WTI Crude Oil: Will History Repeat Itself?

In April, traders were shocked by the fact that WTI crude oil futures plunged into negative figures, amid extreme fears of the coronavirus impacts on oil demand and storage space is running out. In fact, a similar story of an oversupplied oil market can be traced back to the period of 2014-2016, which ultimately led to the first OPEC+ production cut agreement and a rebound in prices.

Despite the fact that the coronavirus crisis dampened the global economy, it does not seems to make sense that someone would get paid for receiving oil. With oil prices bouncing back to the $20s, the market appears to be calmed down.

In reality, there are growing signs of a downtrend in production. Oil field services firm Baker Hughes reported that the number of U.S. oil rigs counts slumped to 325 as of May 1, the lowest level since March 2016 and more than halved compared with the beginning of the year. On Monday, Permian Basin shale oil companies, Diamondback Energy and Centennial Resource Development, announced plans to slash output for May by 10%-15% and 40% respectively.

As the coronavirus crisis appears to be peaked in major countries, a decline in production would certainly aid the recovery in oil prices. Will history repeat itself remains to be seen, though the intraday outlook for WTI crude futures seems appealing.

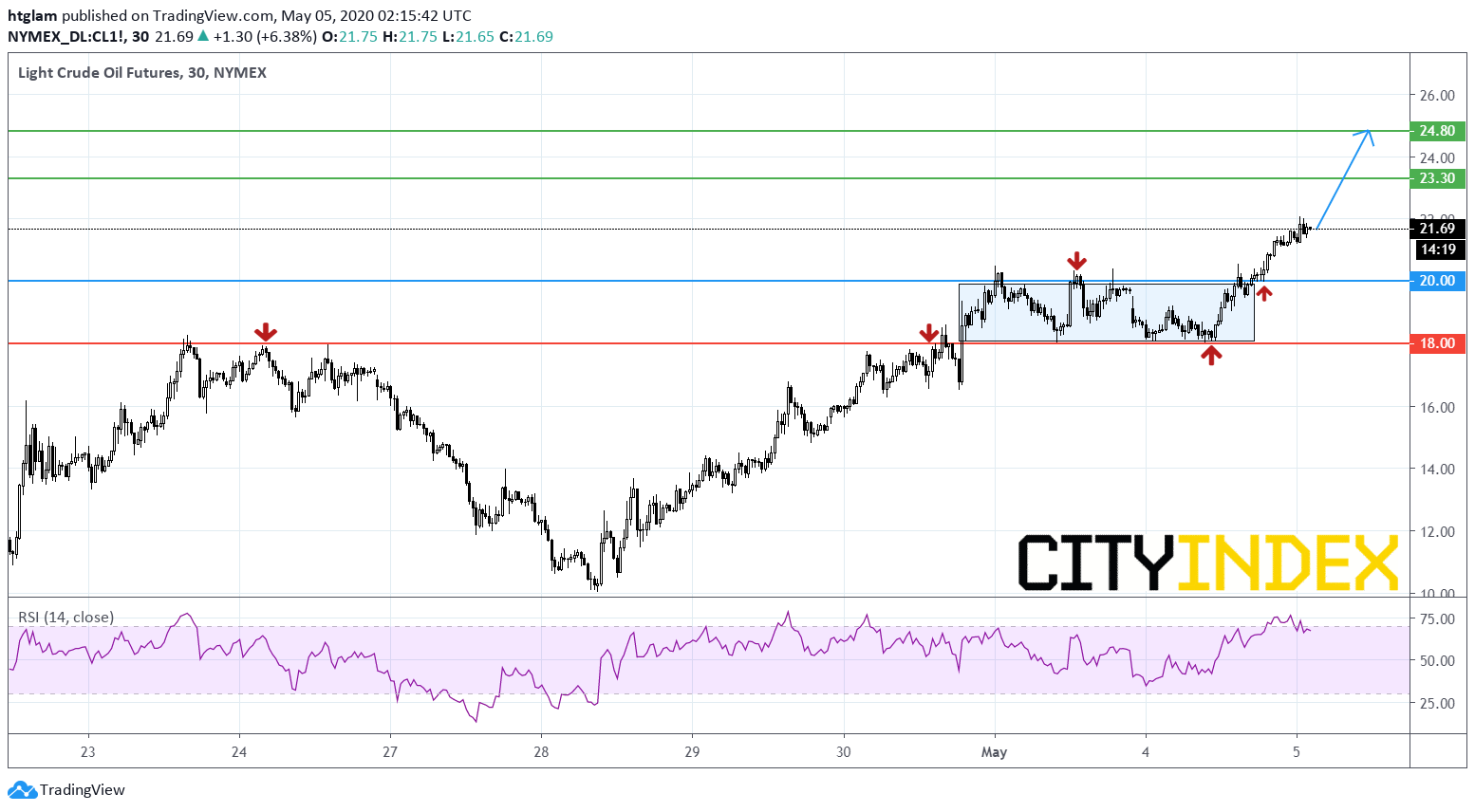

From a technical point of view, WTI crude futures (June contract) is extending its bullish run as shown on the 30-minute chart. It has broken above a consolidation range after a recent rally. Bullish investors may consider $20.00 as the nearest intraday support, with potential upside targets at $23.30 and $24.80. In an alternative scenario, a break below $20.00 would be a warning that it might be heading back to the next support at $18.00.

Source: TradingView, Gain Capital