WTI Crude Futures Intraday: Potential Signals of a Correction

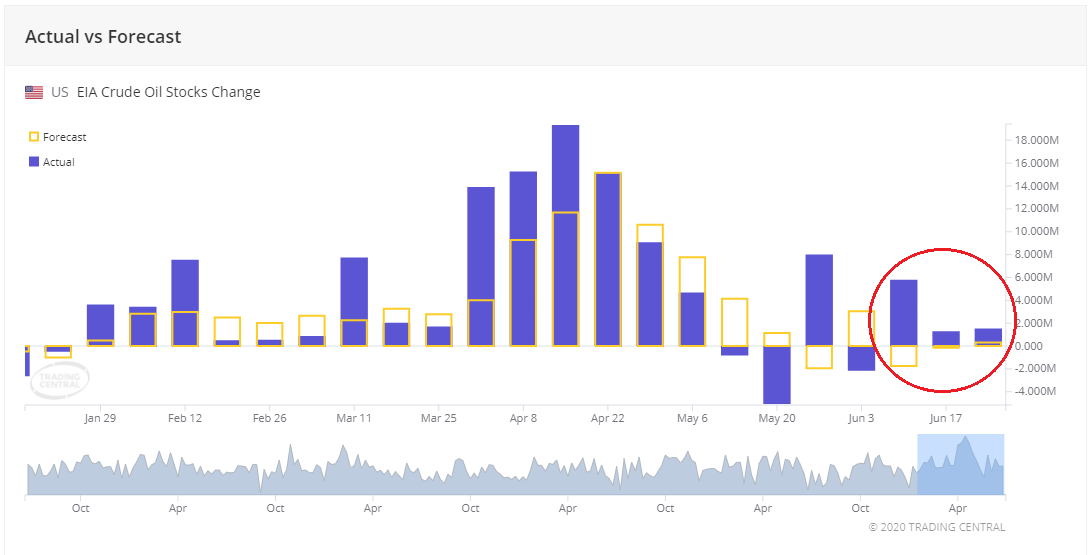

WTI Crude Futures (August contract) plunged 5.9% to $38.01 yesterday, as sentiment was dragged down by a resurgence in coronavirus infections across the U.S. and a larger-than-expected build in U.S. crude oil inventory.

The U.S. Energy Information Administration (EIA) reported that crude oil inventory rose 1.44 million barrels, more than an increase of 0.30 million barrels estimated and it is the third consecutive week of worse than expectations.

Previously, we mentioned that despite there might be some more room for oil's rebound in the short term, over-optimism should be avoided. Now there may be signs of a correction in oil prices.

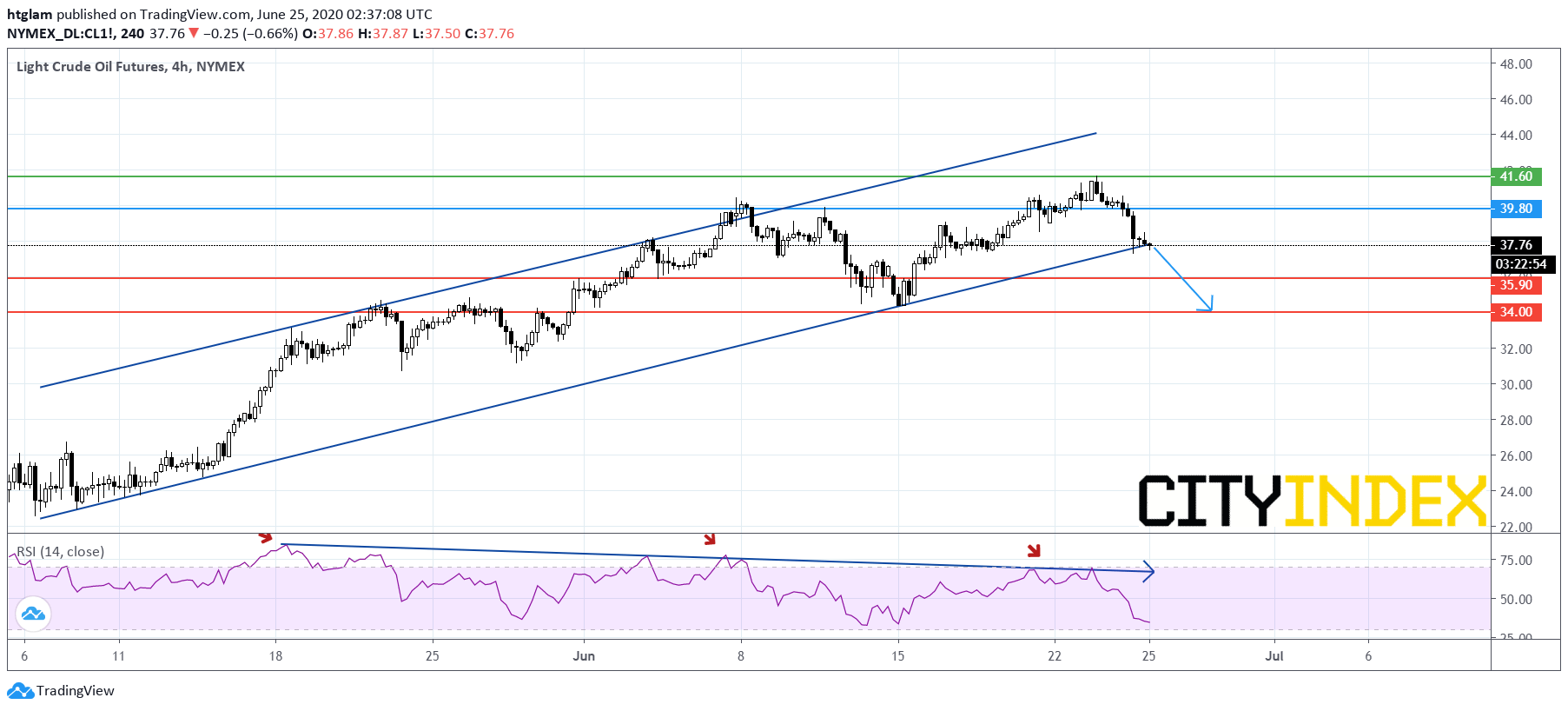

From an intraday point of view, WTI Crude Futures (August contract) is under pressure as shown on the 4-hour chart. There initial signs that a bullish channel drawn from early May might be broken, while the relative strength index continues to show a bearish divergence. Bearish investors might consider $39.80 as the nearest intraday resistance, with prices likely to test the 1st and 2nd support at $35.90 and $34.00 respectively. Alternatively, a break above $39.80 may trigger a revisit to the next resistance at $41.60.