The numbers:

The key figures from this earnings report will be North American sales and, of course, sales in China. Nike’s share price dropped post Q3 results despite overall revenue matching analyst’s expectation. Investors were disappointed that North American revenue lagged, with sales up only 7%, weaker than forecast. Another soft showing from North America could have a similar affect.

China sales were up 24% last quarter and Nike remain bullish on China despite the current uncertainty stemming from trade tariffs and the ongoing trade dispute. However domestic competition is hotting up from Anta and Xtep, potentially putting China sales on course for a rough patch.

That said, innovation and the strong athleisure trend means there is still plenty to be optimistic about.

EPS is expected to have declined just over 4% to $0.66 per share. Revenue is expected to have increased just shy of 4% to $10.17 billion as Nike continues to defy the wider retail industry’s struggles, thanks to an increased focus on own channel e-commerce.

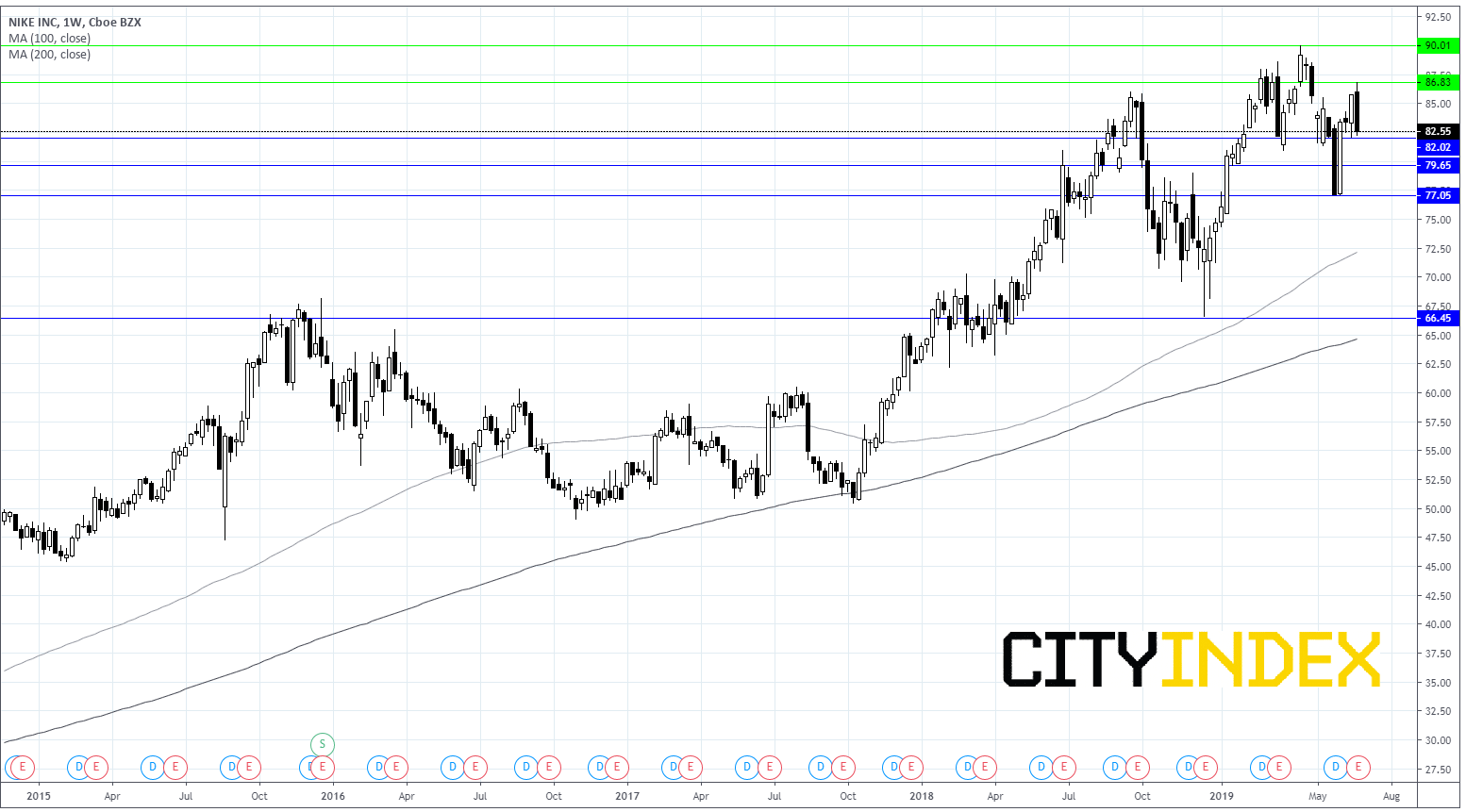

Nike shares are down 3.7% this week so far at $82.50, off 8% from the 52-week intraday high of $90.00. They are up 12% this year meaning Nike shares are underperforming the broader market. 77% analysts have a buy rating and the consensus price target is $92.09.

Levels to watch;

The technical outlook will improve if the stock pushed above this week’s high of $86.84. On the other hand, a breakdown through support at $82 could open the door to $79.65 prior to $77.00.