Pound struggles as UK economy slows

Dismal monthly GDP data, in addition to weak manufacturing and industrial production numbers laid bare the impact of Brexit uncertainty and trade tensions on the British economy. Whilst the monthly GDP tracker is volatile and we say that one bad reading doesn’t constitute a trend, two consecutive readings of contraction are hard to ignore. The data suggests that the UK economy is facing a marked slow down in the second quarter. The pound dropped to a weekly low of $1.2654. Whilst it has picked up marginally in the afternoon session, we expect pressure to remain on the pound as the Conservative leadership battle heats up. With nominations formally opening today, investors will get a first look at how popular pro- Brexit candidates are. This could in fact spook investors further.

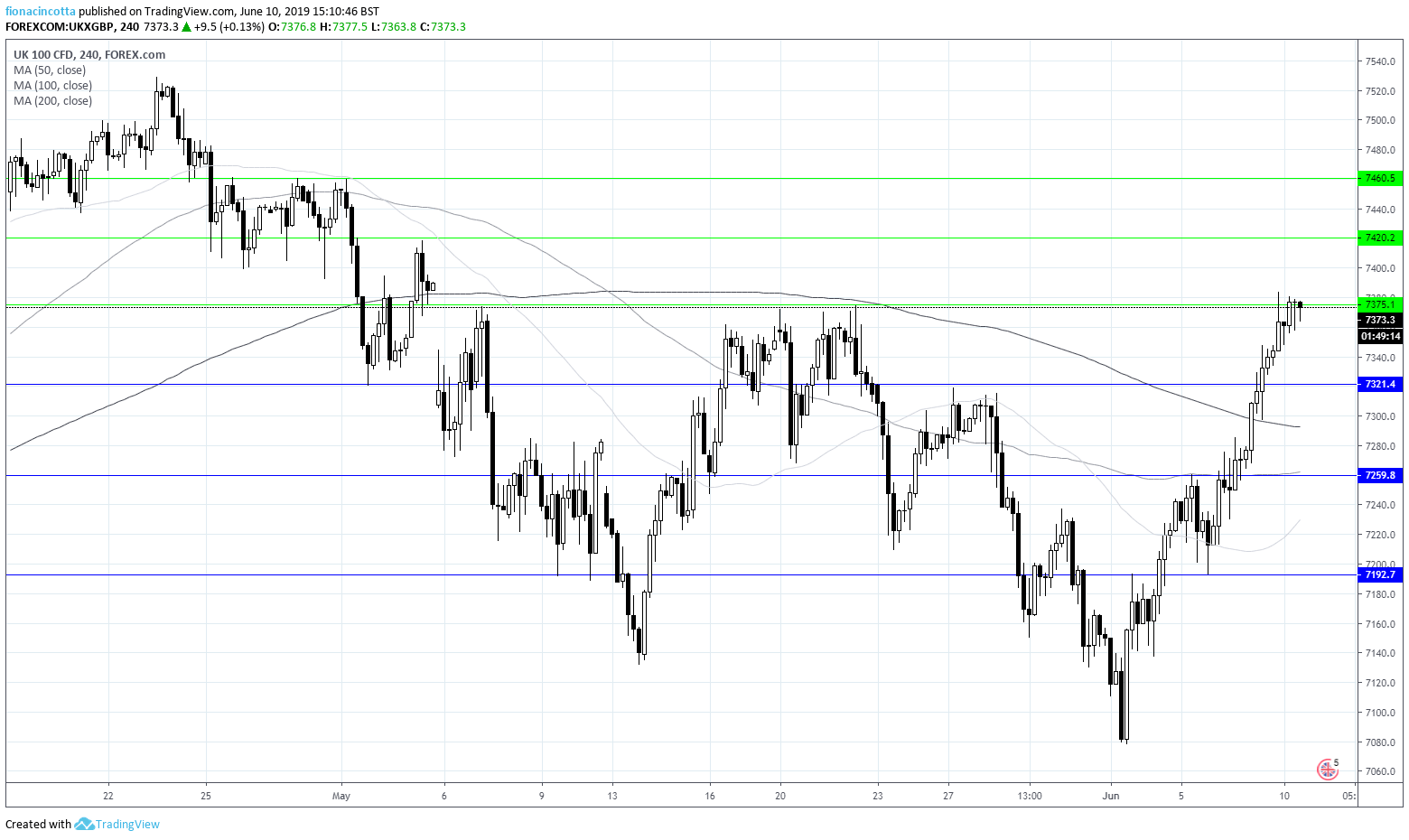

FTSE levels to watch:

The FTSE is trending higher trading above it 50, 100 and 200 sma on 4-hour chart; a bullish chart. The index is currently testing resistance at 7375. A breakthrough at this level could see the index extend gains to 7420 and up to 7460. On the downside support can be seen at 7260 before 7190.