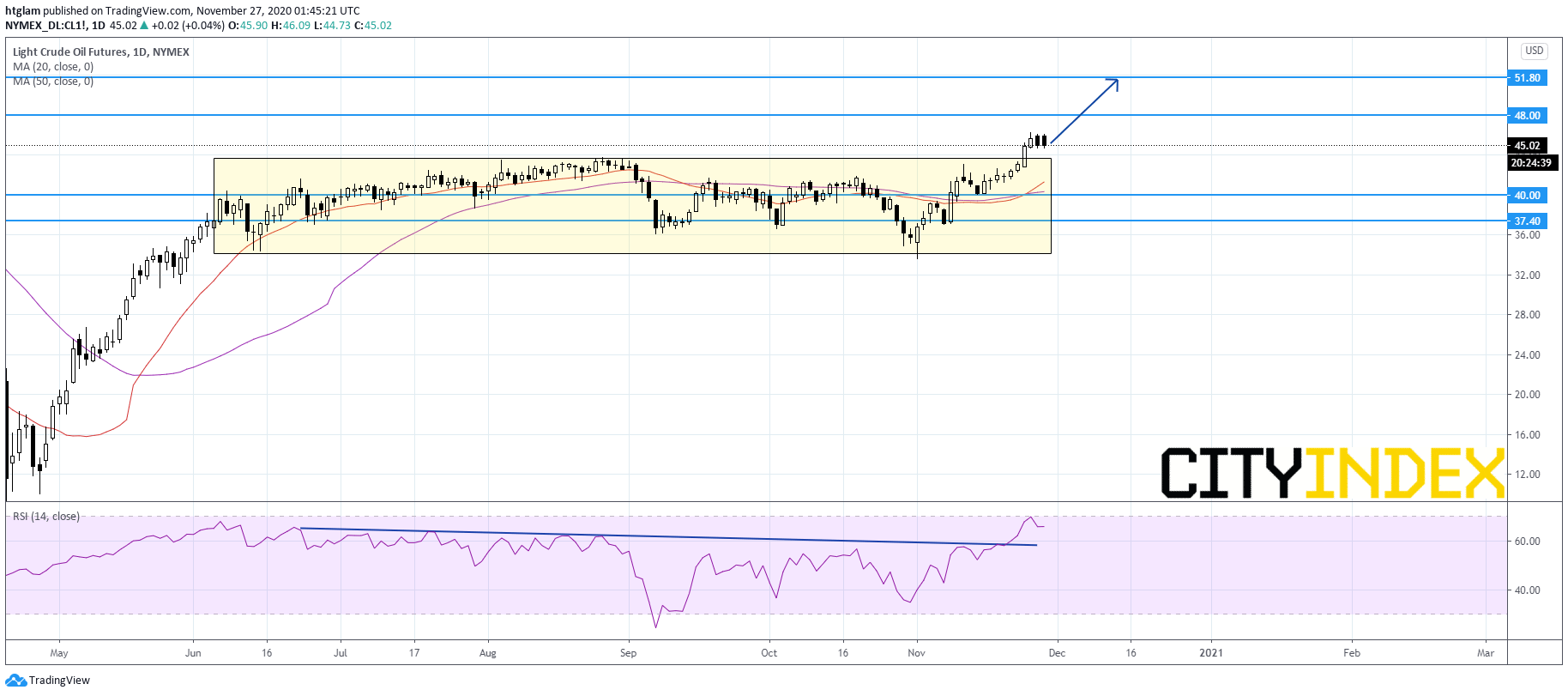

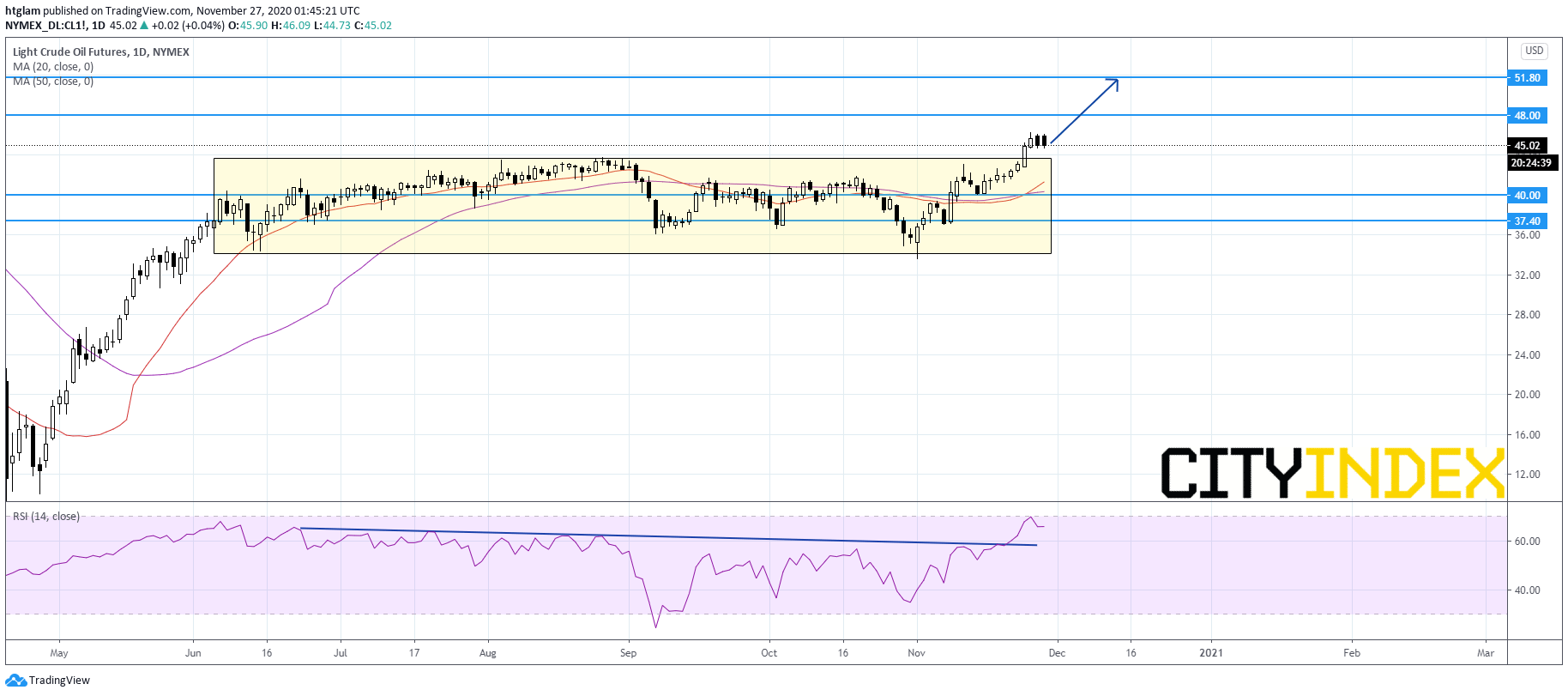

WTI Crude Futures: Above 5 Month Consolidation Range

The coronavirus vaccine breakthrough has caused big fluctuation in the commodity market, with WTI crude oil prices surging more than 20% so far in November, while spot gold has dropped more than 3% and is on track for a fourth month of decline. Post-Covid-19 recovery has spurred optimism on oil demand, while gold has lost shine as a safe-haven asset.

Two weeks ago, we noticed that WTI Crude has shown early signs of an end of consolidation, and it has now broken above the 5-month consolidation range. From a technical point of view, WTI Crude Futures (Jan) stays on the upside as it holds above that consolidation range. Currently, it is trading at levels well above both the 20-day and 50-day moving averages, showing upside momentum. The level at $40.00 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $48.00 and $51.80 respectively.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM