The outperformance in semiconductor stocks promoted by reports Japan will offer tax breaks to revive domestic chipmaking to reverse decades of decline in the industry.

More broadly, the Japanese economy (and the Nikkei) has benefitted from a decision to close Japanese borders to all new foreign arrivals in late November. This decision has helped Japan avoid a surge in new Omicron covid cases being experienced elsewhere in the region, including South Korea and here in Australia.

The Nikkei is an indirect beneficiary of policy easing in China and central bank policy divergence. Specifically, while some developed market central banks, including the Federal Reserve and Bank of England, have commenced tightening policy, the Bank of Japan can remain patient.

Mindful that even after decades of ultra-loose monetary policy, inflation in Japan remains stuck near 0%, a long way from the Bank of Japan’s target.

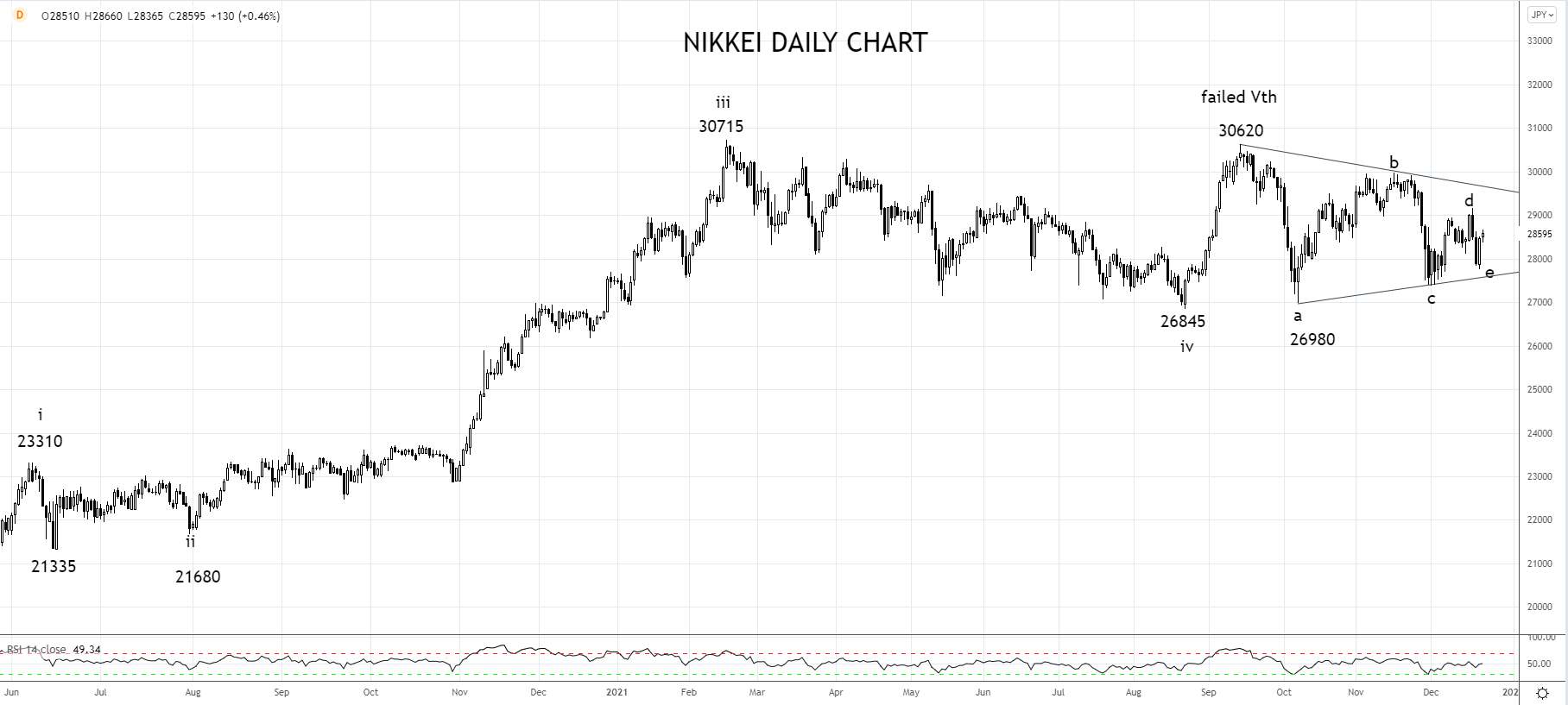

As the chart below shows, the Nikkei has spent the last three months of 2021 tracing out a correction after completing a five-wave advance from the 15,680 March 2020 Covid low at the September 30,620 high. The correction has unfolded in a triangular five wave “abcde” and appears complete at Monday's 27,745 low.

Should the Nikkei break and post a daily close above trendline resistance currently at 29,650ish, it would generate a buy signal in expectation of a retest and break of the 30,715 high before a move towards 32,000.

Source Tradingview. The figures stated areas of December 22nd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade