The news from Moderna further bolstering sentiment after the weekend signing of the largest trade deal in history between 15 Asian Pacific countries including China, Japan, South Korea, and Australia.

While it is doubtful the agreement will ease strained Australia and China tensions, it does provide a pathway for Australia to reduce its trade reliance on China. In response and also buoyed by a weaker U.S dollar, the AUDUSD has been able to cement its first daily close above .7300c for two months.

Further gains in the AUDUSD are likely to depend on the outcome of Thursday's labour force report for October. As confirmed by this morning’s RBA minutes and Governor Lowe's speech last night, the labour market is very much at the centre of the RBA’s monetary policy setting.

Thursday's labour force report is expected to show a 30k drop in jobs and the unemployment rate to rise to 7.2% from 6.9% in September. However, any weakness in the AUDUSD caused by a soft number is likely to be temporary as the market then looks towards a stronger employment number in November, following the easing of lockdown restrictions in Victoria.

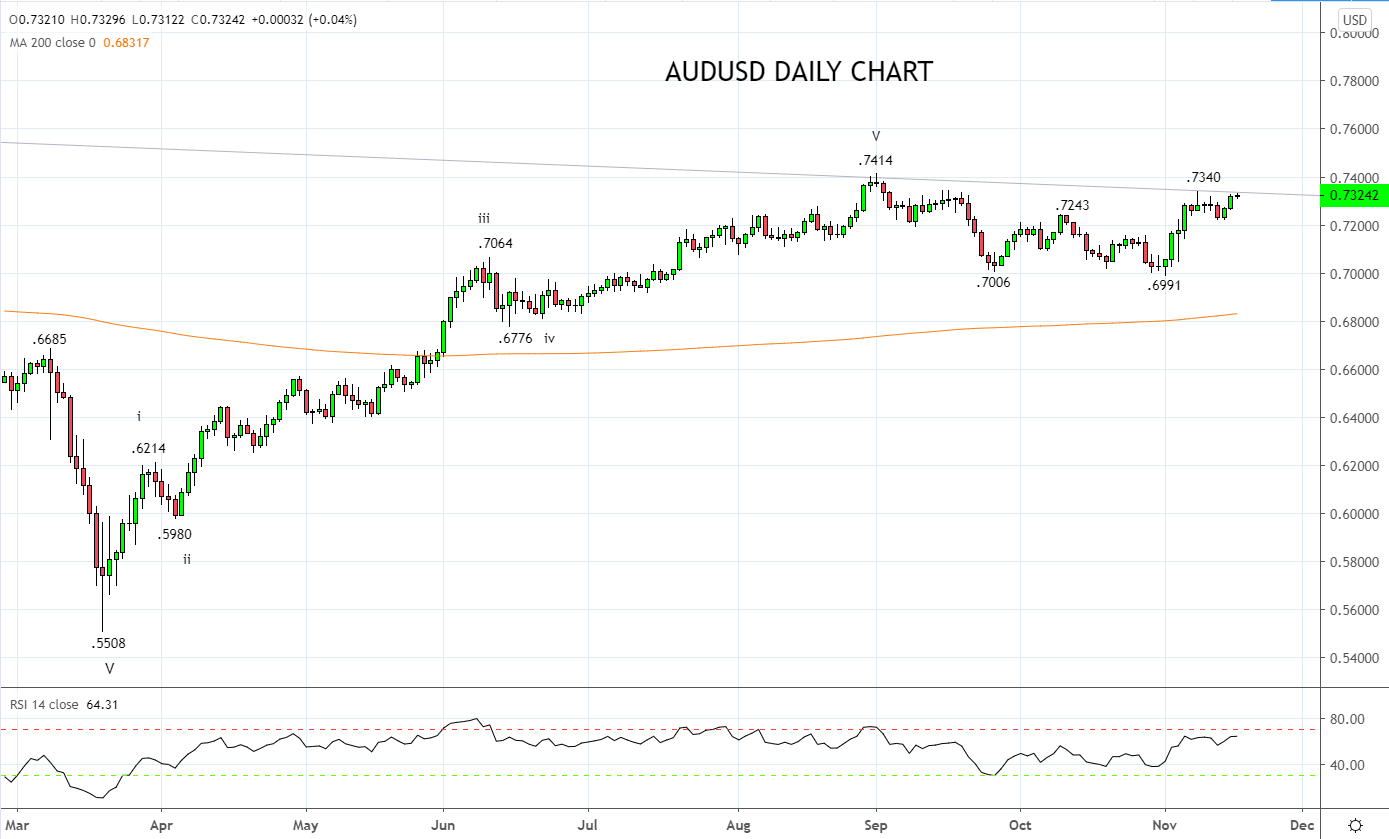

Technically the AUDUSD is at an interesting juncture sitting just below resistance .7340/50ish, coming from a trendline drawn from the .8135 high of January 2018, and above an important layer of support, formerly resistance .7220/00c mentioned in our last article on the AUDUSD here

“Keeping in mind a break/close above .7200c would be initial confirmation the uptrend has resumed.”

A sustained break above the downtrend resistance .7340/50ish, ideally after Thursday's jobs data would reignite the positive momentum in the AUDUSD and with it expectations of a retest of the September .7414 high, before .7500c.

Aware that a failure break/close above .7340/50, followed by the loss of near-term support .7220/00 would warn that a deeper pullback towards range lows at .7000c is underway.

Source Tradingview. The figures stated areas of the 17th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation