Whilst with some stocks such as travel and tourism stocks it is simple to understand why they are falling so sharply with increasing coronavirus restrictions. With tech stocks - they are experiencing a massive supply chain disruption, again it is simple to understand why they are falling. Precious metal miners are also experiencing solid sessions despite the stock markets around them falling off the proverbial cliff.

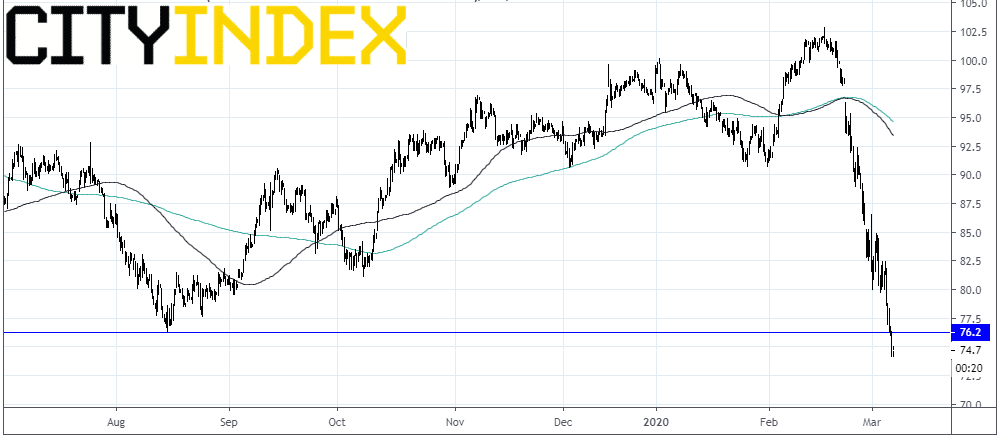

And what about banks? The Euro Stoxx banks index has plunged 24% since the start of the coronavirus outbreak, a steeper fall than the broader market. The link between the banks and coronavirus maybe less obvious than the increase of Dettol sales and rise of Rickett Benckiser.

Assuming no major ECB monetary policy changes

Whilst the Fed has cut interest rates by 50 basis points, the ECB is certainly in no position to behave in a similar fashion. The ECB monetary policy meeting is next week and to say that the ECB is short of ammunition would be an understatement. So, assuming no major changes to eurozone monetary policy there are other headwinds to consider:

A jump in bad loans – an economic slowdown is likely to increase the number of problem loans. Whilst the coronavirus outbreak is not expected to be a long-term issue, for any firms that are already under pressure the demand and potentially a toxic supply demand shock could be the straw that breaks the camel’s back.

A drop in investment banking revenue. This outbreak could well result in all but the top priority deals being pulled. With potentially fewer staff working due to elevated sickness levels work on all levels will be prioritized.

Interest income is already squeezed. The German 10-year bond yield hit its record low of -0.74% as investors seek out the safety of the bond market. Falling bond yields will add extra pressure to already pressurized margins.

On the CaC the worst performing stocks have been Credit Agricole, BNP Paribas and Société Generale. Italy’s Banco BPM has dropped 23% whilst Deutsche Bank is down 34% from its recent 2020 highs.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM