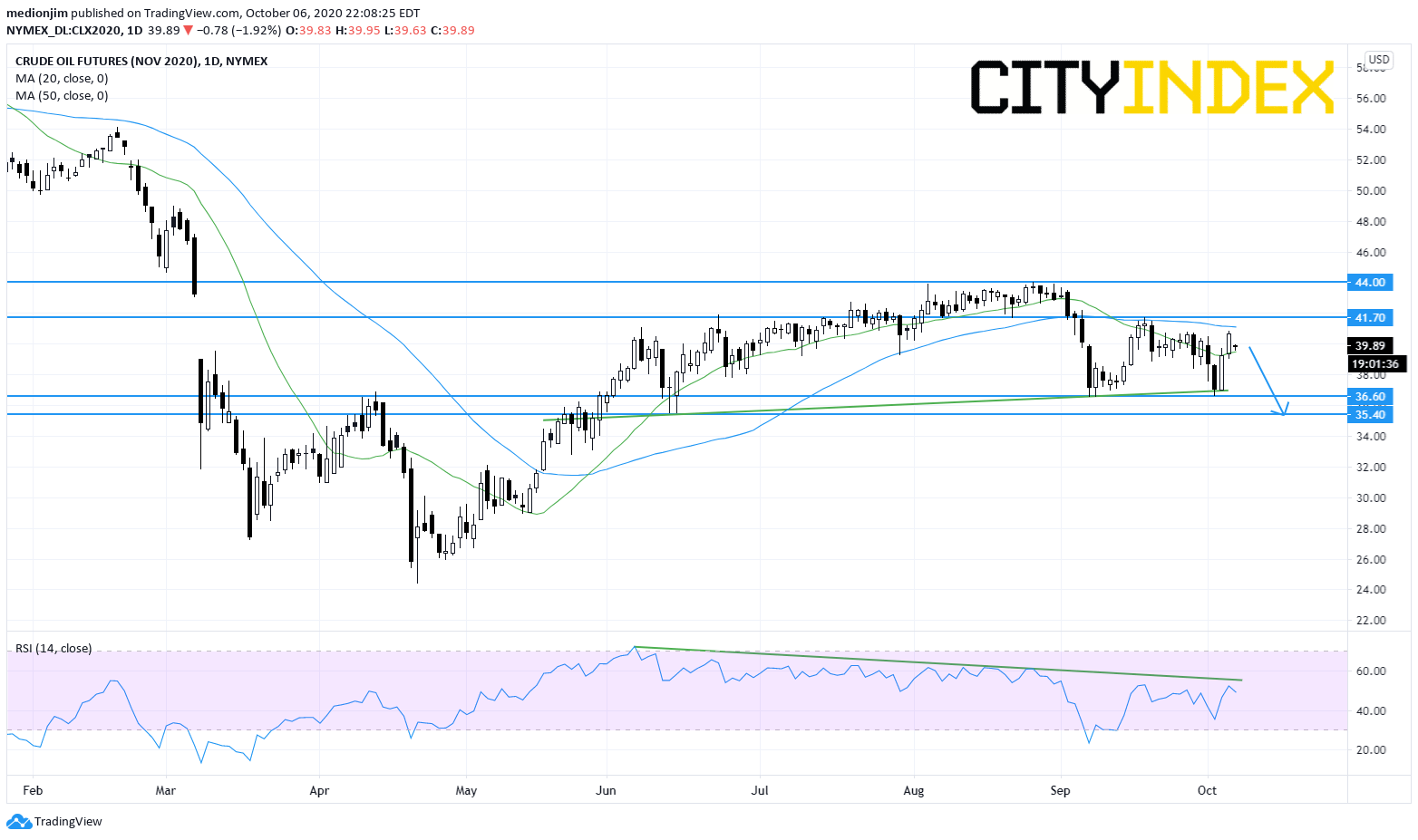

WTI Crude Oil Futures (November): Consolidation below $41.70

Yesterday, WTI Crude Oil futures rose to the intraday high at $40.86 as 29% of oil output was shut in the Gulf of Mexico ahead of Hurricane Delta. After that, futures prices pared the gain after the American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 951,000 barrels in the week ending October 2.

Besides, The U.S. Energy Information Administration (EIA) slightly raised 2021 crude oil production forecast to 11.09 million barrels per day in October from 11.08 million barrels per day, while 2021 crude oil forecast prices is lowered to $44.72 from $45.07 in the previous projection, according to EIA's Short Term Energy Outlook. Later today, the EIA will release official crude oil inventories data for the week ended October 2.

From a technical point of view, WTI Crude oil futures (November) posted a rebound and broke above 20-day moving average after failing to break below the September low at $36.60 and neckline drawn from June on a daily chart.

However, the oil prices remain trading below the declining 50-day moving average. The relative strength index is also capped by a declining trend line drawn from June.

Therefore, as long as the key resistance level at $41.70 is not surpassed, readers should expect oil prices with a bearish outlook in a consolidation phase. The support levels would be located $36.60 and $35.40. Only a break above $41.70 would trigger a rebound to the next resistance level at $44.00 (the high of September).

Source: Gain Capital, TradingView

Besides, The U.S. Energy Information Administration (EIA) slightly raised 2021 crude oil production forecast to 11.09 million barrels per day in October from 11.08 million barrels per day, while 2021 crude oil forecast prices is lowered to $44.72 from $45.07 in the previous projection, according to EIA's Short Term Energy Outlook. Later today, the EIA will release official crude oil inventories data for the week ended October 2.

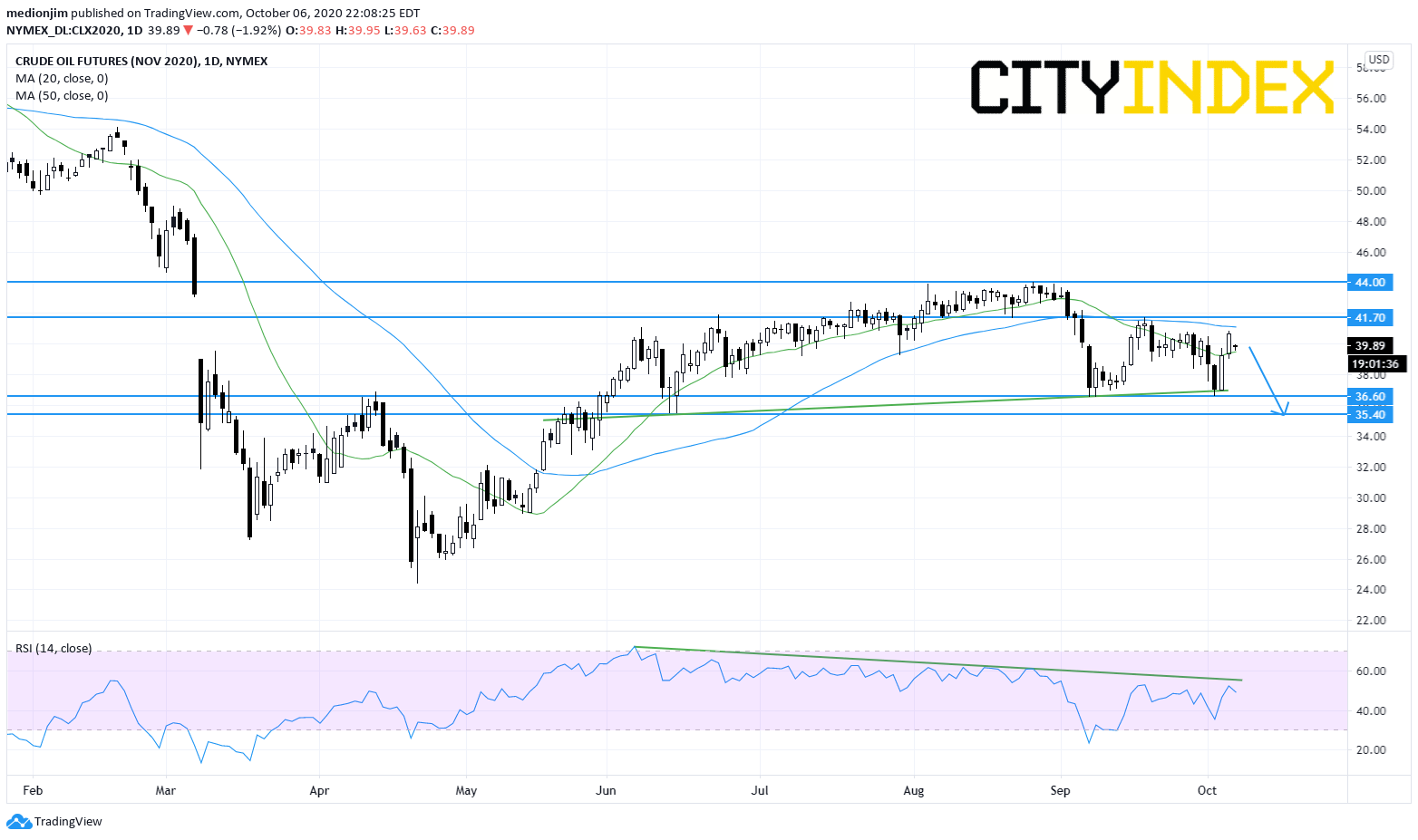

From a technical point of view, WTI Crude oil futures (November) posted a rebound and broke above 20-day moving average after failing to break below the September low at $36.60 and neckline drawn from June on a daily chart.

However, the oil prices remain trading below the declining 50-day moving average. The relative strength index is also capped by a declining trend line drawn from June.

Therefore, as long as the key resistance level at $41.70 is not surpassed, readers should expect oil prices with a bearish outlook in a consolidation phase. The support levels would be located $36.60 and $35.40. Only a break above $41.70 would trigger a rebound to the next resistance level at $44.00 (the high of September).

Source: Gain Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM