over the past few weeks, the Energy Information Administration (EIA) has reported falling inventory levels, which has helped to limit the downside for prices. According to the EIA, oil inventories have fallen by 3.1, 12.8 and 1.1 million barrels over the past three weeks, respectively. Another sharp reduction could see WTI prices stage a rally, while if inventories show a surprisingly large build then that could weigh on prices. Anything else will probably not have too much of an impact, although prices could still spike in knee-jerk reaction. The official EIA data will be published tomorrow afternoon, while the unofficial figures from the American Petroleum Institute (API), an industry group, will come out this evening. The API data does sometimes overshadow the EIA’s figures, although it is not always reliable as we have seen large discrepancies between the two estimates.

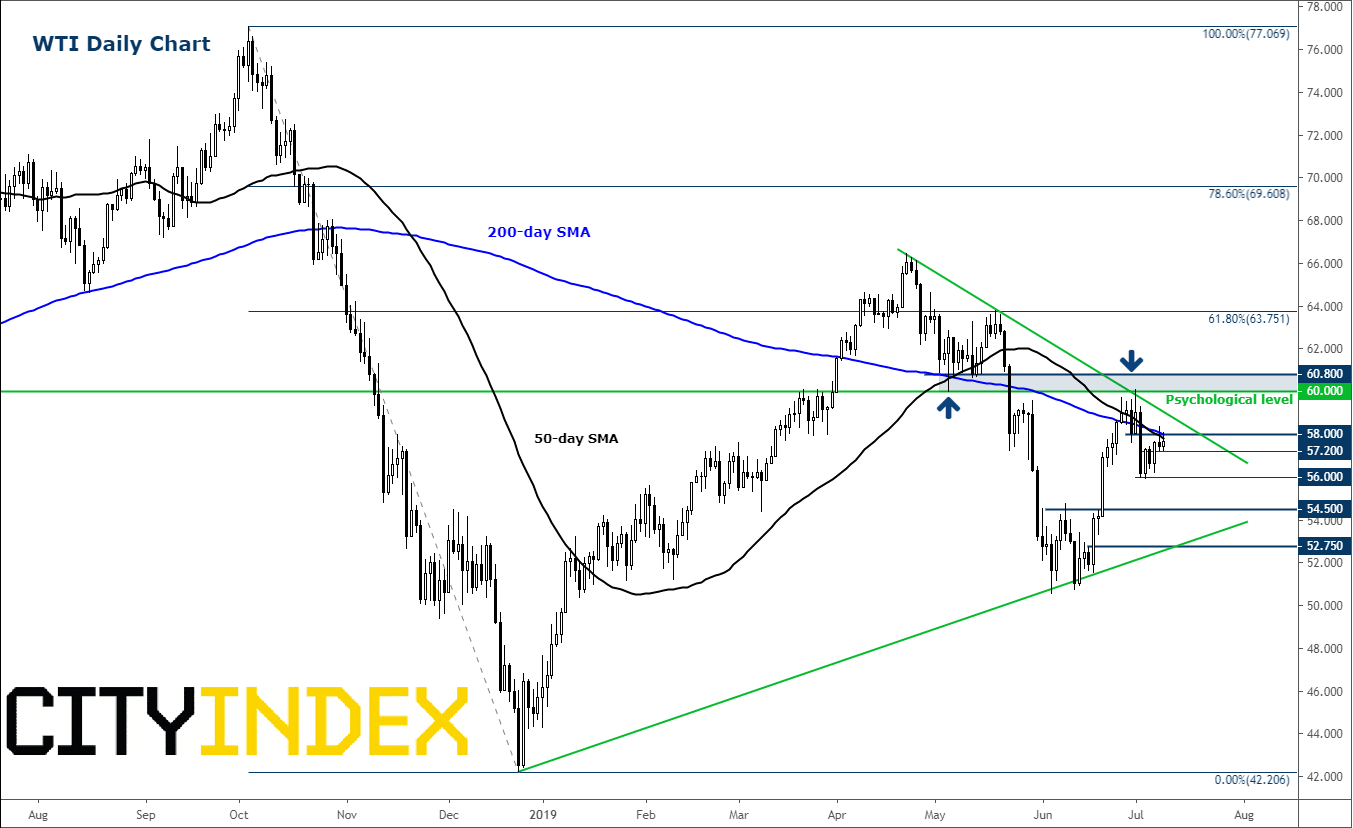

Ahead of the publication of the latest inventories data, WTI crude oil continues to trade inside narrowing ranges, with the upside capped by a bearish trend line and the downside supported by a bullish trend line. Within these converging trend lines, oil prices have hit a key resistance level around $58.00, where an old support meets both the 50- and 200-day moving averages. Given the negative slope of these moving averages, and proximity of WTI from the resistance trend line, we would not be surprised if prices turned lower from here. However, for the bears to step in, we need short-term support at $57.20 to give way first. If so, WTI could fall and take out liquidity below the most recent low at $56.00 next. Key supports thereafter come in at $54.50, which was previously resistance, followed by $52.75 – the base of the recent breakout, where the bullish trend line also comes into play. Meanwhile, if the bulls reclaim $58.00 then a subsequent rally towards the next resistance circa $60.80 would become likely.

Source: Trading View and City Index.