The Fed made it clear in March that they are not looking to hike this year. Furthermore, it is too early for any major shift in policy language. Therefore, a lot hinges on the extent to which Fed Chair Jerome Powell acknowledges the recent improvement in economic data.

US economic data across the month has been encouraging. Retail sales, pending home sales and manufacturing have all improved, consumer confidence is rebounding, and the US labour market remains strong. These are all points that the Fed may want to acknowledge. US GDP also smashed expectations at 3.2%, owing mainly to a big pick up in inventory. However, the Fed may struggle to get excited about strong economic growth based on an unsold inventory build-up. Inflation (PCE) unexpectedly moved lower to 1.6%, which could well keep the Fed patient. The market is currently pricing in a 65% probability of a rate cut by the end of the year.

Which way for the dollar?

The dollar has rallied across the month of April and whilst was the buck has given back some of those gains in recent sessions there are still buyers around keeping the greenback afloat.

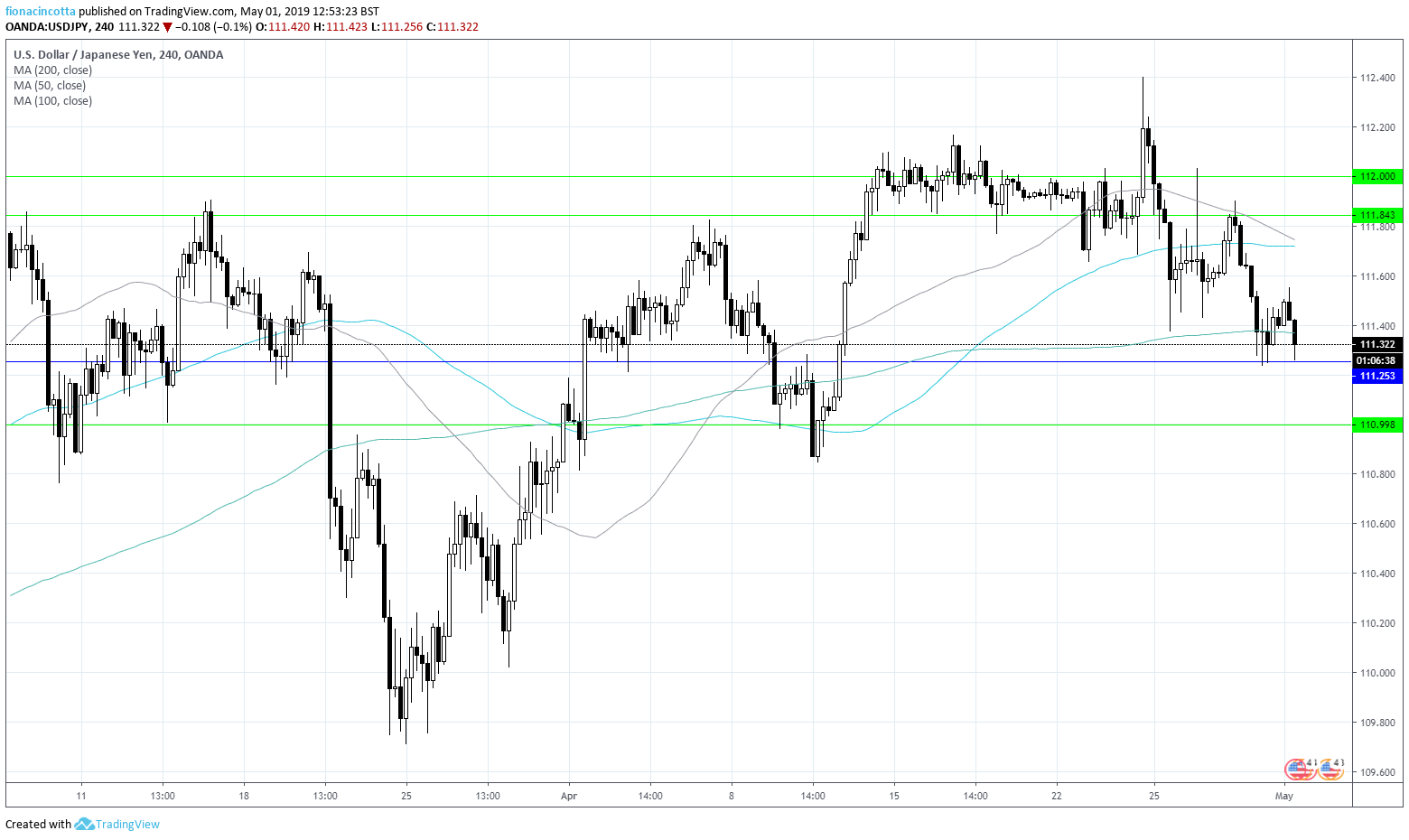

Should the Fed focus on the broadly improving US data and downplay the possibility of a rate cut then we could expect to see the dollar jump higher. The USD/JPY struggled to break above 111.55 earlier today. However, under this scenario the USD/JPY could target 112.00

On the other hand, should the Fed focus on lacklustre inflation and the slowing global growth story whilst emphasizing the need to be patient, we could see the dollar take another step lower. The US/JPY could break through near term support at 111.25 and head towards 111.00.