WTI Crude Oil (Intraday): Bullish Bias Above $32.40

July WTI Crude Oil futures rallied over 80% from the April's close price at $18.84/bbl to $33.92/bbl as of the close price on May 21 due to global output cut.

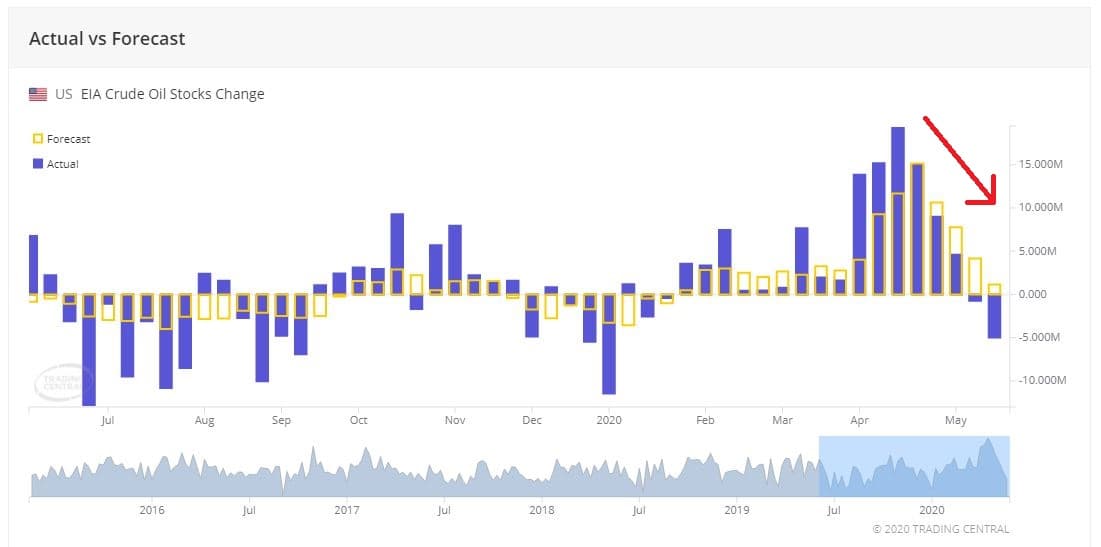

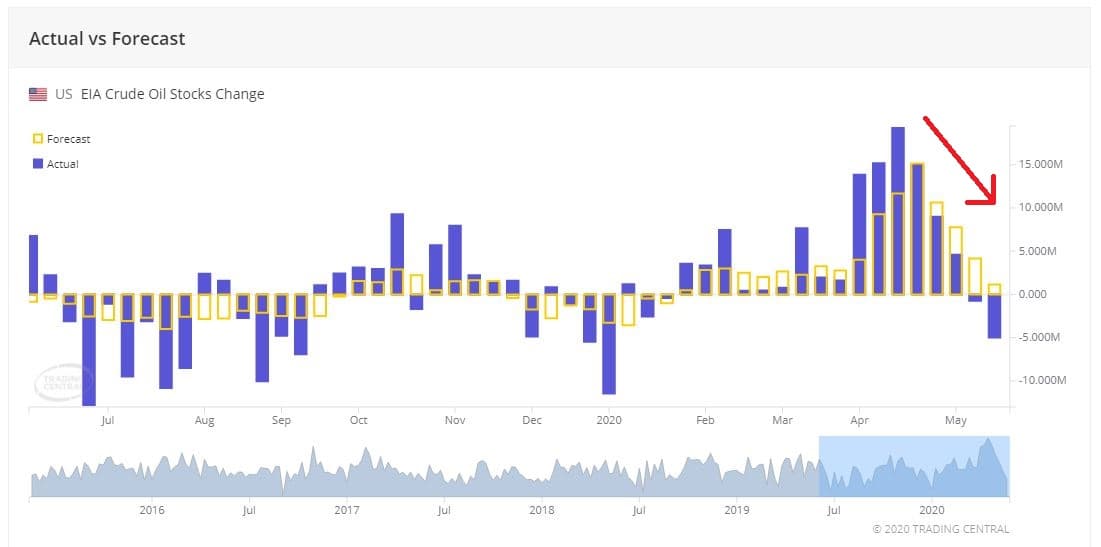

On Wednesday, the U.S. Energy Information Administration (EIA) released a weekly report for May 15, which stated that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.0M barrels from the previous week to 526.5M barrels. In the below chart, the increase of U.S. crude oil inventories peaked in April and returned the status of withdraw inventories.

Source: Trading Economic

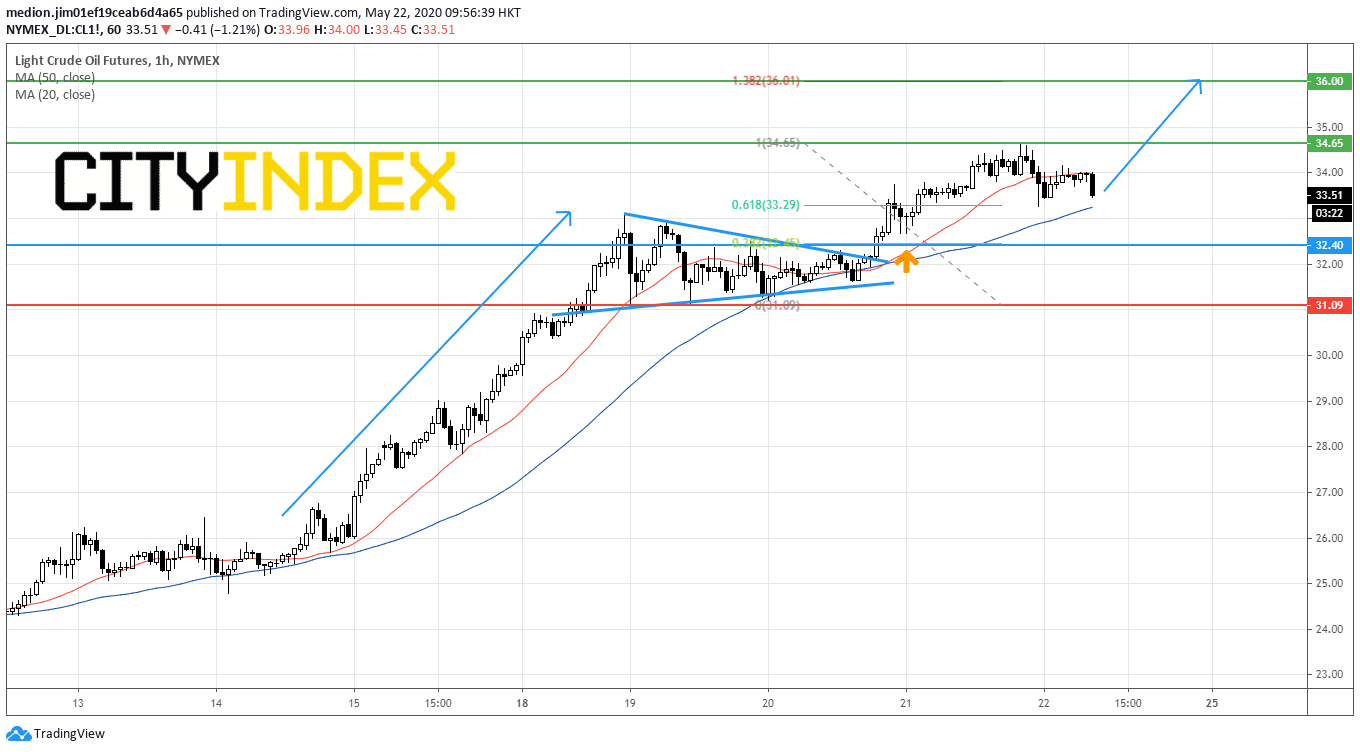

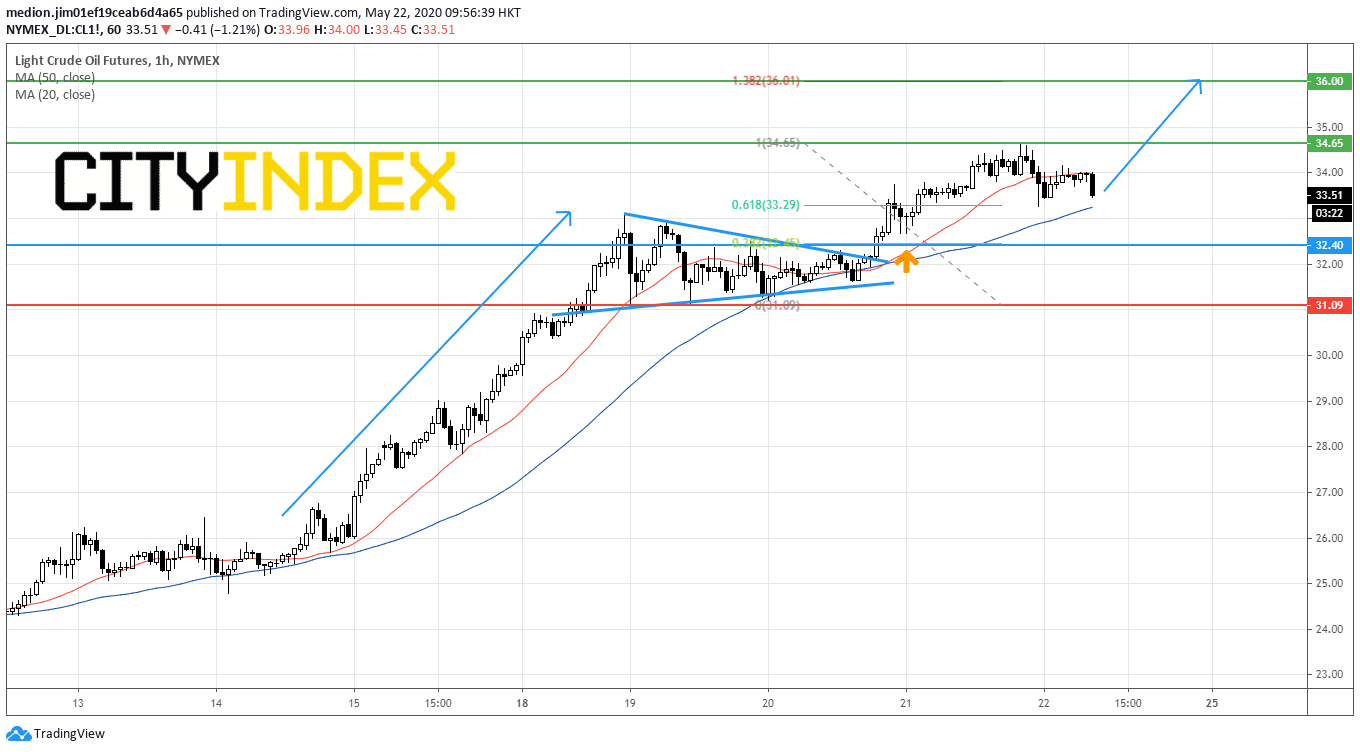

On the 1 hour chart, July Crude Oil futures validated a bullish breakout of the symmetric triangle. Currently, the prices posted a pullback from $34.65, but it is still holding above the 38.2% retracement level. In addition, the prices are still supported by a rising 50-period moving average, helping to maintain the bullish outlook.

Therefore, bullish readers could set the support level at $32.40 (61.8% retracement level of current rebound) and resistance levels at $34.65 (the previous top) and $36.00 (138.2% expansion of current rebound).

In an alternative scenario, a clear break below $36.40 would erase the bullish outlook and call for a return to $31.10 (the low of May 19)

Source: GAIN Capital, TradingView

On Wednesday, the U.S. Energy Information Administration (EIA) released a weekly report for May 15, which stated that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.0M barrels from the previous week to 526.5M barrels. In the below chart, the increase of U.S. crude oil inventories peaked in April and returned the status of withdraw inventories.

Source: Trading Economic

Meanwhile, U.S. crude oil production fell to 11.5M barrels per day last week from 11.6M barrels per day in the prior period. IHS Markit projected that U.S. Crude Oil production would drop 1.75M barrels per day in June.

On the 1 hour chart, July Crude Oil futures validated a bullish breakout of the symmetric triangle. Currently, the prices posted a pullback from $34.65, but it is still holding above the 38.2% retracement level. In addition, the prices are still supported by a rising 50-period moving average, helping to maintain the bullish outlook.

Therefore, bullish readers could set the support level at $32.40 (61.8% retracement level of current rebound) and resistance levels at $34.65 (the previous top) and $36.00 (138.2% expansion of current rebound).

In an alternative scenario, a clear break below $36.40 would erase the bullish outlook and call for a return to $31.10 (the low of May 19)

Source: GAIN Capital, TradingView

Latest market news

Today 07:49 AM

Today 04:24 AM

Yesterday 10:48 PM