Woolworths is a defensive stock that benefitted from the arrival of COVID-19 in Australia last year as households stocked up on toilet paper, pasta, and other pantry items.

The Delta outbreak along the Eastern Seaboard states that occurred midyear prompted another round of panic buying that pushed the share price of Woolworths above $42.00 in August.

In October, Woolworths CEO Brad Banducci noted, “Q1 F22 has arguably been the most challenging COVID quarter for the business, with the Delta variant causing major disruptions to our supply chain and stores, especially in NSW and Victoria.”

In an update in December, the CEO noted the COVID environment had impacted expected earnings in H1. The market duly responded by sending the share price of WOW from near $41.00 down to a low near $36.00.

However, worse was to come. The arrival of Omicron in December has again wreaked havoc on supply chains. At one point, Woolworths had 35% of its distribution center workers in isolation, leaving Woolworths shelves lying bare.

Taking advantage of this, IGA and other independent supermarkets have been able to gain market share as their more localized supply chains kept food on shelves during the Omicron wave. With the number of omicron cases steadily dropping, the worse is likely now behind Woolworths.

Woolworths reported group NPAT of $1.972 billion for FY21 on group sales of $67.278 billion. Analysts expect Woolworths to report NPAT of $878 million for 1HY22 and announce an interim dividend of $0.48c per share.

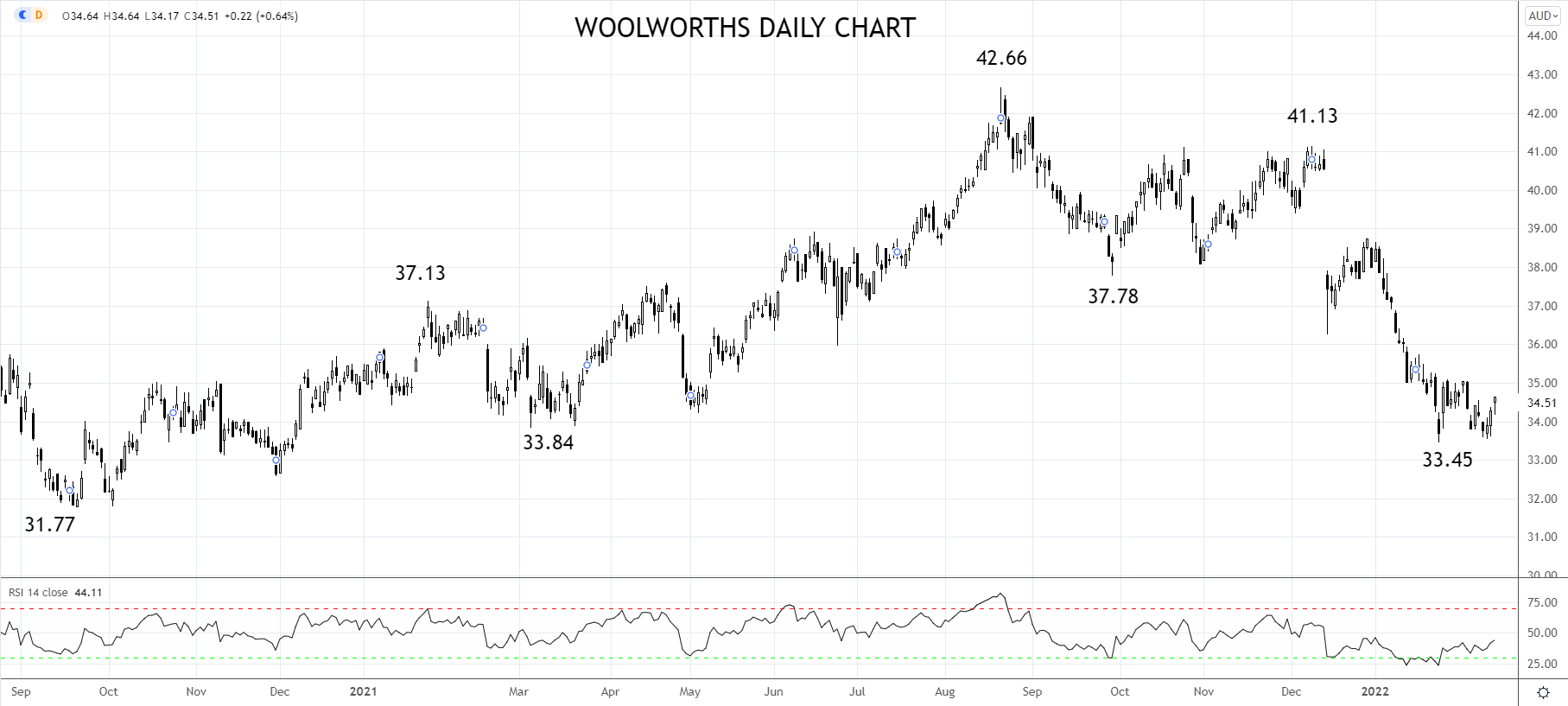

WOW Share Price Chart

In recent weeks the share price of Woolworths has found support near $33.50, after a 12% fall during the first weeks of 2022.

Presuming the worst of the COVID disruption is now in the rear vision mirror, the WOW share price has the potential to recover back towards resistance at $37.00 in coming months.

Source Tradingview. The figures stated areas of February 16th 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade