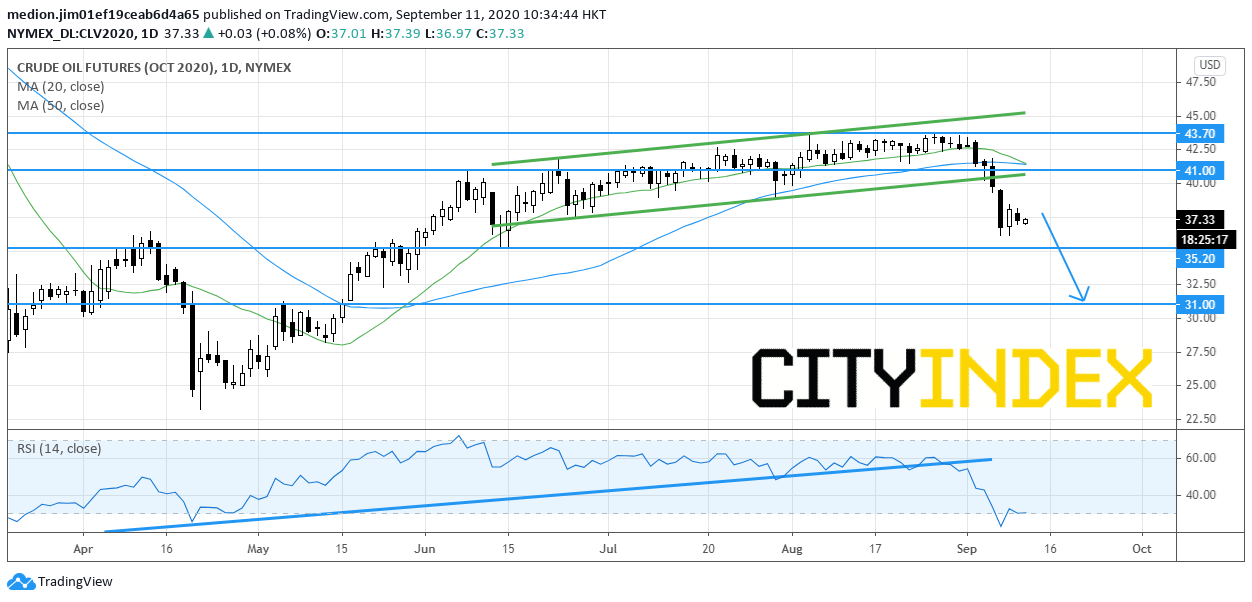

WTI Crude Oil futures (October): Holding on the Downside after the EIA Data

WTI Crude Oil futures (October) slumped more than 15% since early of September due to the worries of demand recovery.

The U.S. Energy Information Administration (EIA) reported that crude oil inventories rose 2.03 million barrels in the week ending September 4 (-1.96 million barrels expected) to 500.4 million barrels. U.S. crude oil inventories are about 14% above the five year average for this time of year. Besides, the U.S. crude oil production bounced 0.3 million barrels per day to 10.0 million barrels per day.

Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

From a technical point of view, the futures prices are holding on the downside after breaking the rising channel. The bearish cross between 20-day and 50-day moving averages has been identified. The relative strength index is locating at 30s, showing the downside momentum for the prices.

In this case, bearish readers could set the nearest resistance levels at $41.00, while support levels would be located at $35.20 and $31.00 respectively.

Source: Gain Capital, TradingView

The U.S. Energy Information Administration (EIA) reported that crude oil inventories rose 2.03 million barrels in the week ending September 4 (-1.96 million barrels expected) to 500.4 million barrels. U.S. crude oil inventories are about 14% above the five year average for this time of year. Besides, the U.S. crude oil production bounced 0.3 million barrels per day to 10.0 million barrels per day.

Later today, Baker Hughes will report the total number of rig counts for the U.S. and Canada.

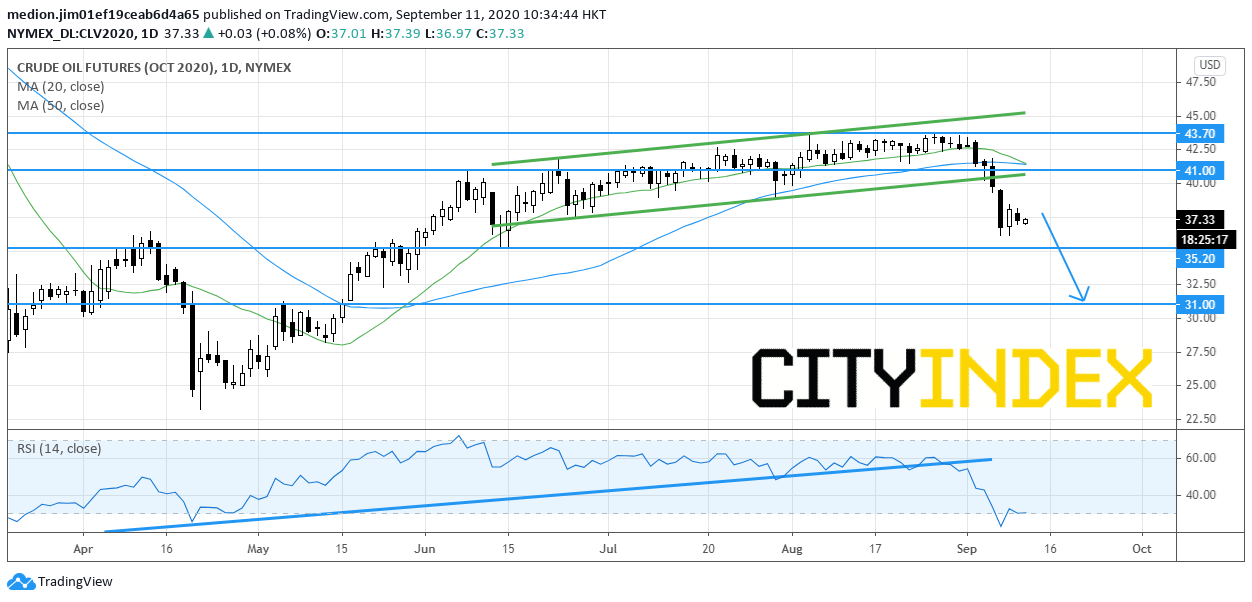

From a technical point of view, the futures prices are holding on the downside after breaking the rising channel. The bearish cross between 20-day and 50-day moving averages has been identified. The relative strength index is locating at 30s, showing the downside momentum for the prices.

In this case, bearish readers could set the nearest resistance levels at $41.00, while support levels would be located at $35.20 and $31.00 respectively.

Source: Gain Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM