While the return of inflation has been widely anticipated in the wake of the re-opening, there is a divergent range of views as to whether inflation this cycle, will be transitory or permanent.

Central banks including the Federal Reserve are of the view that rising inflation will be temporary. The Fed has also said it has the tools to curb any inflationary pressures.

On the other hand, some think shortages in commodities, consumer goods, and labour markets, combined with money supply growing at 27% per year, (the fastest rate in history) will see inflation return with a vengeance and remain.

Due to the time it takes to build and open new mines and to grow crops, more than likely some inflationary effects will be temporary and some permanent.

Stock markets have thus far mostly preferred to side with the Fed's view of inflation. However, into last night’s US inflation data for April, signs of nerves in US and other developed stock markets had already become apparent.

Last night the inflation number for April 2021 of +0.9% was added, while the number for April 2020 (-0.7%) dropped out. Worst fears were confirmed as the annual rate of inflation rose to +4.2%, significantly exceeding consensus expectations of +3.6%.

Why does higher inflation matter?

In a nutshell, the inflation rate has quickly approached the threshold where it will bring forward the “overshoot” the Fed is looking for under its Average Inflation Targeting (AIT) framework. This in turn brings forward rate hike expectations, a scenario that is bad for bonds and bad for stocks.

Thus with another few months of hot inflation numbers coming up as the 2020 base effects are removed, there is good reason to think the sweet spot for equities is in the rear vision mirror and that a rise in volatility is likely.

Learn more about trading indices

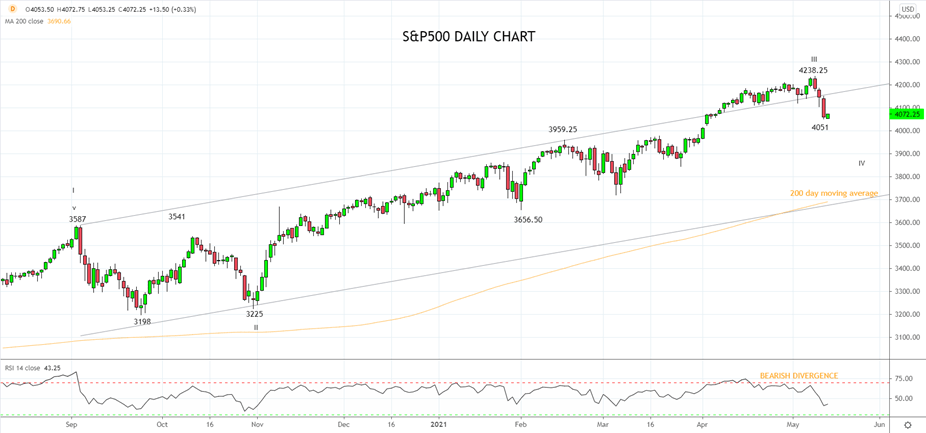

Technically, the S&P500’s overnight close below the band of recent lows 4120/00 area, opens up a move towards support at 3900.

Below 3900, the risks are for a test of trend channel support and the 200 day moving average, 3750/00 area. Aware that a rally back above 4120 is needed to negate the downside risks.

Source Tradingview. The figures stated areas of the 13th of May 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation