WTI Crude Oil Futures Continues to Rebound But Sinopec (386-hk) Remains Weak

WTI Crude Oil futures soared around 90% in 2Q, lifted by the production cuts from OPEC+ and the rebounding oil consumption after the unlocking economy from China.

In fact, the rise of Crude Oil futures in June is around 10%, much less than the gain of 85% in May. It suggests that the upward momentum of crude oil is slowing down as the market already digested the good news as above mentioned. Secondly, investors are worried about the lower demand of crude oil due to the second wave COVID-19.

The American Petroleum Institute (API) reported that the U.S. crude oil stockpile dropped 8.2M barrels for the week ended June 26. Later today, The U.S. Energy Information Administration will release crude oil inventories data for last week (-950K barrels expected).

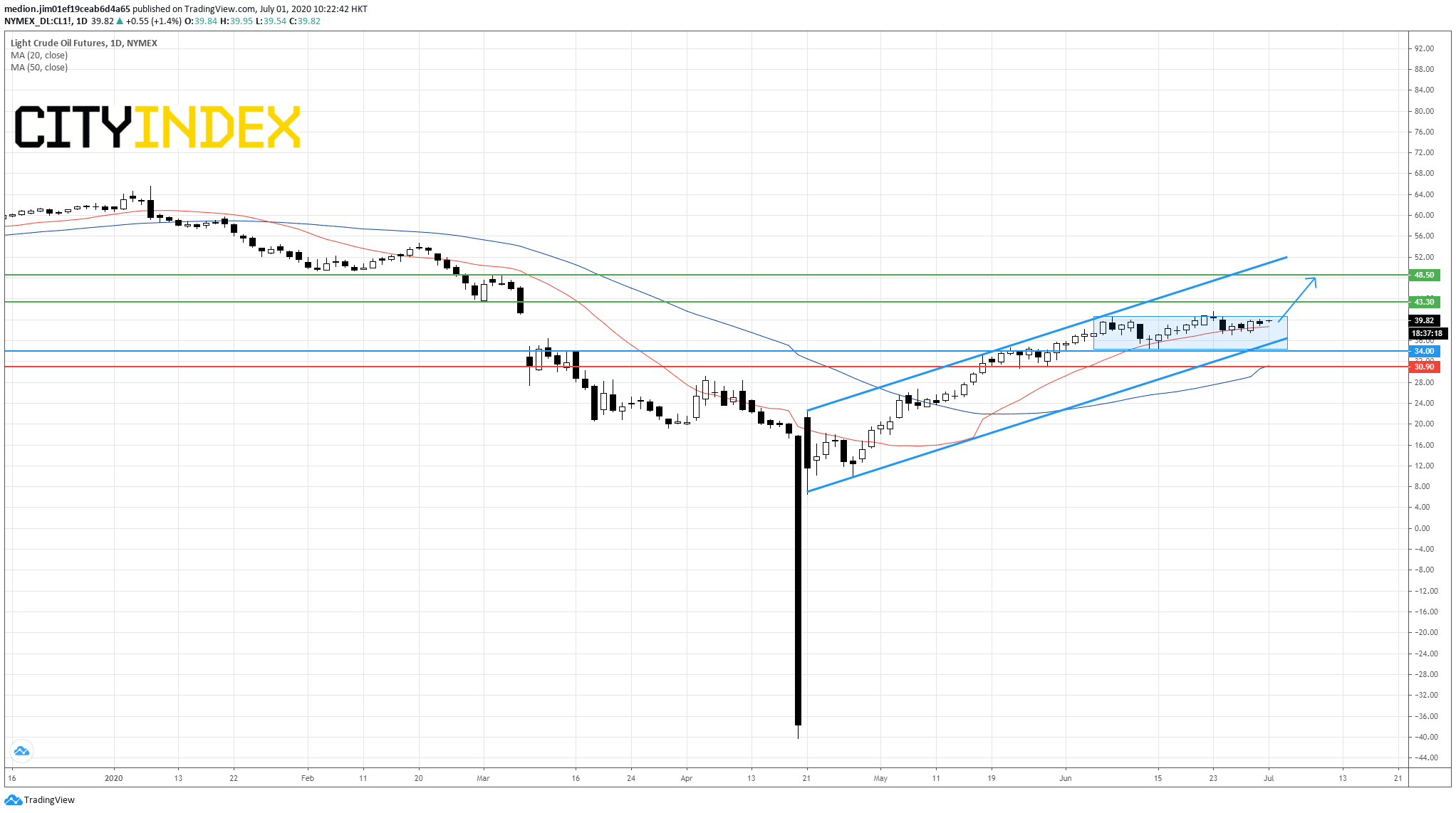

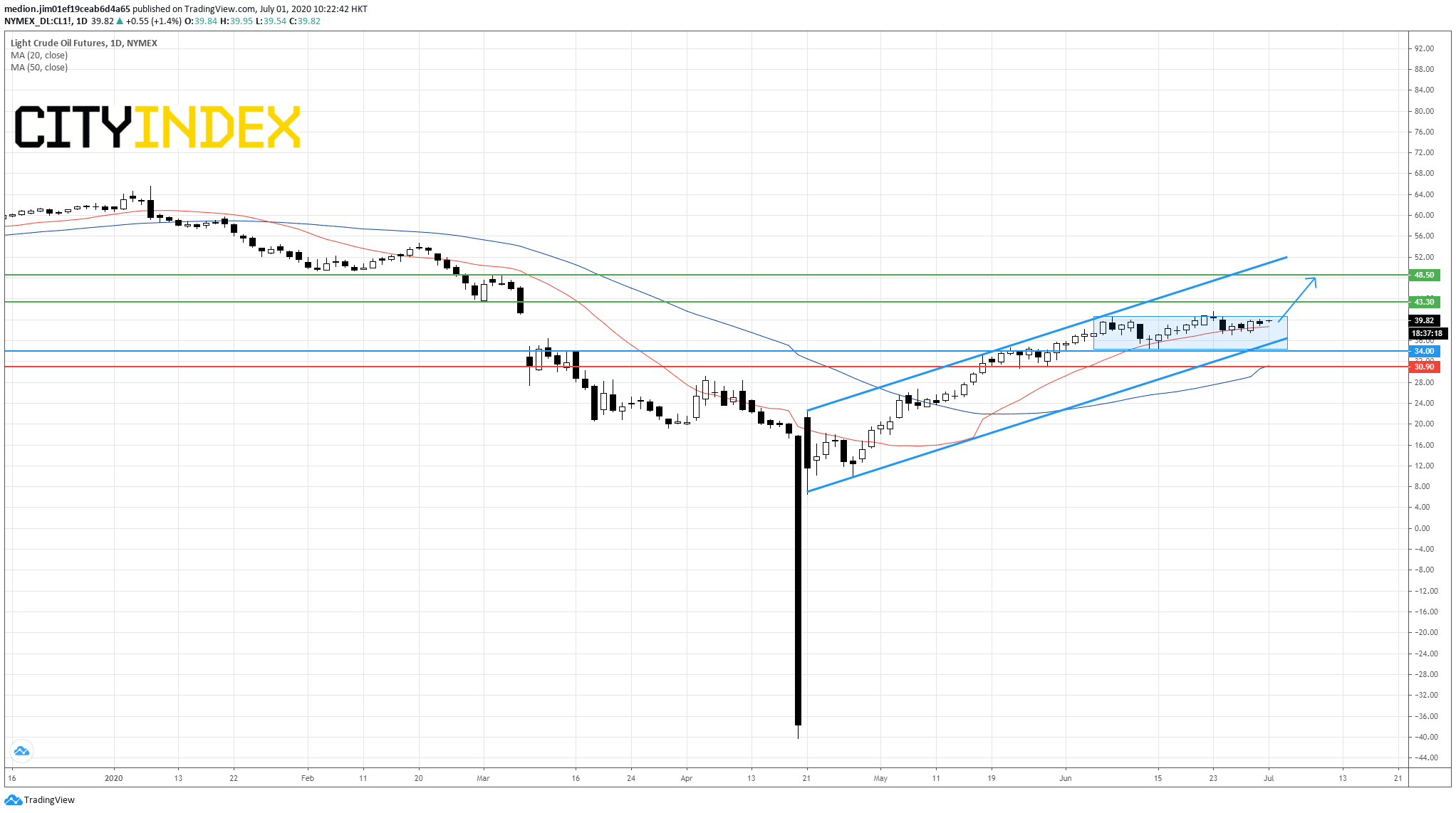

From a technical point view, Crude Oil is holding on the upside within the consolidation zone between $40.35 and $34.00 on a daily chart. A break above $40.35 could enhance the bullish outlook.

Currently, the prices remain supported by a rising 20-day moving average. Moreover, the futures prices remain trading within the rising channel. Both technical configuration would favor the positive outlook.

Bullish readers could set the support level at $34.00 (the low of June 15). while resistance levels would be located at $43.30 (the low of March 2) and $48.50 (the high of March 3).

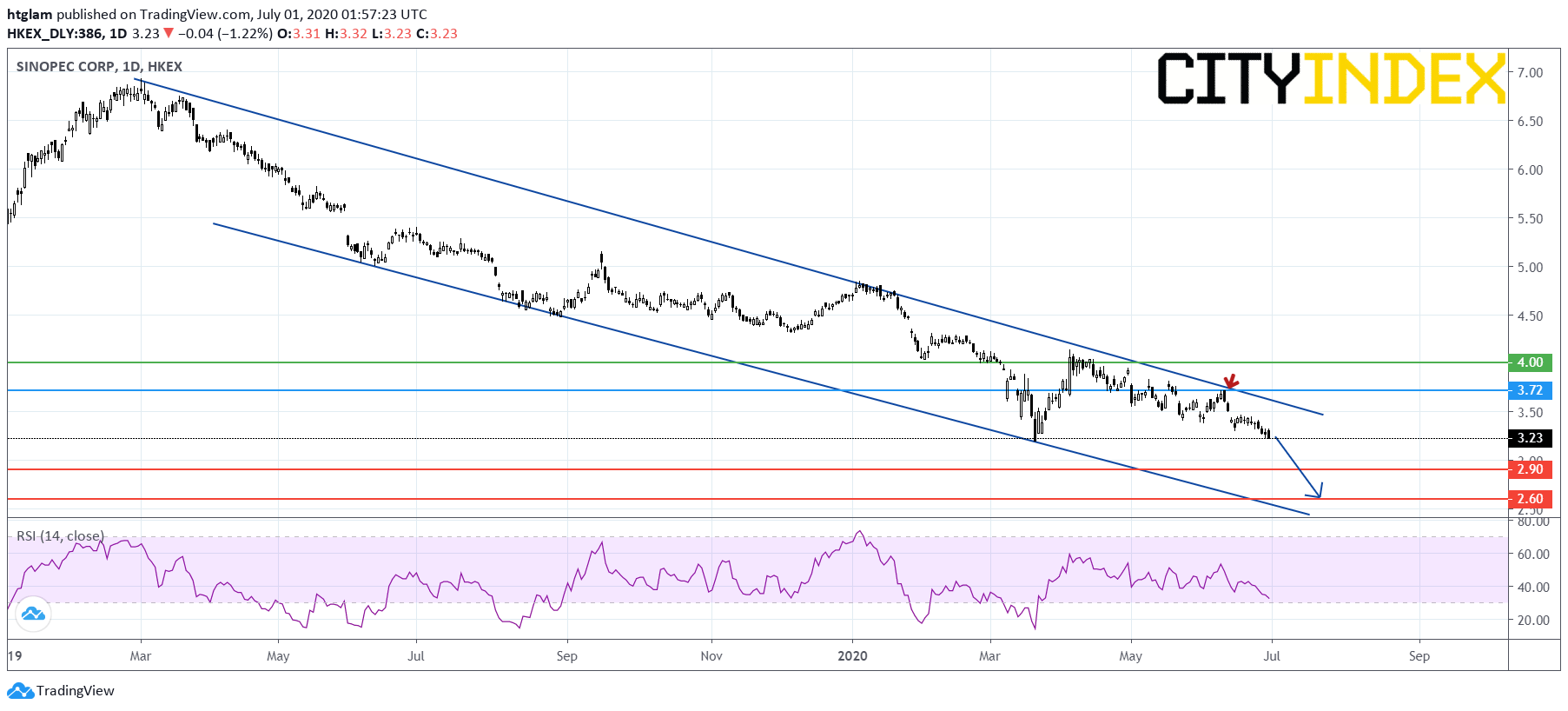

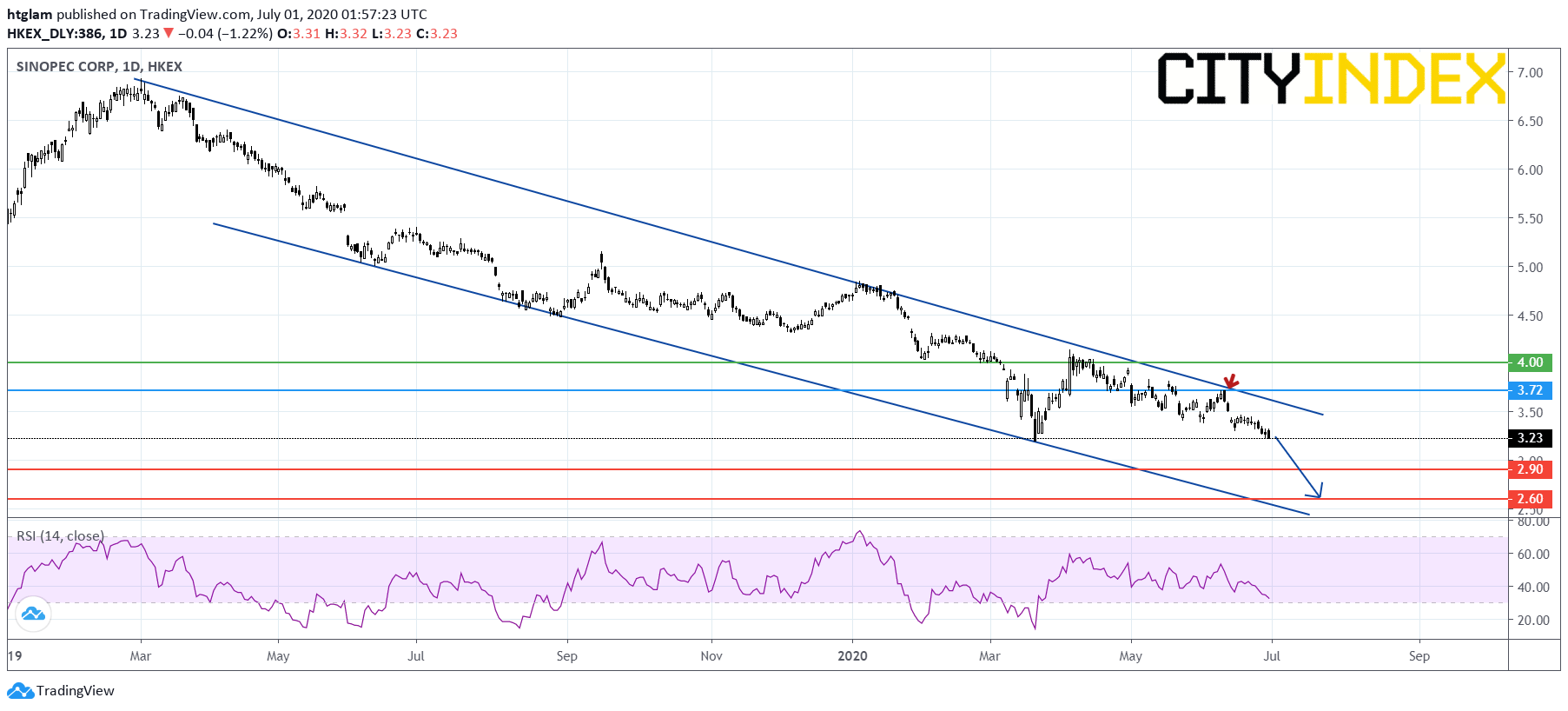

However, the trend of Sinopec (386-hk) remains weak.

From a technical point of view, Sinopec (386-hk), a petroleum and petrochemical giant which has not benefited from the rebound in oil prices, risks breaking below its previous low marked in March as shown on the daily chart. It keeps trading within a long term bearish channel drawn from February last year and has recently retreated after reaching the upper boundary of the channel. Bearish investors might consider $3.72 as the nearest resistance, with prices trending to test the 1st and 2nd support at $2.90 and $2.60. Alternatively, a break above $3.72 would suggest an upturn and open a path to the next resistance at $4.00.

In fact, the rise of Crude Oil futures in June is around 10%, much less than the gain of 85% in May. It suggests that the upward momentum of crude oil is slowing down as the market already digested the good news as above mentioned. Secondly, investors are worried about the lower demand of crude oil due to the second wave COVID-19.

The American Petroleum Institute (API) reported that the U.S. crude oil stockpile dropped 8.2M barrels for the week ended June 26. Later today, The U.S. Energy Information Administration will release crude oil inventories data for last week (-950K barrels expected).

From a technical point view, Crude Oil is holding on the upside within the consolidation zone between $40.35 and $34.00 on a daily chart. A break above $40.35 could enhance the bullish outlook.

Currently, the prices remain supported by a rising 20-day moving average. Moreover, the futures prices remain trading within the rising channel. Both technical configuration would favor the positive outlook.

Bullish readers could set the support level at $34.00 (the low of June 15). while resistance levels would be located at $43.30 (the low of March 2) and $48.50 (the high of March 3).

Source: GAIN Capital, TradingView

However, the trend of Sinopec (386-hk) remains weak.

From a technical point of view, Sinopec (386-hk), a petroleum and petrochemical giant which has not benefited from the rebound in oil prices, risks breaking below its previous low marked in March as shown on the daily chart. It keeps trading within a long term bearish channel drawn from February last year and has recently retreated after reaching the upper boundary of the channel. Bearish investors might consider $3.72 as the nearest resistance, with prices trending to test the 1st and 2nd support at $2.90 and $2.60. Alternatively, a break above $3.72 would suggest an upturn and open a path to the next resistance at $4.00.

Source: GAIN Capital, TradingView

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM