A quiet session overnight with markets in the U.S. closed for the Thanksgiving holiday and ahead of a half session on Friday. The holiday acting as a circuit breaker after President Trump caught markets off guard yesterday by signing a bill to support the Hong Kong protestors, much to the annoyance of China.

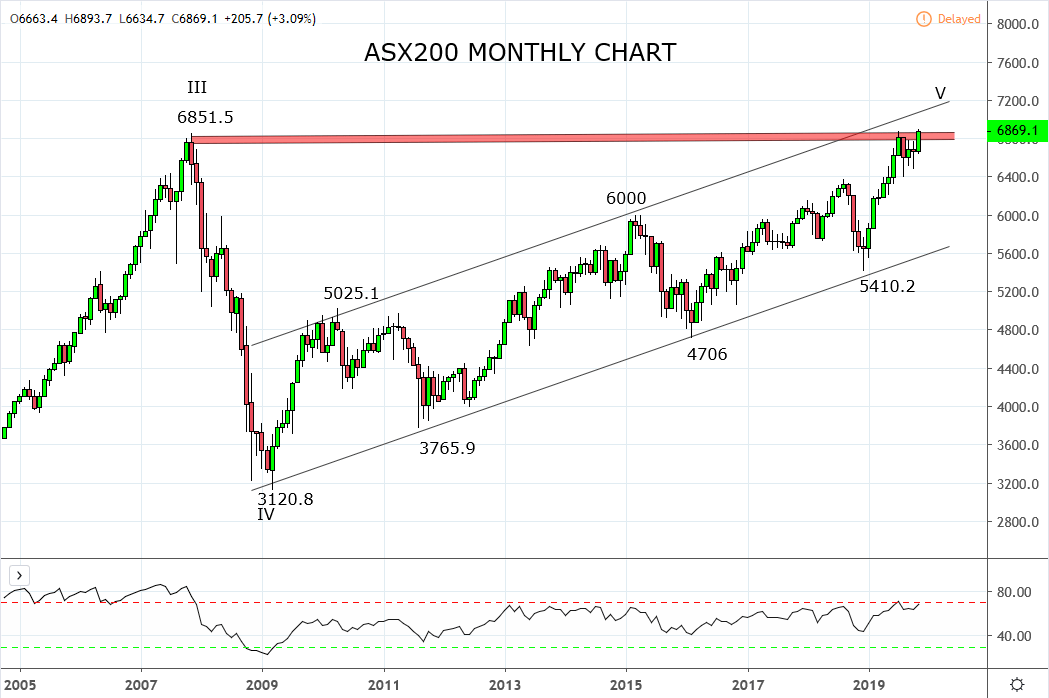

Signs elsewhere of the equity market FOMO we spoke about in a note on Wednesday as the ASX200 broke out of a four-month range and traded to fresh new all-time highs. The ASX200 is notorious for marching to its own drumbeat. In typical fashion, it has frustrated traders over the past two months, content to ignore strong rallies in other key equity markets, until this week.

The catalyst for this week’s surge higher was Australia’s most closely followed economist, Bill Evans from Westpac adding another interest rate cut to his forecast. Specifically, Bill thinks the RBA will cut official interest rates to 0.25% before June 2020 and then commence Quantitative Easing (QE) in the second half of 2020.

For investors and retirees who use term deposits to supplement their income, this presents a very real scenario where the interest rates on term deposits will fall below 1% by the middle of 2020. The ASX200 despite its 20% rally in 2019 remains attractive due to the near 4% dividend yield on the index. While at single stock level, the big four banks offer a dividend yield in excess of 5%.

Additionally, QE is recognized as being supportive of stocks and other real assets as is the increasing likelihood of economic stimulus from Fiscal Policy by the Liberal government in 2020.

Technically, the break above the July 6875.5 high warrants respect and provides an opening for the ASX200 to test the top of its long-standing trend channel resistance currently near 7100. In the interim, dips towards 6800/6750 should be well supported and it would take a break and close below 6700 to suggest this week’s breakout has failed.

Source Tradingview. The figures stated areas of the 29th of November 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation