Over the past few days, I have skimmed over the research from various banks about potential one-off month end flows in equity and currency markets. It’s safe to say that there is some disagreement about whether the end of month or end of quarter rebalance will dominate proceedings and I am content to remain on the side-lines and contemplate what comes next.

In that context, the next “big thing” for markets and for the U.S dollar index, the DXY, is the June jobs report in the U.S. scheduled for release early this Thursday, ahead of the July 4th long weekend.

Because key U.S. markets will be closed for a long weekend, the recent surge in new COVID 19 cases and also due to the difficulty in accurately forecasting the jobs data after the large scale job losses, the potential for a “surprise” and another bout of risk aversion that allows the DXY to rally into the weekend seems quite high.

After ending the past three weeks on a soft note, risk assets experienced a strong snap back following their re-open after the weekend and I don’t see why the price action this coming Monday following the patriotic July 4th long weekend will be any different. This may present an opportunity to short the DXY.

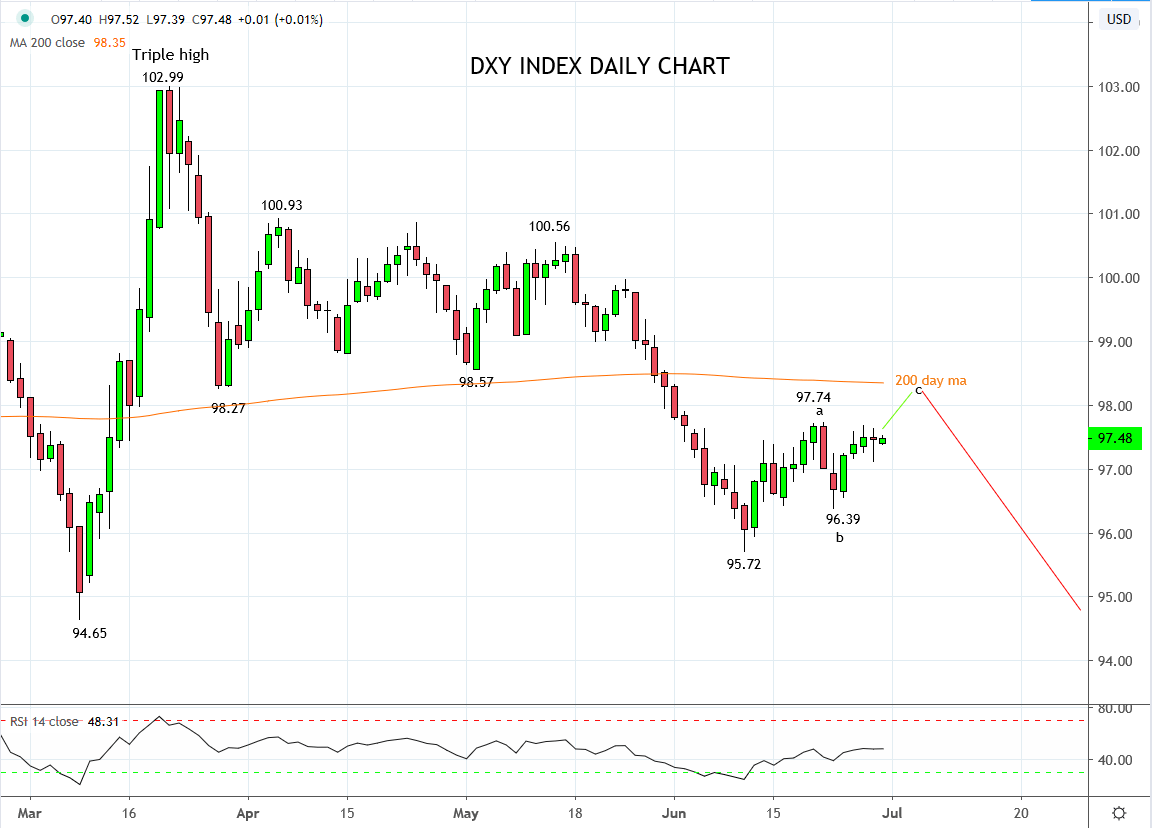

As can be viewed on the chart below, the decline in the DXY from the Mid-May, 100.56 high to the June 10, 95.72 low has impulsive characteristics. The rally from the 95.72 low appears to be an incomplete three-wave “abc” type correction.

Should the DXY push towards the wave equality target and the resistance from the 200 day moving average 98.20/40 area, I am expecting to see signs of U.S. dollar selling emerge. It is also where I will be looking for an opportunity to sell the DXY index in expectation of a retest and break below the 95.72 low.

Source Tradingview. The figures stated areas of the 30th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation