WTI Crude Futures: Downside Correction

WTI Crude Futures (November contract) have dropped about 8% so far in September with increased volatility compared with the last two months. Optimism on a speedy recovery in the global economy has eased, while weakness in the stock markets and a rebound in U.S. dollar have also put pressure on the oil prices.

Meanwhile, the American Petroleum Institute (API) reported that U.S. crude-oil inventories rose 691,000 barrels in the week ending September 18 (-2.26 million barrels expected). Later today, the U.S. Energy Information Administration (EIA) will release official crude oil inventories data for the same period.

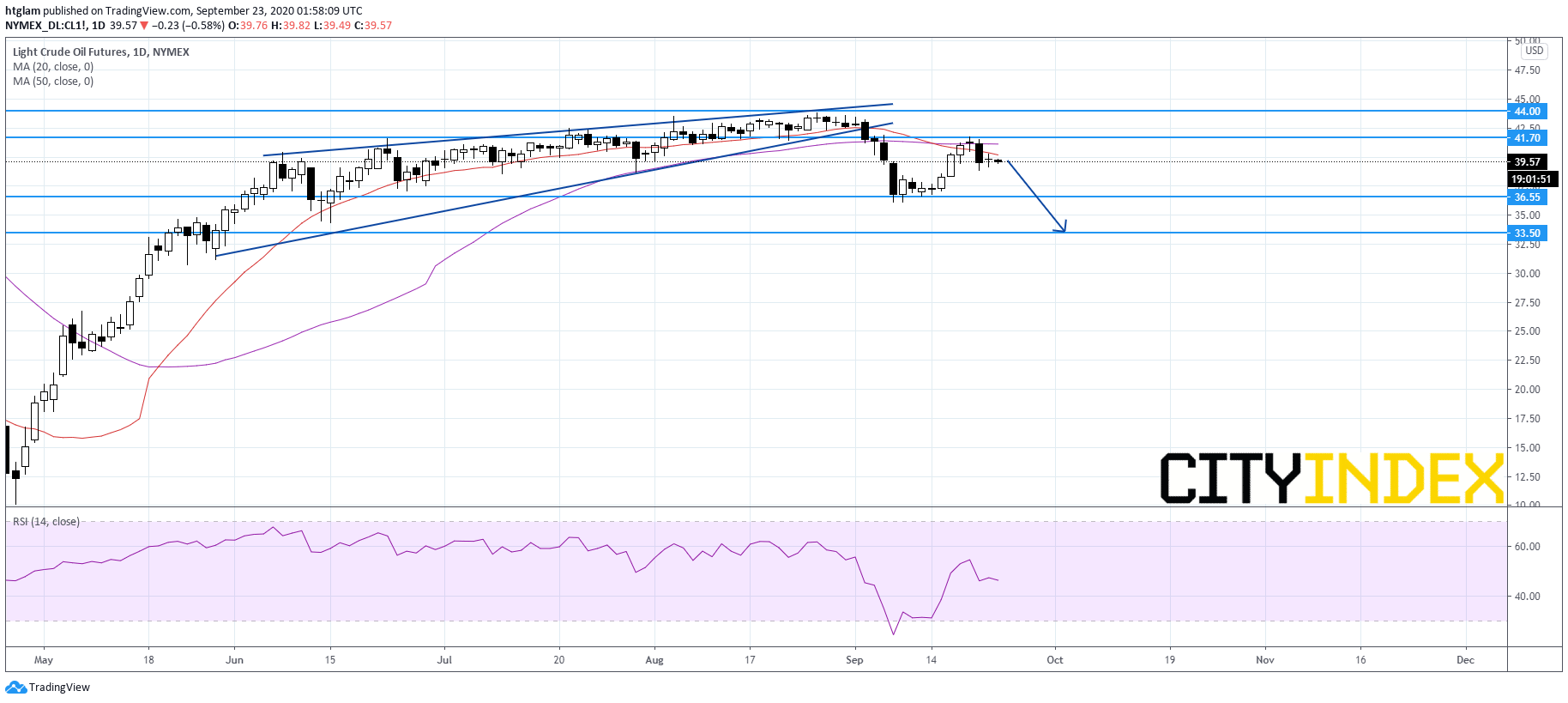

From a technical point of view, WTI Crude Futures (November contract) flags downside risks as shown on the daily chart. It has broken below a bearish rising wedge pattern, while the 20-day moving average has crossed below the 50-day one. The level at $41.70 may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $36.55 and $33.50.