WTI Crude Futures: Early signs of an end of consolidation

On Tuesday, WTI Crude Futures (Dec) advanced 2.7% to a 3-week high at $41.36, after surging 8.5% in the prior session, as market sentiment was buoyed by Covid-19 vaccine breakthrough. Meanwhile, investors would focus on the EIA crude inventories data due on Thursday (-0.87 million barrels expected).

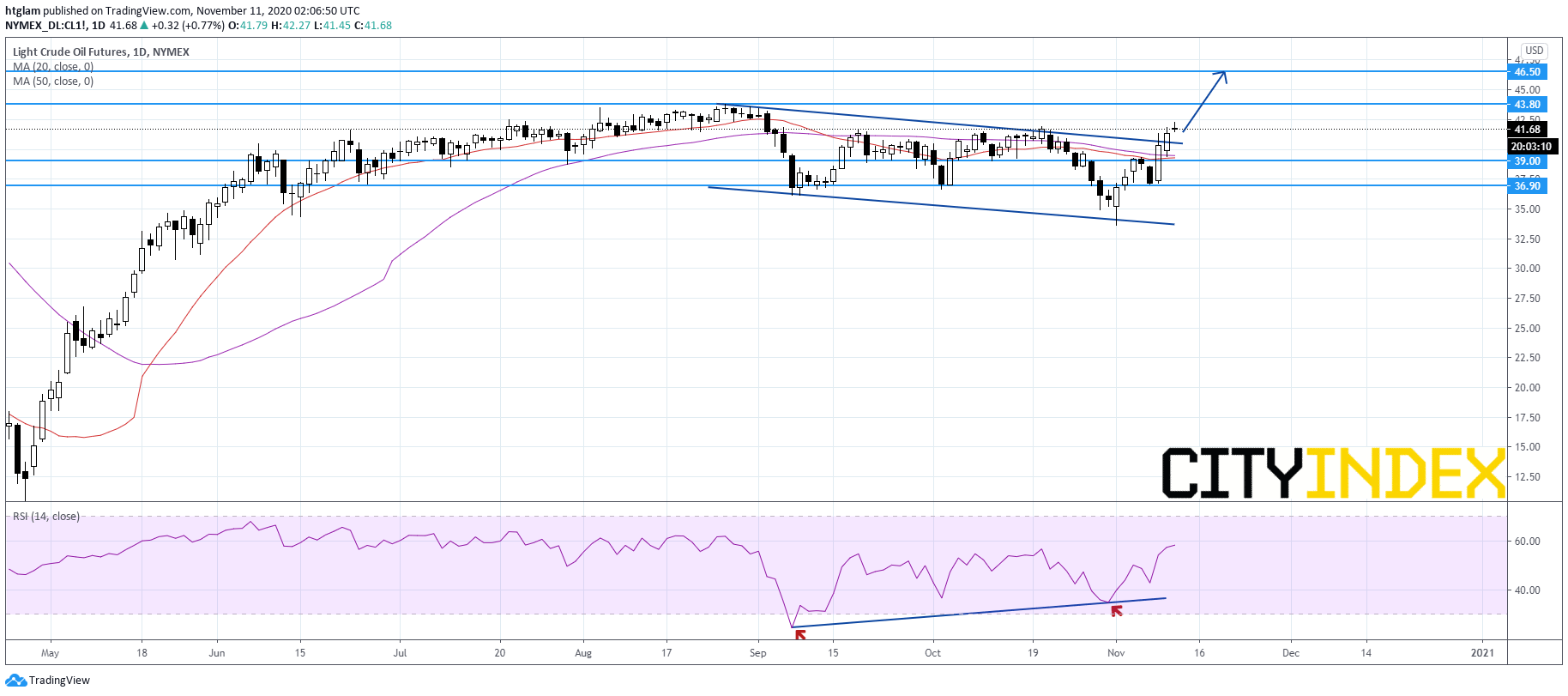

On a daily chart, WTI Crude Futures (Dec) shows early signs of an upside breakout from a bearish channel drawn from August. In fact, it has returned to levels above both the 20-day and 50-day moving averages, while the relative strength index showed bullish divergence. The level at $39.00 might be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $43.80 and $46.50 respectively.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM