The decline in November gained momentum after U.S. President Joe Biden launched a campaign calling for OPEC+ to increase supply to lower energy prices to ease inflationary pressures. A campaign gained traction amongst energy-consuming nations and culminated in last week's coordinated announcement to release strategic oil reserves.

The arrival of the Omicron variant saw the move to the downside accelerate last week on concerns over existing vaccines efficacy and what it means for demand from auto and travel demand as international borders once again slam shut.

The final straws that broke the markets back last night comments firstly from the Moderna CEO, who said yesterday that existing vaccines would struggle to cope with the new variant. And testimony from Federal Reserve Chair Jerome Powells indicated the Federal Reserve would discuss speeding up its tapering of bond purchases in response to higher inflation and a more robust economic recovery at its next meeting.

The ball is now firmly back in OPEC+s court ahead of its monthly meeting on December 2. In response to the threat to demand, OPEC+ can now justify putting on hold plans to add 400,000 barrels per day to supply in January.

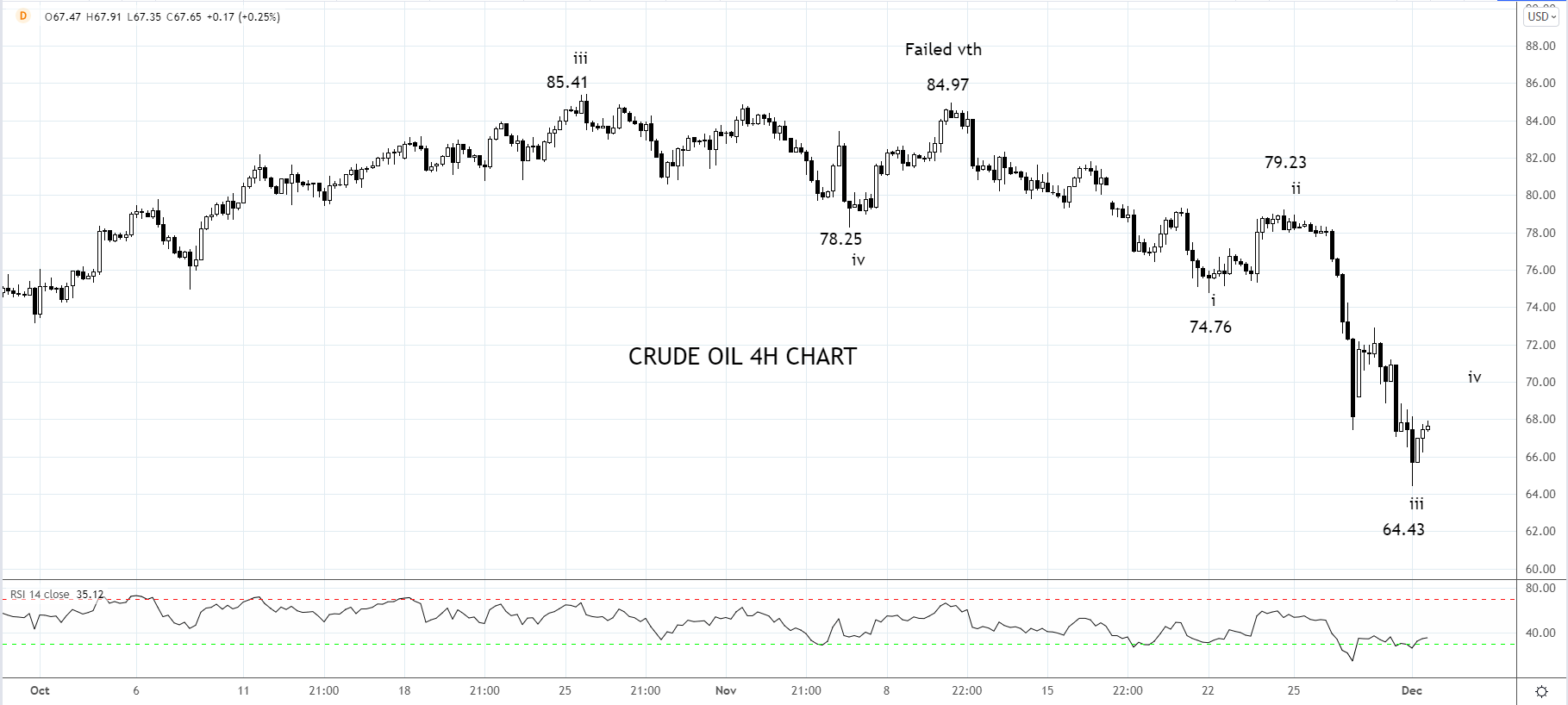

Technically the evidence suggests crude oil topped out in October (at the $85.41 high) as it does most years according to seasonal studies, and as such, the bias is now to be a seller into bounces.

In terms of preferred levels to sell, based on the structure of the four-hour chart below, the current bounce could extend back to $70.00 to complete a Wave four correction. From near $70.00, look for signs of upside fatigue/exhaustion and evidence the downside is resuming towards $62.00.

Source Tradingview. The figures stated areas of December 1st, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade