WTI Crude Oil Futures (Short Term): Bullish Bias Remains

Oil prices retreated as caution grew about continued momentum of the economic recovery. U.S. WTI crude oil futures (August) settled 3.1% lower at $39.62 a barrel.

Investors began to doubt smooth reopening from the coronavirus shutdowns. As new infections per day in the U.S. spike to more than 50,000, state governors are slowing the return to business.

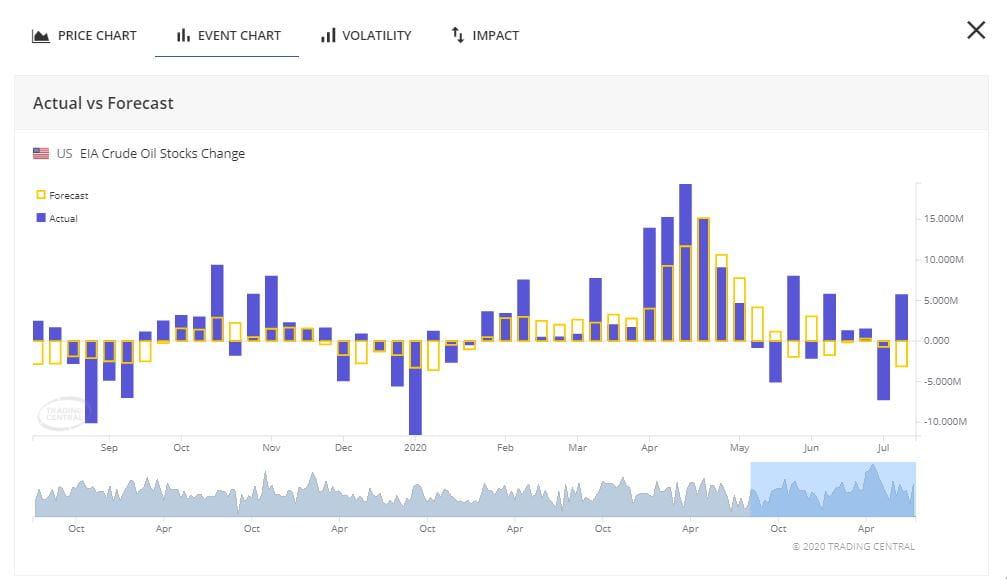

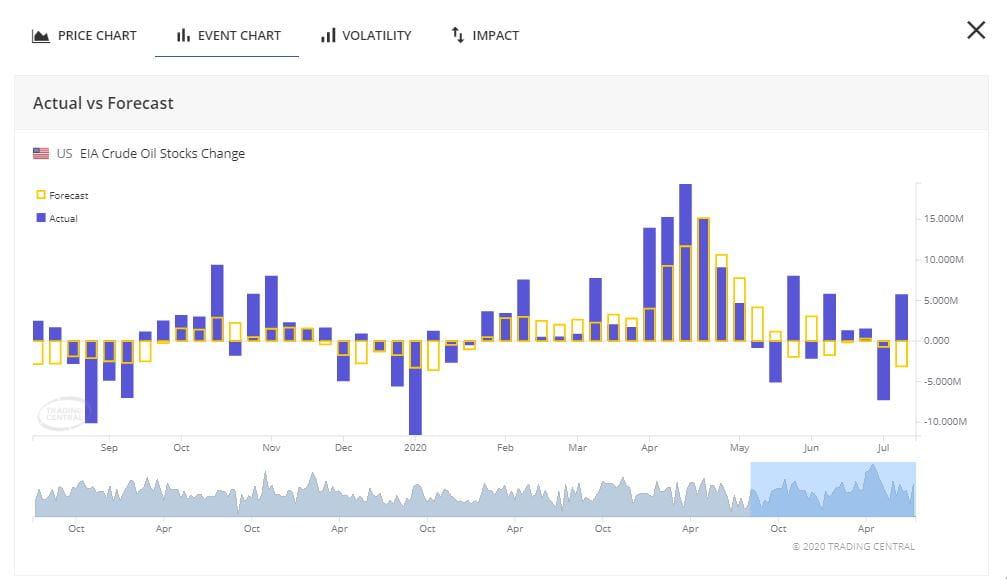

On Wednesday, the Energy Information Administration reported a build of 5.7 million barrels in crude-oil stockpiles last week, in contrast to expectations of a reduction of 3.1 million barrels. In below charts, it shows that the recent change of oil stockpile is fluctuating. As the trend is unclear, investors would not be optimistic on the growth of oil demand.

Source: Trading Economic

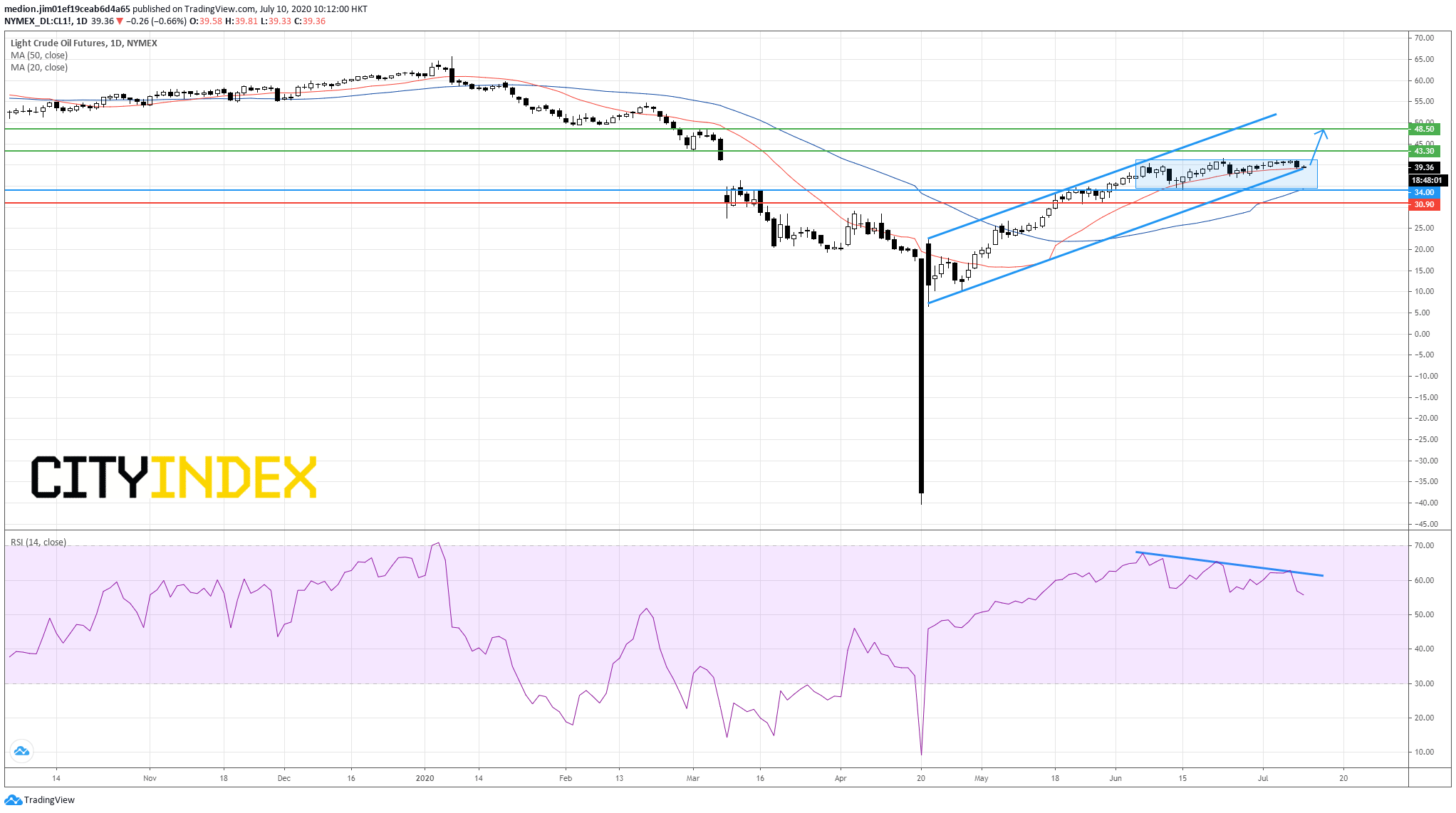

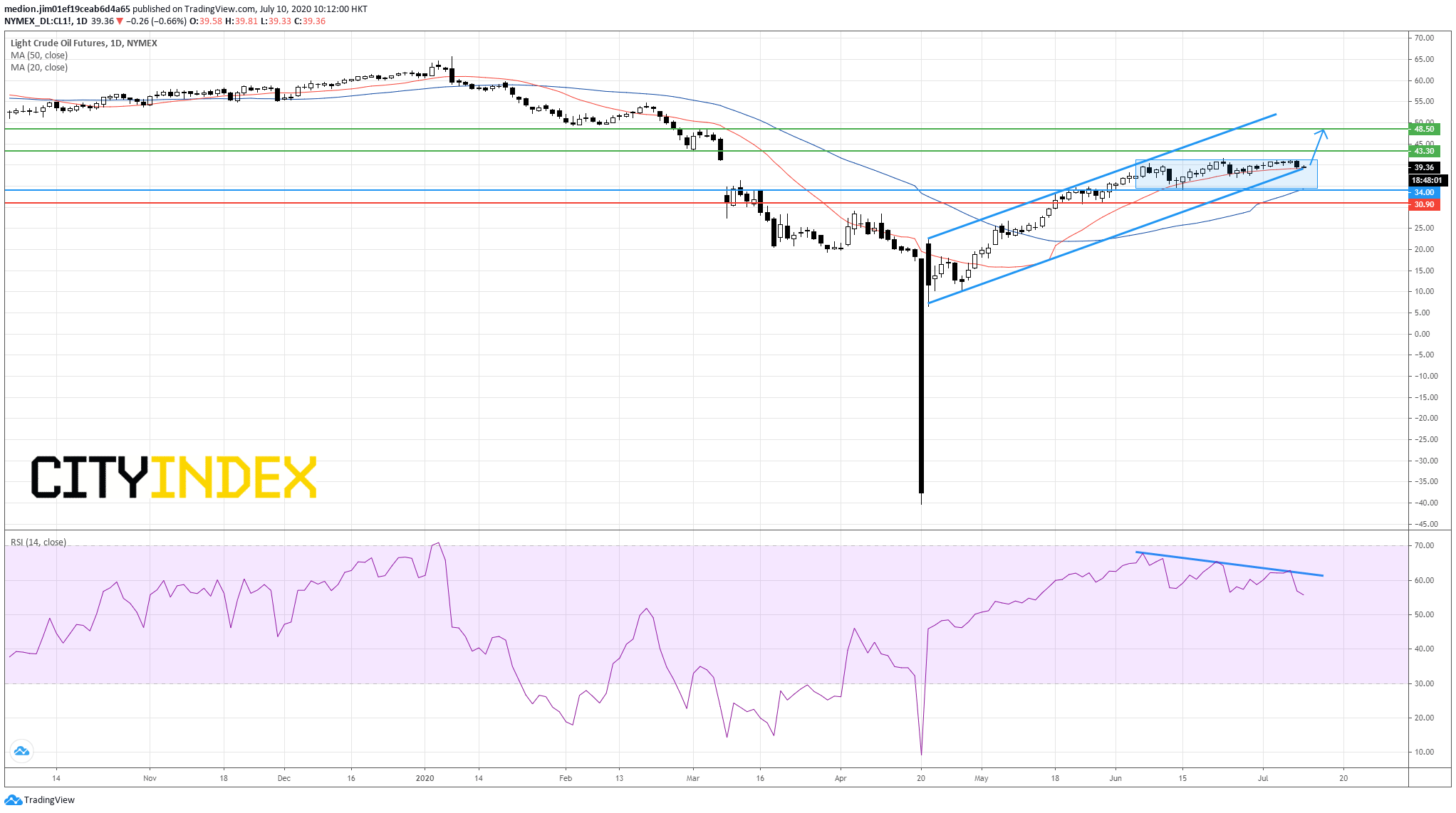

From a technical point of view, WTI Crude Oil futures remain trading within the range between $41.60 and $34.00. The 20-day moving average is flattening, while RSI forms a declining trend line. Those indicators suggest the loss of upward momentum.

However, the prices are still supported by a rising channel. Besides, the series of higher tops and higher bottoms pattern remains intact. Those evidence would support the bullish outlook.

The technical outlook remains bullish, but the momentum is being weaker. Therefore, investors should focus on the breakout signal for rebuilding the momentum.

A break above the upper consolidation zone at $41.60 could consider a rise to $43.30 (the low of March 2) and $48.50 (the high of March 3).

In an alternative scenario, a break below $34.00 would indicate a bearish reversal signal and bring a return to $30.90 (the low of May 22).

Source: GAIN Capital, TradingView

Investors began to doubt smooth reopening from the coronavirus shutdowns. As new infections per day in the U.S. spike to more than 50,000, state governors are slowing the return to business.

On Wednesday, the Energy Information Administration reported a build of 5.7 million barrels in crude-oil stockpiles last week, in contrast to expectations of a reduction of 3.1 million barrels. In below charts, it shows that the recent change of oil stockpile is fluctuating. As the trend is unclear, investors would not be optimistic on the growth of oil demand.

Source: Trading Economic

From a technical point of view, WTI Crude Oil futures remain trading within the range between $41.60 and $34.00. The 20-day moving average is flattening, while RSI forms a declining trend line. Those indicators suggest the loss of upward momentum.

However, the prices are still supported by a rising channel. Besides, the series of higher tops and higher bottoms pattern remains intact. Those evidence would support the bullish outlook.

The technical outlook remains bullish, but the momentum is being weaker. Therefore, investors should focus on the breakout signal for rebuilding the momentum.

A break above the upper consolidation zone at $41.60 could consider a rise to $43.30 (the low of March 2) and $48.50 (the high of March 3).

In an alternative scenario, a break below $34.00 would indicate a bearish reversal signal and bring a return to $30.90 (the low of May 22).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM