WTI Crude Oil Futures Shows a Reversal Signal

WTI Crude Oil futures (October) dropped after Saudi Arabia cut the pricing for October sales. It would indicate that the top oil producer would consider the slower demand recovery after the outbreak of COVID-19.

Paul Horsnell, head of commodities research at Standard Chartered Bank, said: "The demand recovery coming in a bit flatter than early expectations has been one of the key themes in fundamental data over the past couple of months."

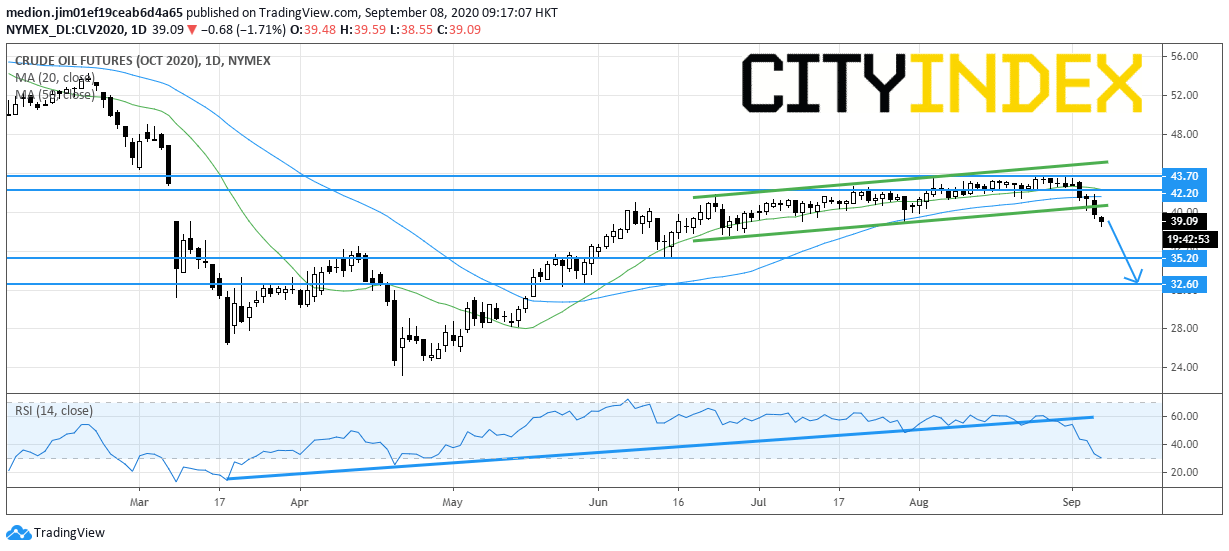

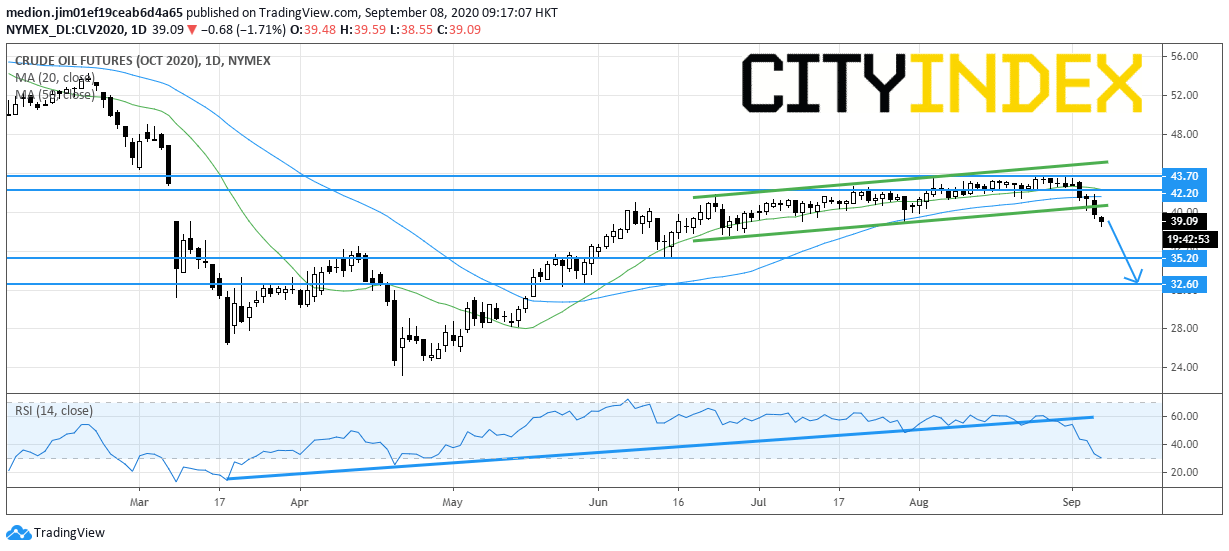

On a daily chart, the futures broke below the rising channel and previous low at $39.00, indicating a bearish reversal signal. In fact, the 20-day moving average is also turning downward, while the relative strength index drops to 30s after breaking below the ascending trend line drawn from March.

To conclude, the bearish readers could set the resistance level at $42.20, while the support levels would be located at $35.20 and $32.60.

Source: GAIN Capital, TradingView.

Paul Horsnell, head of commodities research at Standard Chartered Bank, said: "The demand recovery coming in a bit flatter than early expectations has been one of the key themes in fundamental data over the past couple of months."

On a daily chart, the futures broke below the rising channel and previous low at $39.00, indicating a bearish reversal signal. In fact, the 20-day moving average is also turning downward, while the relative strength index drops to 30s after breaking below the ascending trend line drawn from March.

To conclude, the bearish readers could set the resistance level at $42.20, while the support levels would be located at $35.20 and $32.60.

Source: GAIN Capital, TradingView.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM