While the arrival of a vaccine has sparked hopes for a return to normality, in the short term things remain far from normal. Rolling lockdowns and the wearing of masks have become part of everyday life as governments and central banks push the economic levers to help nurture the economic recovery and boost job creation.

Yesterday after previously threatening not to, US President Donald Trump signed off on a spending bill, that included a $900 billion relief package. With the ink barely dry, the House passed a new bill that proposed replacing the $600 stimulus checks with a $2,000 payment.

Whether the new bill will pass the Republican-held Senate remains unclear. However, there is little doubt more stimulus will arrive in 2021, as President-elect Joe Biden has repeatedly called the $900 billion package a “down payment”.

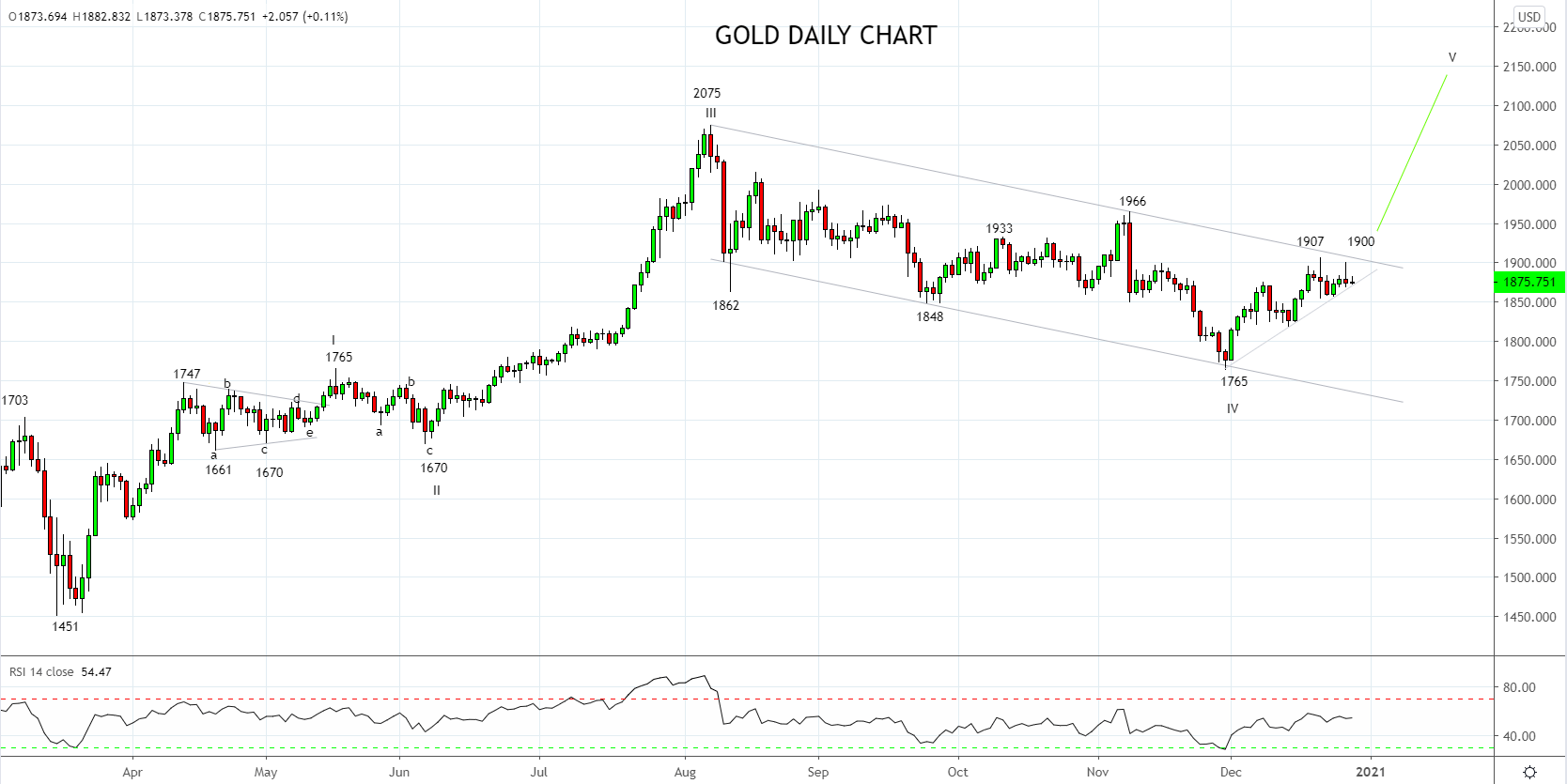

This brings us around to an update on an article to the Gold article from early December here in which we suggested opening long positions at $1810 looking for a retest of the August $2075 high.

The fundamental reasons for owning gold remain strong and are supported by the arrival of bullish gold seasonals in January. Yet further confirmation from a technical perspective is required to confirm the fundamental bullish bias.

As can be viewed on the chart below for the second time in recent sessions, gold stalled overnight from ahead of trend channel resistance, currently $1910 area.

To confirm the bullish bias from a technical perspective, gold needs to break/close above $1910ish without first falling below uptrend support $1870ish and then the band of support $1850 area.

For those who followed our suggestion in early December, we would suggest raising the stop loss on longs to protect profits to $1866, or for those who want to give the trade more room, to $1849. Upside targets are the November $1966 high, followed by the August $2075 high.

Source Tradingview. The figures stated areas of the 29th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation