In our last article on the EURUSD written back on February 19th, we asked how low could the EURUSD go, after it fell quickly from just below 1.1100 to 1.0800. As a result, oversold readings were at extreme levels and our thoughts were the EURUSD would launch a countertrend rally from the trendline support coming in 1.0750ish.

This played out broadly as expected as the EURUSD reached our 1.0880/1.0920 bounce target five days later, before surging higher again as last week’s violent fall in equity markets and accompanying sharp rise in volatility forced traders to unwind short EUR FX carry trades.

The Feds overnight intermeeting 50bp cut brings the EURUSD back into focus. Although the Feds rate cut is viewed as part of a coordinated round of easing’s, the U.S. dollar sagged because the Fed quite simply has more room to cut again. It could conceivably take rates all the way back to zero whereas other key central banks are already there and have just pea shooters and cap guns left in their conventional monetary policy armory.

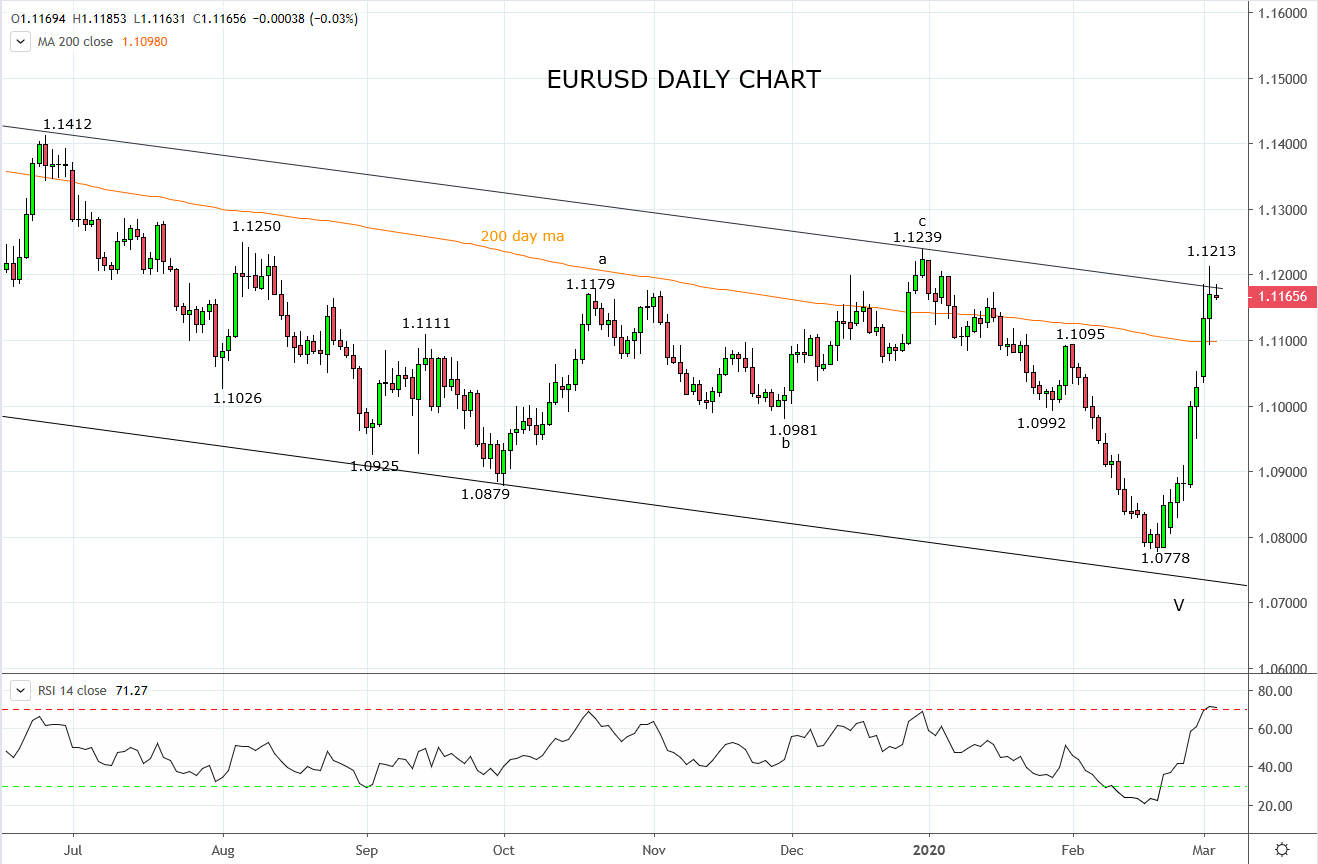

As can be viewed on the chart below, the EURUSD after completing a v-shaped bottom at the 1.0778 low is now testing trend channel resistance, which if we are brutally honest has been a burial ground for past EURUSD rallies. Importantly we are still waiting on the ECB’s response to the Covid-19 epidemic which depending on the balance of fiscal vs monetary, is likely to determine if the EURUSD fails again or makes a clean break for the hills.

In this regard price action will be important. Should the EURUSD break and post two consecutive daily close above trend channel resistance and year to date highs, let's say 1.1260ish to give it some room, a move towards 1.1600/1.1800 is likely to unfold and the catalyst to consider EURUSD longs. Until that occurs allow for the possibility of another round of EURUSD failure.

Source Tradingview. The figures stated areas of the 4th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation