WTI Crude Oil Futures Continues To Rebound On the Expectation of Extent of OPEC Oil Cut

WTI Crude Oil futures slumped from January to April due to the outbreak of COVID-19. In April, Crude Oil futures even plunged to the negative value as the investors have to close their position to avoid the settlement of crude oil.

After that, Crude Oil futures rebounded around 90% from April's close price at $18.84 per barrel to May's close price at $35.44 per barrel due to the supply cut from OPEC+ and expectation of the economy reopening.

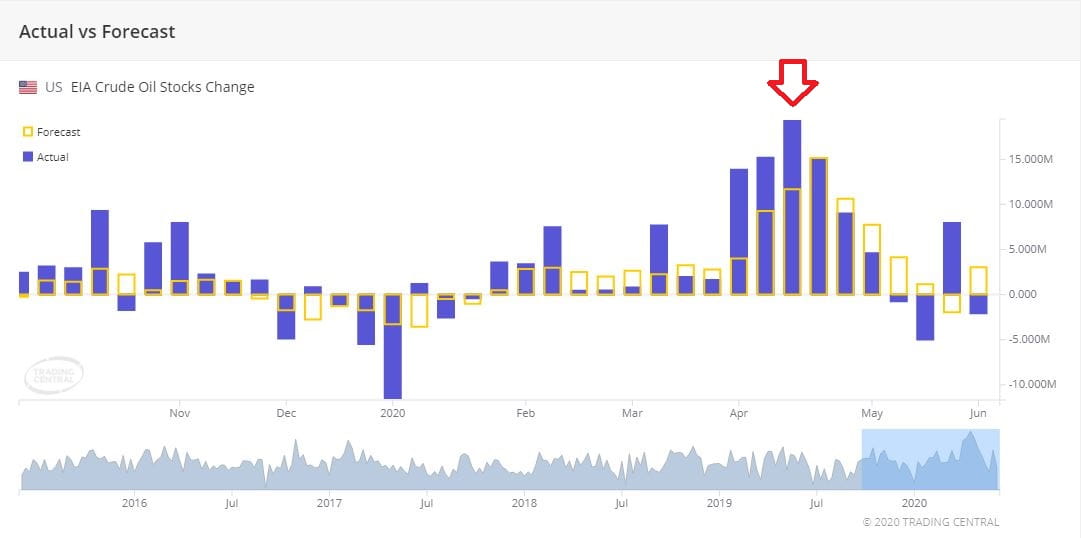

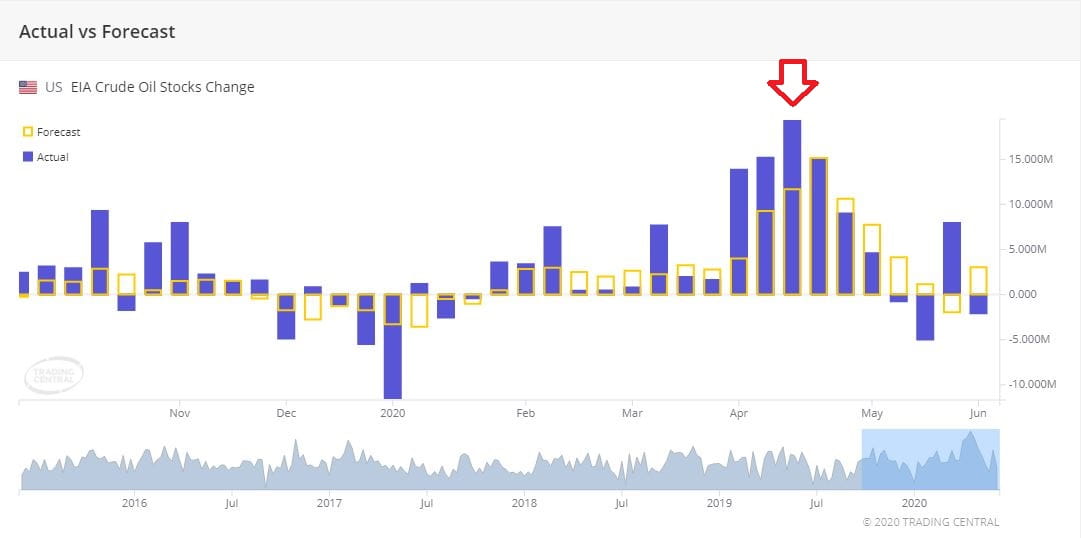

The U.S. Energy Information Administration (EIA) reported that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.1M barrels from the previous week to 532.3M barrels for week ended May 29. Besides, U.S. oil production decreased to 11.2M b/d from 11.4M b/d in the prior period.

In the below chart, it showed that the increase of crude oil inventory peaked in April, which timing is similar to the bottom of Crude Oil futures prices. Currently, the stockpile data swung from negative to positive, then returned to negative again. Investors should focus on the next inventory data to show whether the trend of stockpile withdrawal starts.

Source: Trading Economic

Currently, the media reported that OPEC+ would set to extend the oil cuts after a breakthrough with Iraq, and the deal might be signed as soon as this weekend. Under the original agreement, OPEC+ agreed to cut the oil production with 9.7M b/d in May and June. And the group would ease its cuts to 7.7M b/d from July to December. The extent of the deepest oil cut would be good fundamental news for the reduction of supply

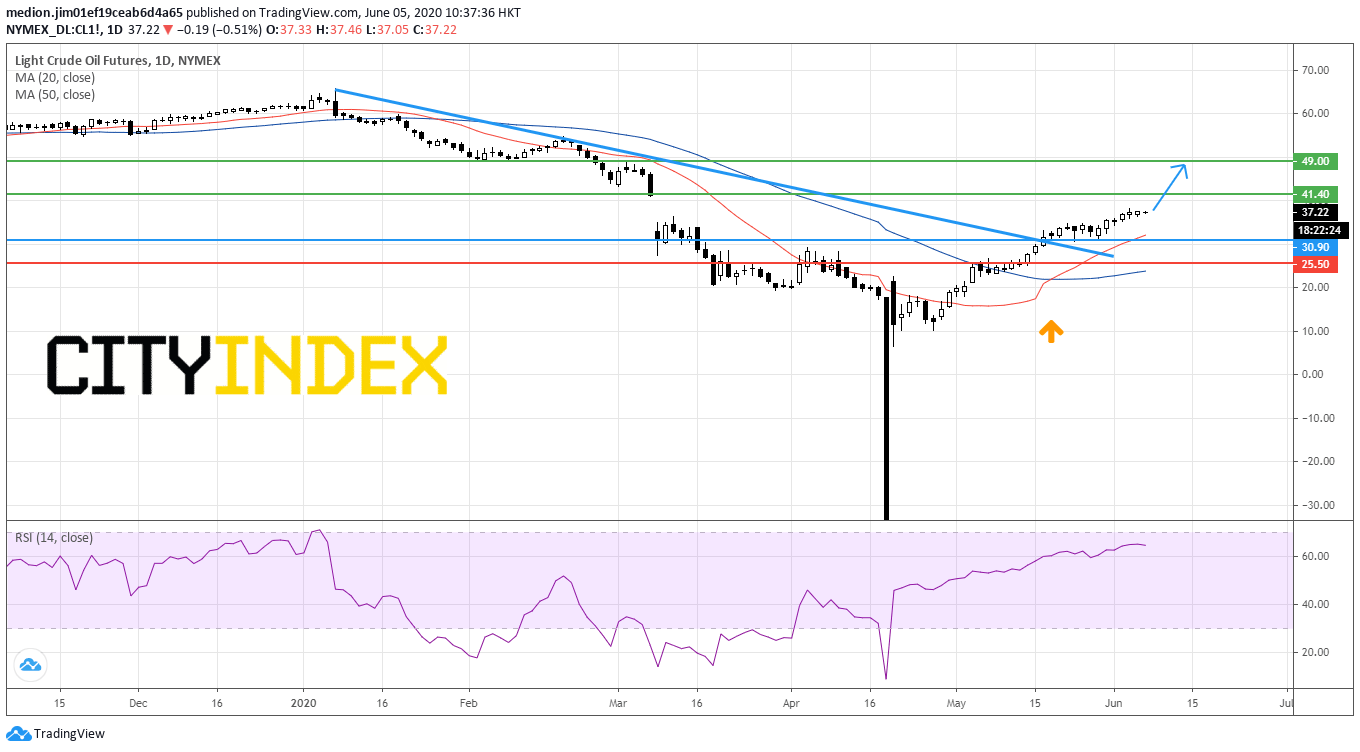

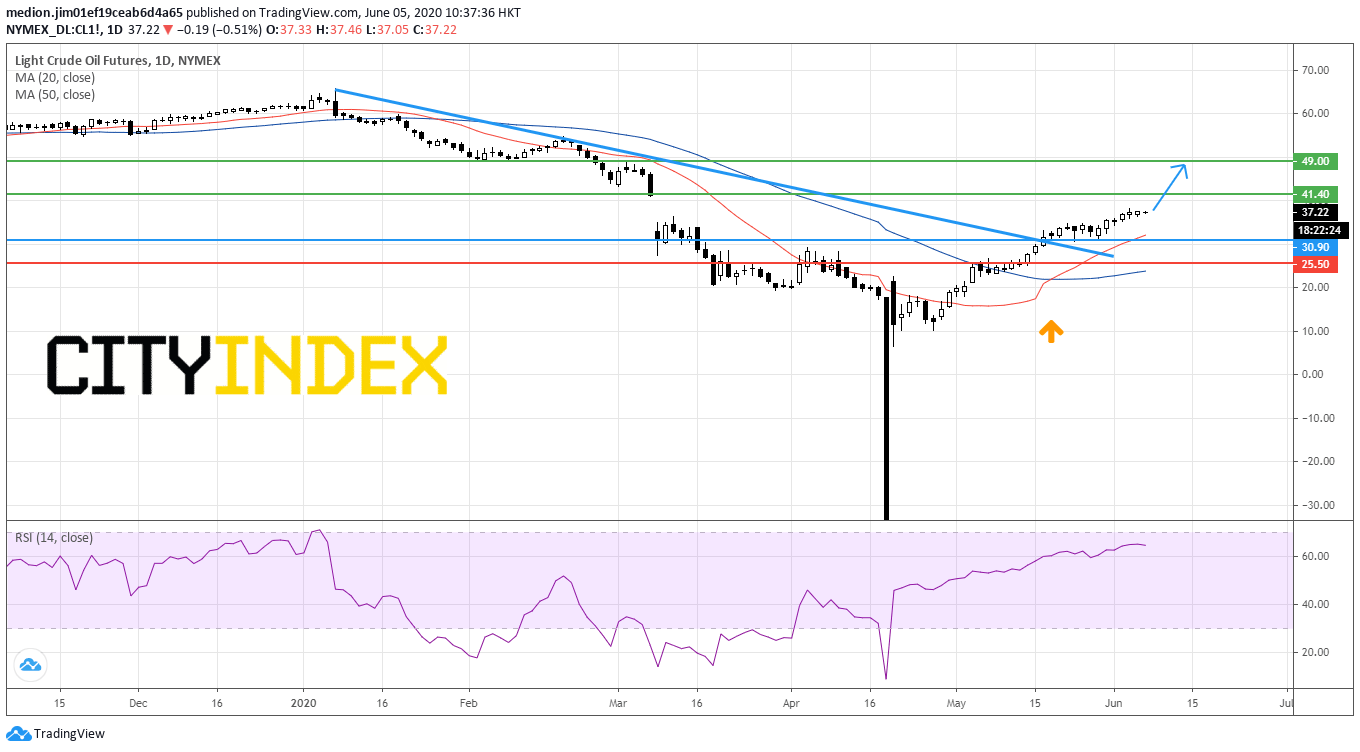

From a technical point of view, Crude Oil broke above the declining trend line from January, indicating the bullish reversal signal.

Source: GAIN Capital, TradingView

In fact, golden cross between 20-day and 50-day moving averages has been identified, enhancing the bullish technical outlook.

The bullish readers could set the support level at $30.90 (the support base between May 19 to May 29), while the resistance levels would be located at $41.4 (the gap created on March 9) and $49 (the high at March 3).

After that, Crude Oil futures rebounded around 90% from April's close price at $18.84 per barrel to May's close price at $35.44 per barrel due to the supply cut from OPEC+ and expectation of the economy reopening.

