- Sales £3.29 billion +5.2%

- LFL revenue climbed 1.9% (excluding Kantar)

- US biggest source revenue £1.24 billion +3.8%

- UK revenue £468 million +1.48%

- Europe revenue £613 million +4.1%

WPP has had a tough few years. Shares shed 50% of their value from 2017 – 19 as WPP lost big clients such a Ford and American Express and as big ad agencies suffer from stiff competition from the likes of Google and Facebook. Add into the mix the fact that marketing budgets are being hit by ongoing global growth uncertainties and today’s return to quarterly organic sales growth for the first time in over a year looks all the more impressive.

A new strategy and more streamlined approach from boss Mark Read is clearly helping the advertising giant attract talent and win contracts, picking up clients such as eBay and Mondelez.

An air of caution remains

It is still early days, let’s not forget that WPP had a less than impressive H1. It appears that WPP is on the right path, however it remains cautious in its 2019 outlook, deciding not to move up guidance at this stage. Expectations for 2020 could be a good deal higher. There are tentative signs that WPP is following in the footsteps of it stronger performing US peers, rather than French rival Publicis which slashed its sales outlook earlier this month.

- 3 Strong buy

- 8 Buy

- 10 Hold

- 3 Sell

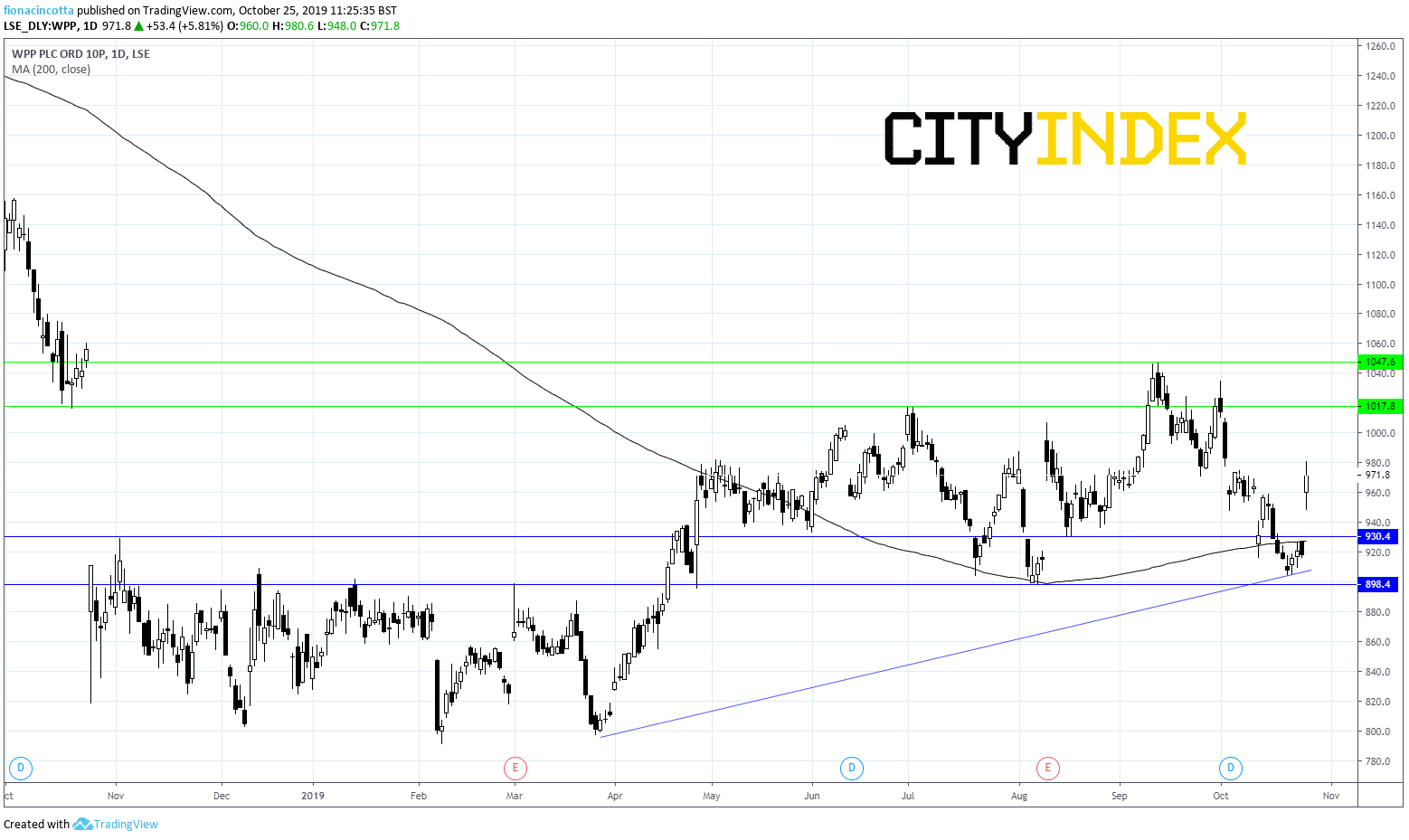

WPP traded between 800p – 900p for the first 4 months on the year. In April the share price started advancing, hitting a high of 1047p mid-September. Following today’s results, the share price has jumped over 5% pushing back over the 200 sma. We are looking for a break above 1017p to confirm a more bullish trend. Support can be seen at 930p prior to 900p.