The government’s lock down of Britain has caused demand for goods and services to evaporate. Businesses are laying off staff to control costs. As a result, these individuals will struggle to pay back any loans they have.

Despite cutting costs and help from the government many businesses could struggle to survive. If they are not doing business the likelihood of the business failing, increases. No -one really knows how long the lock down will go on for. However, the three months floated by some senior medical advisers could prove to be too much of a strain for the UK high street.

Bankruptcies

The UK high street was already under strain prior to the coronavirs outbreak. One week into lock down and Carluccio’s and Brighthouse have collapsed. These are just the start of what promises to be a long list of companies failing. Bankruptcies could be a significant challenge for banks over the coming months.

The prospect of a dividend being cancelled has caused investors to jump ship into higher yielding investments, explaining today’s decline. Should the Bank of England implement the move for a freeze on bank dividend pay outs, Lloyds could be a particularly poor performer. Lloyds share price is already down 50% over the past 12 months.

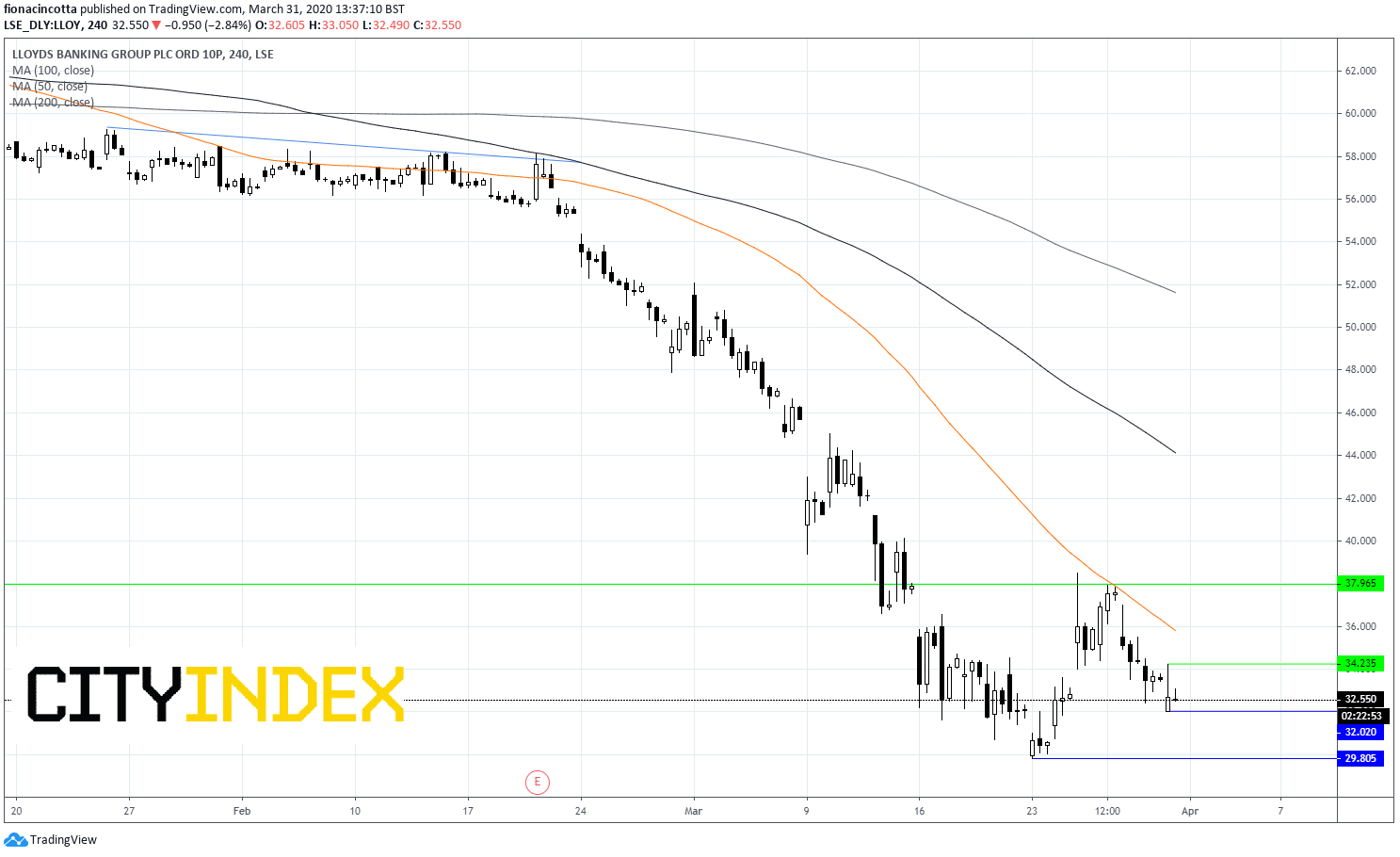

Lloyds levels to watch

Lloyds trades below its 50, 100 and 200 sma on the 4 hour chart, a bearish chart. At the end of last week, the move higher was capped by the 50 sma at 38p. The path of least resistance is to the downside.

Resistance can be seen at 34.2 (today’s high) prior to 35.9 (50 sma).

Support is seen at 32p today’s low prior to 29.8p (low 23rd March)