The U.S. Energy Information Administration (EIA) reported that U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.1M barrels from the previous week to 532.3M barrels for week ended May 29. Besides, U.S. oil production decreased to 11.2M b/d from 11.4M b/d in the prior period.

In the below chart, it showed that the increase of crude oil inventory peaked in April, which timing is similar to the bottom of Crude Oil futures prices. Currently, the stockpile data swung from negative to positive, then returned to negative again. Investors should focus on the next inventory data to show whether the trend of stockpile withdrawal starts.

Source: Trading Economic

Currently, the media reported that OPEC+ would set to extend the oil cuts after a breakthrough with Iraq, and the deal might be signed as soon as this weekend. Under the original agreement, OPEC+ agreed to cut the oil production with 9.7M b/d in May and June. And the group would ease its cuts to 7.7M b/d from July to December. The extent of the deepest oil cut would be good fundamental news for the reduction of supply

From a technical point of view, Crude Oil broke above the declining trend line from January, indicating the bullish reversal signal.

Source: GAIN Capital, TradingView

In fact, golden cross between 20-day and 50-day moving averages has been identified, enhancing the bullish technical outlook.

The bullish readers could set the support level at $30.90 (the support base between May 19 to May 29), while the resistance levels would be located at $41.4 (the gap created on March 9) and $49 (the high at March 3).

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM