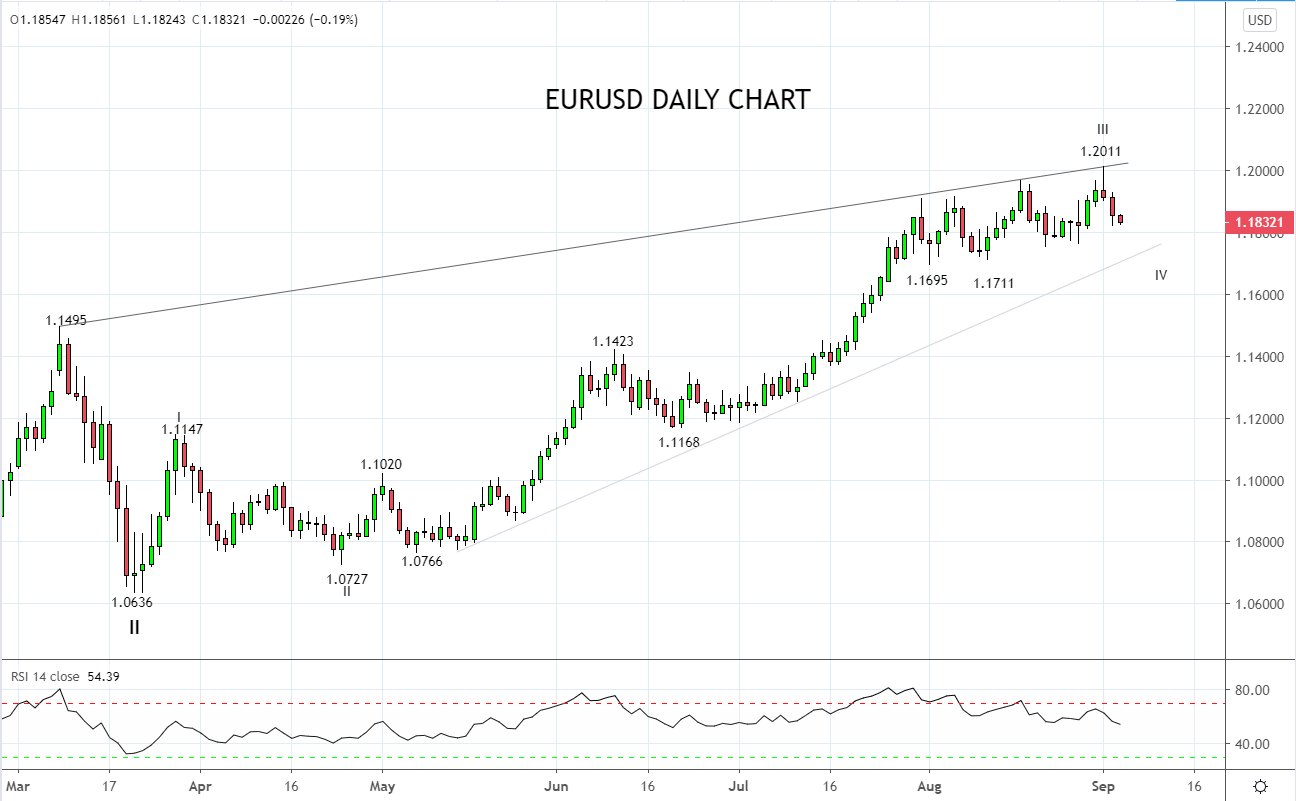

The main point of interest in FX markets overnight was a second day of gains for the U.S. dollar index, driven principally by a move in the EURUSD which closed -1.30% below its 1.2011 recent high.

After maintaining a bullish view of the EURUSD since May, last week the reasons why the EURUSD was setting up for a corrective pullback were outlined here.

As readers may recall, the view for a pullback was based on technical analysis (more on this later) as well as an acceleration in new coronavirus cases in Europe, in comparison to falling new cases fell in the U.S.

It was also based on a run of economic data that indicates the U.S economy will enjoy a speedier coronavirus recovery, than Europe. Further accentuated this week by the release of a stronger than expected U.S manufacturing PMI at 56 verse the Eurozone manufacturing PMI at a barely expansionary reading of 51.7.

Also playing a part in the EURUSD’s pullback, a comment on Tuesday night from ECB Chief Economist Lane noting that while the ECB does not target FX rates the “euro dollar rate matters.”

The timing of Lanes comment coincided with the EURUSD hitting the significant 1.2000 level. Both factors were highlighted in our interview on Ausbiz TV yesterday here. (You will need to sign up to Ausbiz TV to hear the interview - it is free to do so.)

If an additional reason was needed, IMM positioning data showed that speculative accounts added another 15k long EURUSD contracts last week, taking the total to an unprecedented 212k long contracts.

Returning to the technical setup. After the formation of a textbook daily bearish reversal candle on Wednesday from trendline resistance and from the key 1.2000/1.2050 resistance zone, the EURUSD commenced a pullback. The pullback has scope to extend towards uptrend support and recent lows 1.1720 area, which will be looked at as a possible buying opportunity, should prices stabilise in this area.

In the meantime, bounces back towards 1.1950/70 are likely to attract sellers and this will remain the case providing the EURUSD does not see a sustained break above 1.2050.

Source Tradingview. The figures stated areas of the 3rd of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation