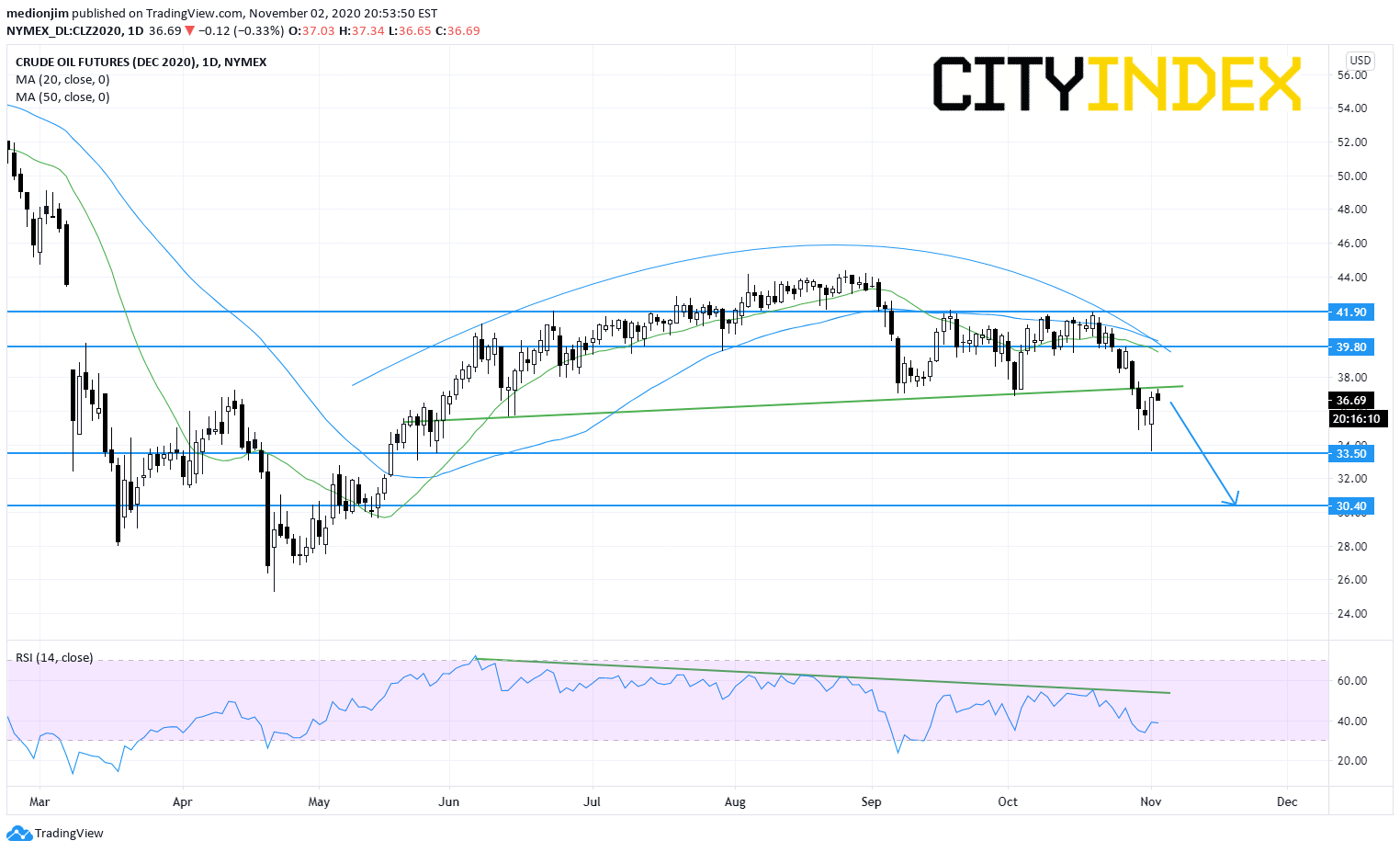

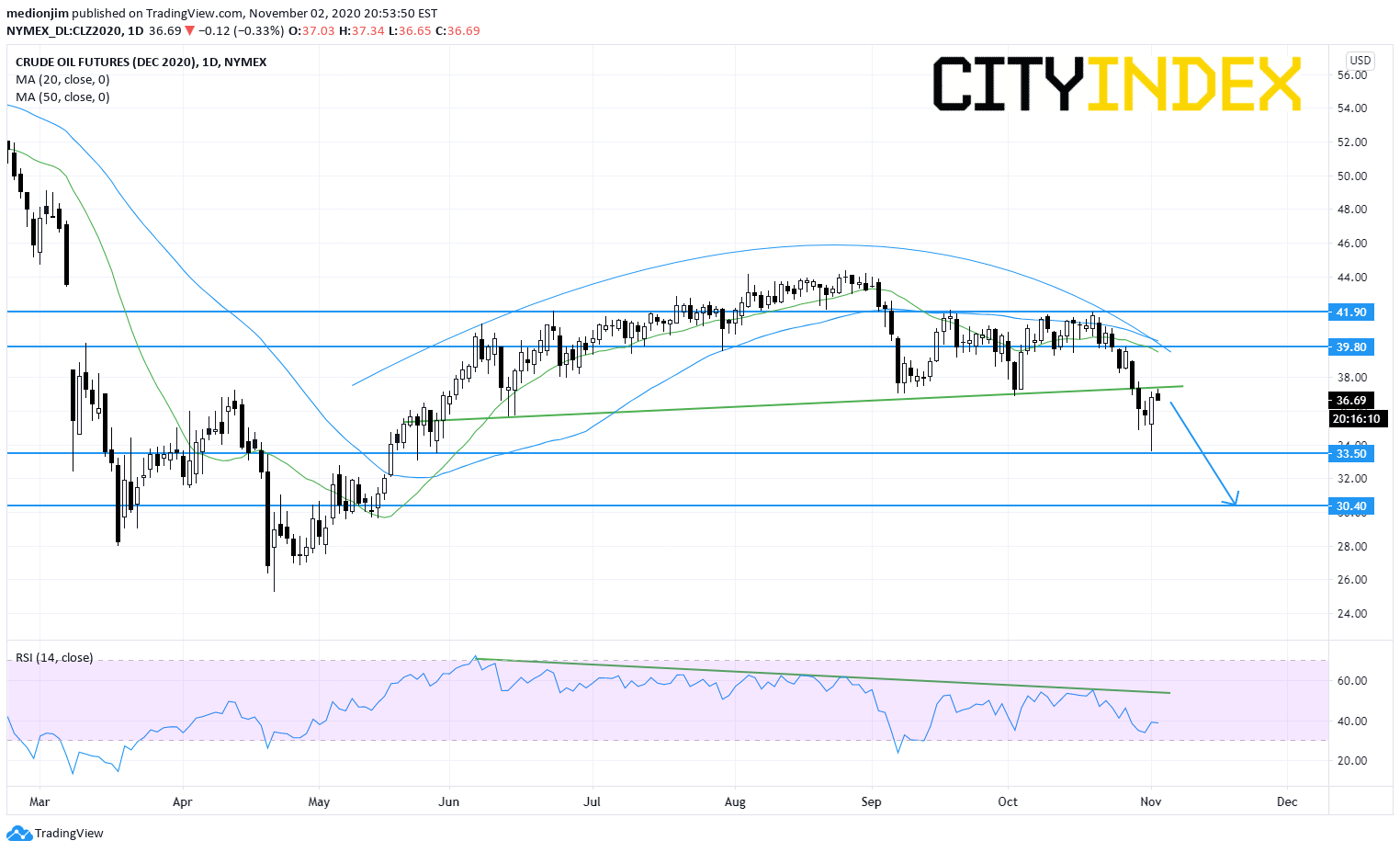

WTI Crude Oil Futures (December): A Round Top Pattern Found

Oil prices slumped at the end of October due to the second wave of coronavirus. WTI Crude Oil futures (December) lost 14% from the top of October. More and more European countries announced the lockdown plans to limit the new inflections.

JPMorgan lowered the 4Q average Brent forecast to $39/bbl from $41/bbl as renewed lockdowns in Europe further weigh on demand. The bank cut the oil demand estimates by 890K barrels per day for November and 1.08M barrels per day for December.

On the other hand, OPEC+ might delay its January output increase for extra three months, reported Bloomberg. Russia President Vladimir Putin also said he was open to a delay for the oil cut plan.

Bearish readers could set the resistance level at $39.80, while support level would be located at $33.50 and $30.40 respectively.

Source: GAIN Capital, TradingView

JPMorgan lowered the 4Q average Brent forecast to $39/bbl from $41/bbl as renewed lockdowns in Europe further weigh on demand. The bank cut the oil demand estimates by 890K barrels per day for November and 1.08M barrels per day for December.

On the other hand, OPEC+ might delay its January output increase for extra three months, reported Bloomberg. Russia President Vladimir Putin also said he was open to a delay for the oil cut plan.

From a technical point of View, WTI Crude Oil Futures (January) broke below the neckline and confirmed a round top pattern. Currently, it is still trading below both declining 20-day and 50-day moving averages. The relative strength index is also capped by a declining trend line.

Bearish readers could set the resistance level at $39.80, while support level would be located at $33.50 and $30.40 respectively.

Source: GAIN Capital, TradingView

Latest market news

Today 10:37 AM

Today 08:25 AM