WTI Crude Oil: How far can it go?

Thanks to the latest OPEC+ oil cut, oil prices have recouped most of its losses during the selloff started in March.

In early May, we mentioned that history tends to repeat itself and the same may happen soon. While the rebound in oil prices was staggering, we might have to avoid being over optimistic.

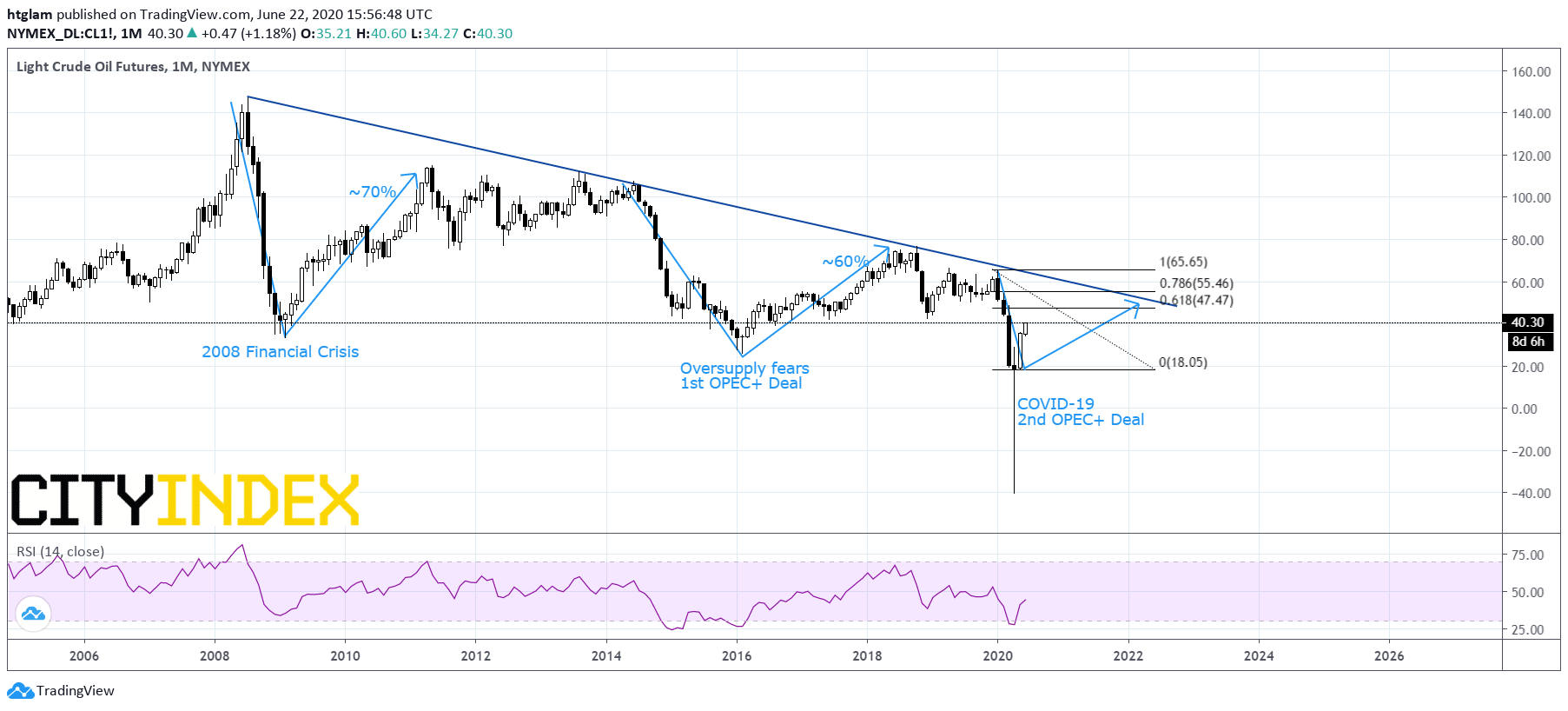

WTI Crude Oil price has been trending lower since 2008, given the rise of clean energy and the U.S. shale oil boom. It is worth noticing that the previous OPEC+ oil production cut had led to a roughly 60% rebound in WTI oil price, but failed to change the down trend, as the prices recovery led to higher output again. This time after a remarkable bounce back, the remaining upside potential for WTI oil price could be limited.

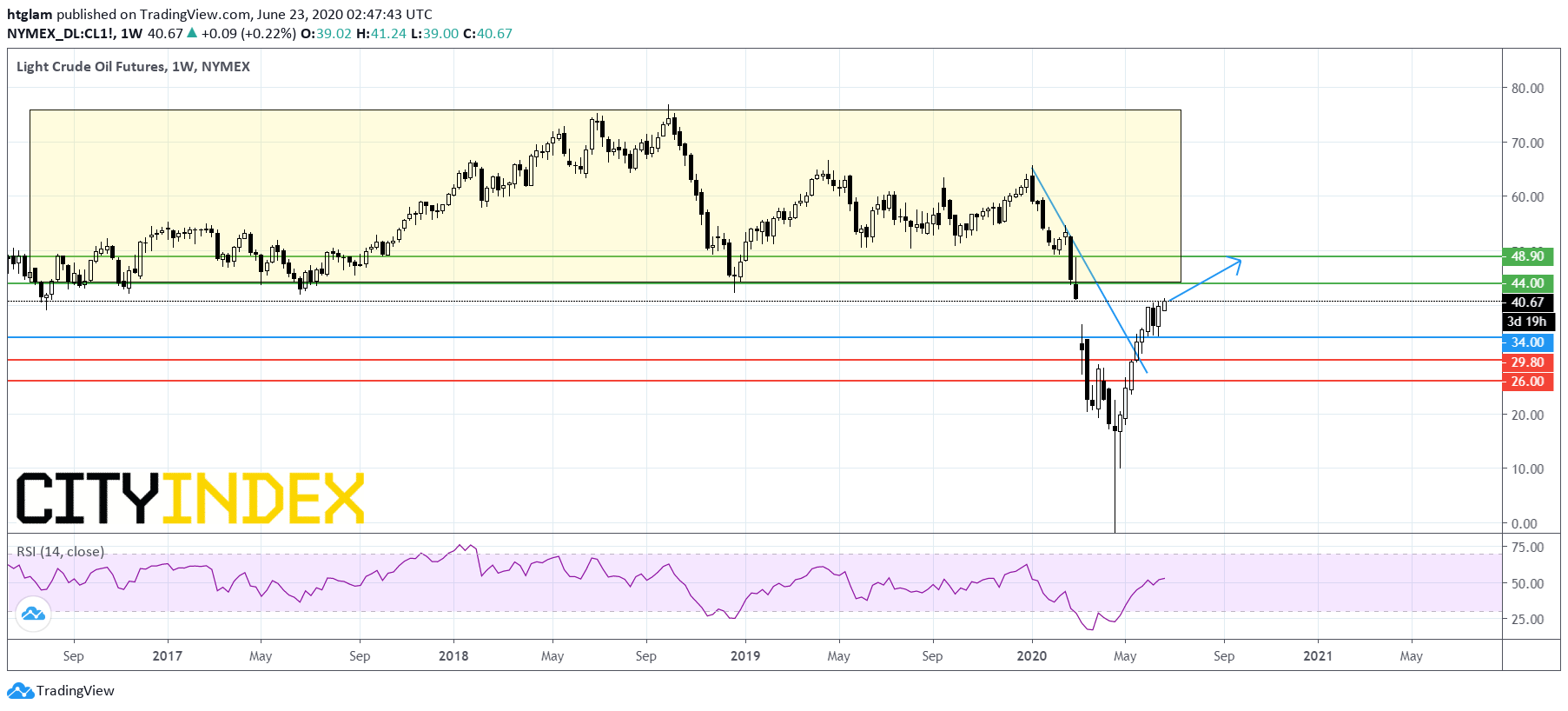

Source: Trading View, Gain Capital (WTI Crude Oil Futures weekly chart)

Nevertheless, WTI Crude Oil Futures stay on the upside as shown on the weekly chart after posting a V-shaped rebound. However, it has to break above its nearest resistance level at $44.00, which is the bottom of its previous trading range in 2017 to 2019, to open a path to the next resistance at $48.90. Alternatively, losing the nearest support at $34.00 would suggest that the next support at $29.80 might be exposed.