In yesterday’s note, we spoke about the imminent arrival of fiscal stimulus to help settle the tug of war that exists in markets between central banks who have aggressively cut rates in response to the challenges presented by the U.S.- China trade war.

After two months of relative calm on the trade war front, signs of green shoots had begun to emerge in some global economic data. Notably, Chinas PMI’s were better than expected, U.S. Q3 GDP was revised higher and even the reliably dour German consumer was beginning to see the world in a more cheery light.

However, today the green shoots are under threat and the central banker team left grim-faced as President Trump upped the ante in his trade war over the past 24 hours which included;

- Re-imposing steel tariffs on Argentina and Brazil citing currency weakness.

- Threatening France with tariffs in response to a proposal to tax digital companies.

- Threatening to raise tariffs on China in mid-December if a “phase one” trade deal is not agreed beforehand.

- Indicating he had “no deadline” on the timing of a “phase one” trade agreement with China and suggesting he could wait until after the 2020 election.

- Threatening NATO members with tariffs who aren’t spending enough on defence.

With the economy seemingly back on a cliff-edge, equity traders have elected to shoot first and ask questions later. However, it is possible there is a good reason behind the timing of the President Trump’s tirade.

As mentioned before, President Trump and his team are highly attuned to the stock market and its cycles. There is a strong seasonal tendency for the S&P 500 to pullback in early December, after the Thanksgiving rally and before the Santa Claus rally starts in Mid-December.

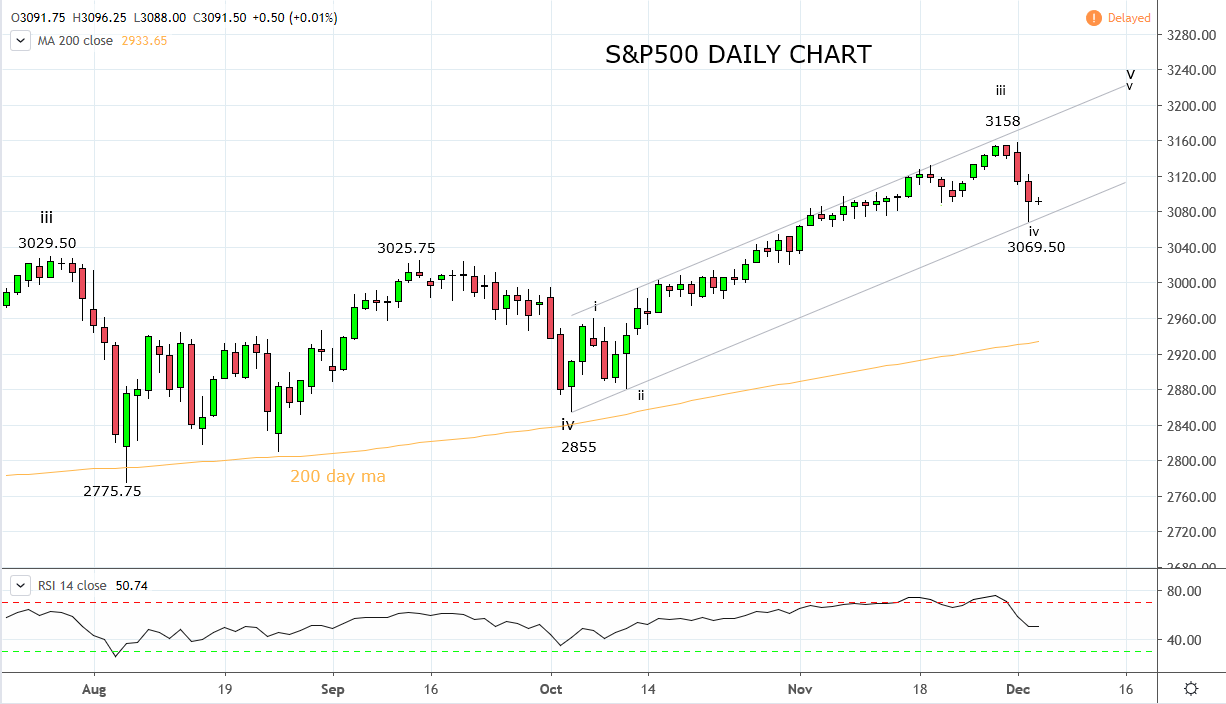

This fits with the technical view that the S&P 500 is currently in a Wave iv pullback that is likely to hold above the trend channel support 3070/3060 area and at worse 3020, before a rally towards 3200 into year-end. Only a break and close below 3020 would cause a reassessment of this view.

Source Tradingview. The figures stated areas of the 4th of December 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation