WTI Crude Oil Futures Holds Above $40.00 a Barrel Before the Landing of Storms

The upward movement of WTI Crude Oil futures price is being slower in 3Q. The price was up around 7% from the end of June, much less than the gain of 23% in 2Q.

Facing with storms approaching the Gulf of Mexico this week, U.S. WTI crude oil futures (September) added 0.7% to $42.62 a barrel yesterday. 82% of oil output in the U.S. Gulf and more than a million barrels of refining capacity was shut down before the landing of the tropical storm Laura, which is forecast to become a hurricane, on Thursday.

Later today, American Petroleum Institute will release the change of U.S. oil stockpile data for August 21. On Wednesday, The U.S. Energy Information Administration will release official crude oil inventories data for the same week

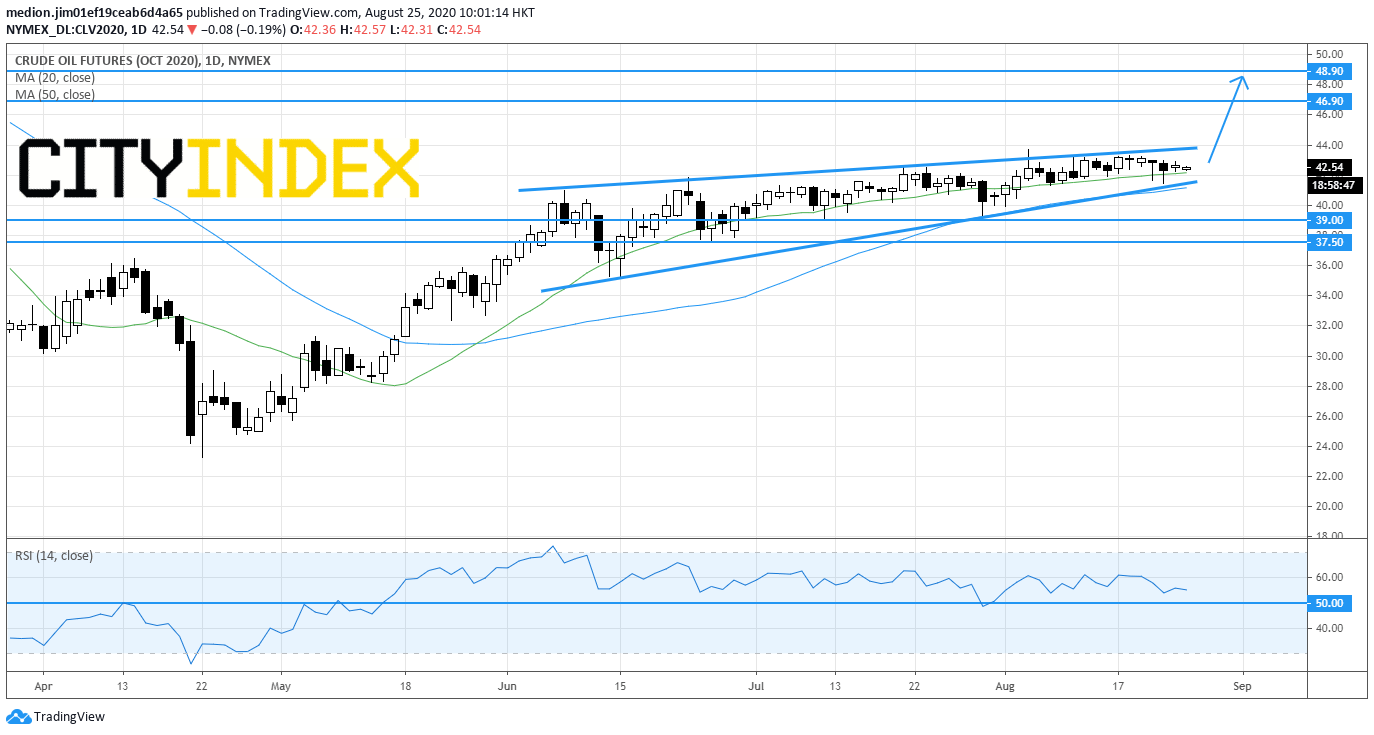

On a daily chart, WTI Crude Oil futures are trading within the converging zone.

Source: GAIN Capital, TradingView

Currently, the prices are still trading above both rising 20-day and 50-day moving averages. The relative strength index stays above the neutrality level at 50, suggesting the lack of downward momentum. A breakout of upper trend line would enhance the bullish outlook and rebuild the upward momentum.

Bullish readers could place the nearest support level at $39.00, while the resistance levels would be located at $46.9 and $48.90

Facing with storms approaching the Gulf of Mexico this week, U.S. WTI crude oil futures (September) added 0.7% to $42.62 a barrel yesterday. 82% of oil output in the U.S. Gulf and more than a million barrels of refining capacity was shut down before the landing of the tropical storm Laura, which is forecast to become a hurricane, on Thursday.

Later today, American Petroleum Institute will release the change of U.S. oil stockpile data for August 21. On Wednesday, The U.S. Energy Information Administration will release official crude oil inventories data for the same week

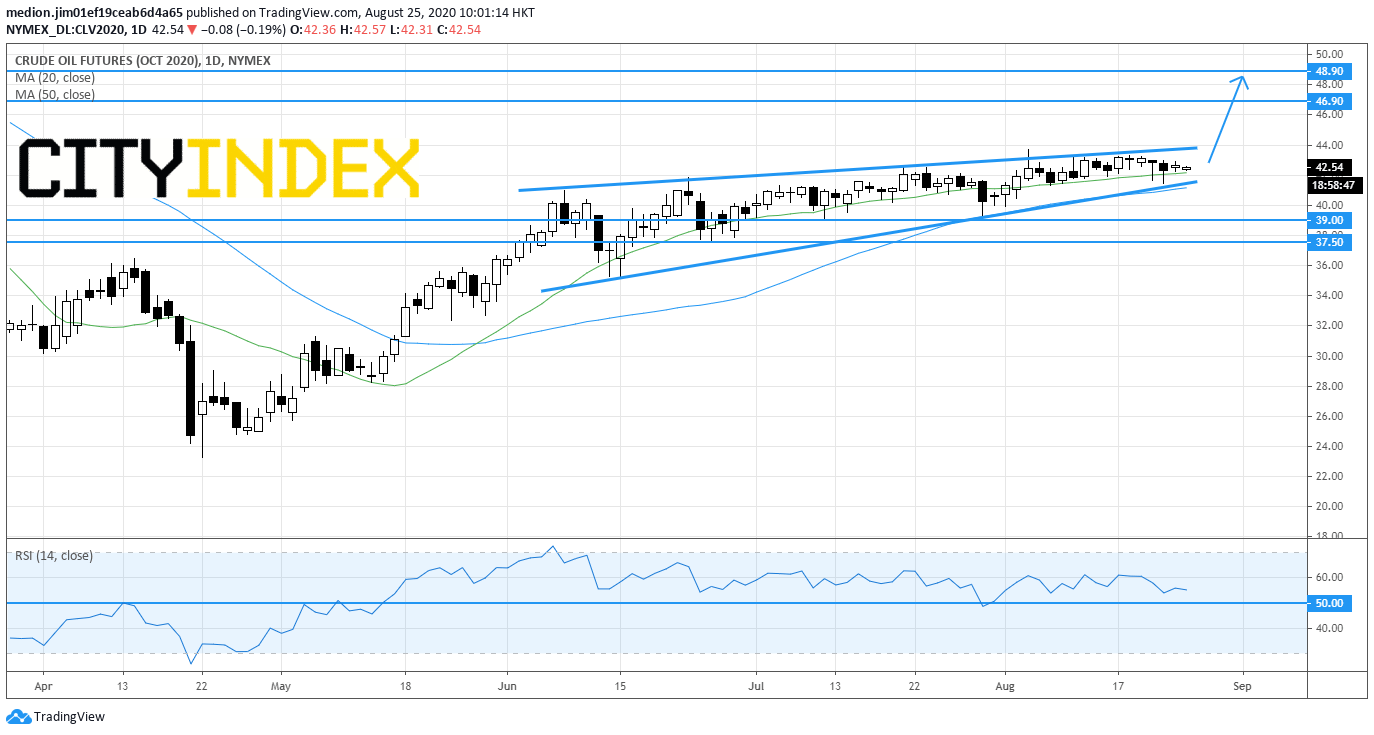

On a daily chart, WTI Crude Oil futures are trading within the converging zone.

Source: GAIN Capital, TradingView

Currently, the prices are still trading above both rising 20-day and 50-day moving averages. The relative strength index stays above the neutrality level at 50, suggesting the lack of downward momentum. A breakout of upper trend line would enhance the bullish outlook and rebuild the upward momentum.

Bullish readers could place the nearest support level at $39.00, while the resistance levels would be located at $46.9 and $48.90

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM