However something more interesting and potentially far more important has caught our attention, a two-day, 20% fall in the price of Bitcoin. Bitcoin's sharp decline comes just days after its market capitalisation surpassed $1 trillion and has sparked concerns that Bitcoin has further to fall after its strong run higher over the past four weeks.

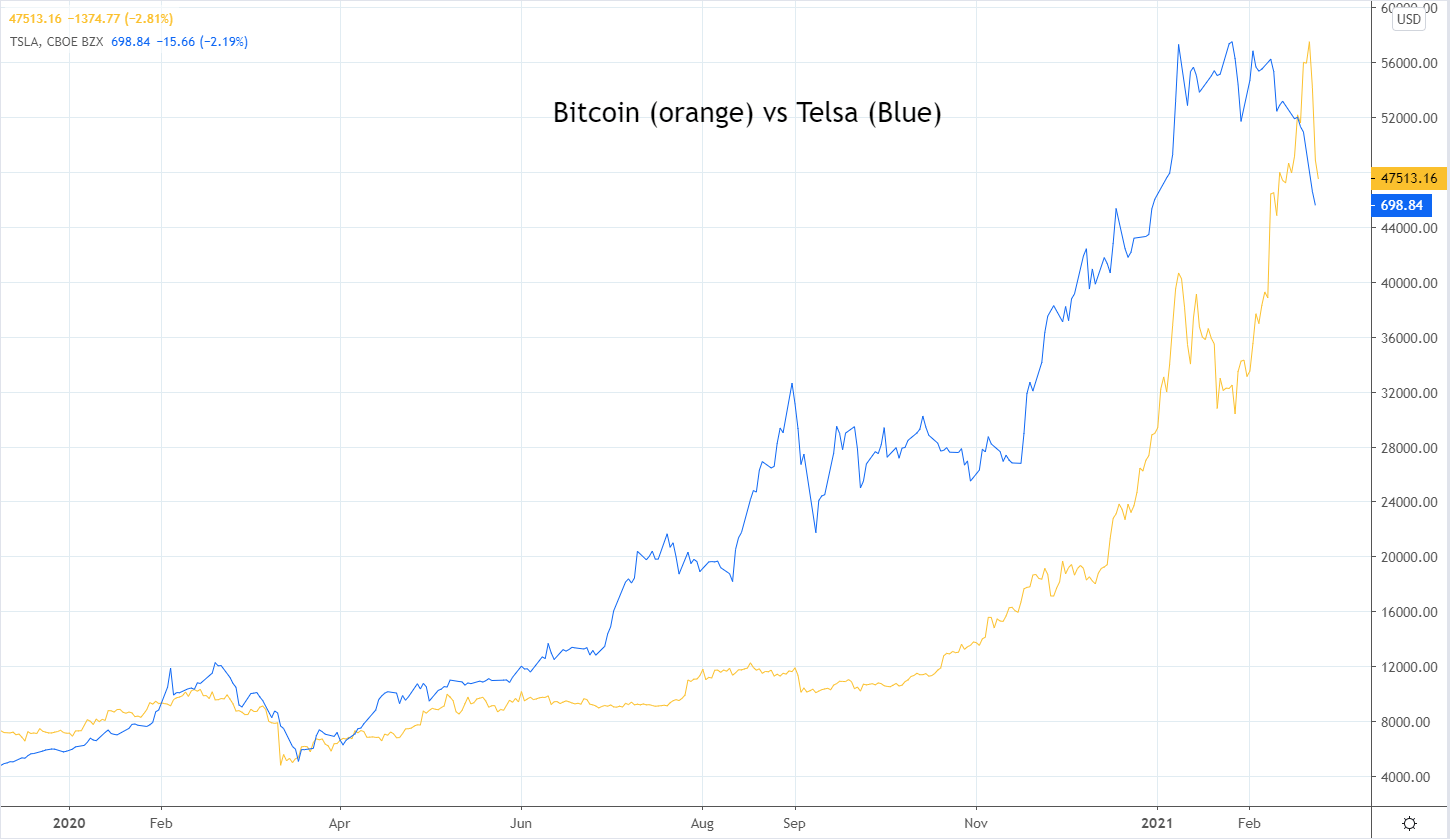

Why movements in Bitcoin matters for other risk assets is because Bitcoin has become a bellwether for the bullish market sentiment and global liquidity that has coursed through markets in recent months. Furthermore, the price action in Bitcoin displays a positive correlation to other risk markets including specific “hyped” stocks such as Tesla, as viewed on the chart below.

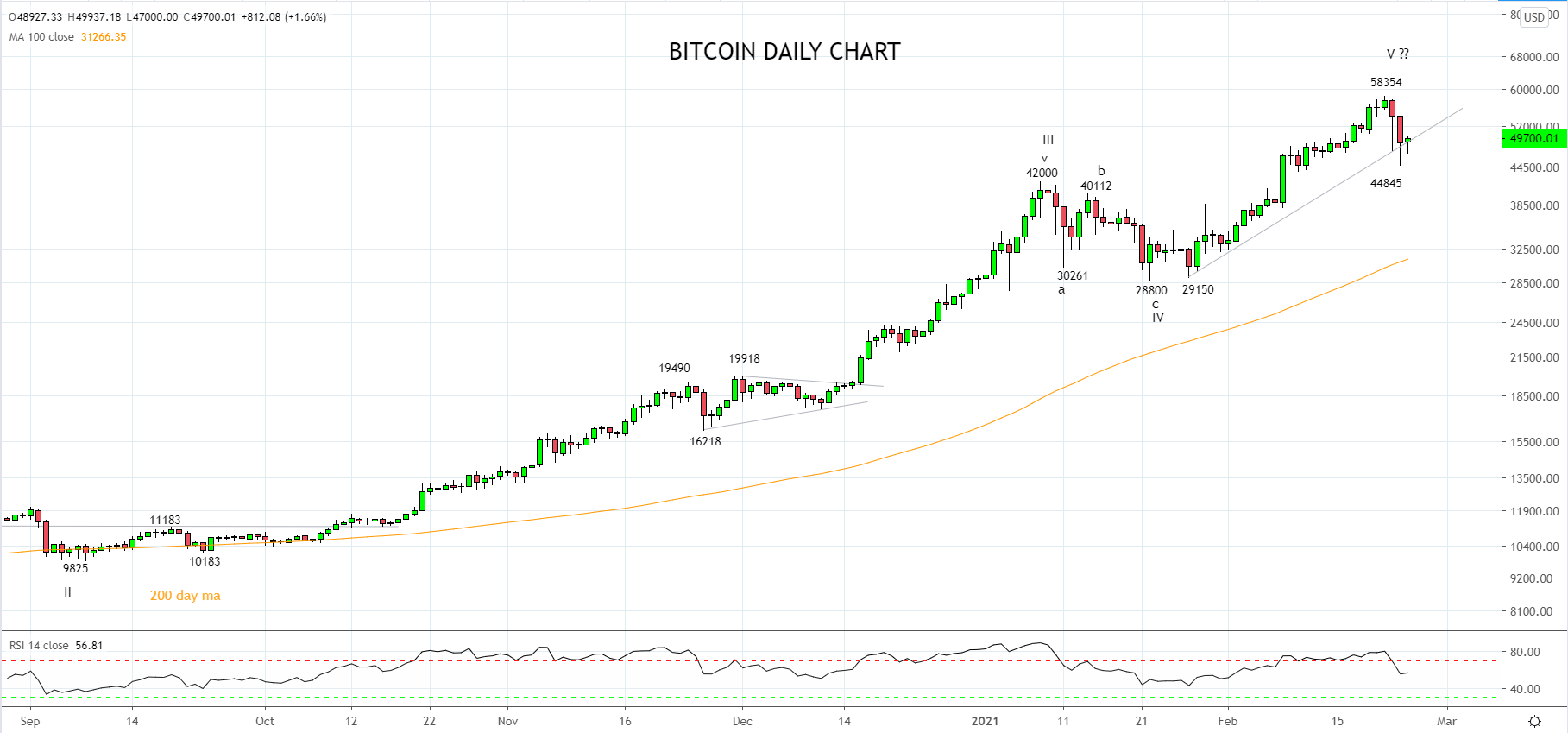

As the outlook for Bitcoin is intertwined with the broader risk complex, it matters then where Bitcoin is heading. In our last article on Bitcoin in late January, when it was trading near $34,000, we opined here that Bitcoin had further to rally.

“Providing Bitcoin remains above the band of support ahead of $28,000 and then rallies above trendline resistance coming in currently near $36,000, the expectation is for a retest and break above the January $42,000 high, before $50,000.”

After reaching and exceeding the $50,000 price target, there is some risk that Bitcoin through an Elliott Wave lens has completed a 5 wave advance and a possible medium term high at last week’s $58,354 high.

Should Bitcoin post a daily close below the uptrend support near $47,000 coming from the January lows, it would increase the chances of a pullback towards $30,000. Aware that if Bitcoin can reclaim the uptrend support, as it's attempting to do now, allow for a retest and break of the $58,354 high. before a move towards $65,000.

Source Tradingview. The figures stated areas of the 24th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation