When will Boohoo release H1 results?

Boohoo will release interim results on the morning of Thursday September 30.

Boohoo H1 earnings preview: what to expect from the results

Boohoo has capitalised using its strong online offering since the pandemic erupted 18 months ago. Not only was it able to attract more customers looking to shop while physical clothing stores were shut during lockdown, but it has also managed to save a number of big names from collapse by purchasing the likes of Debenhams and a string of brands from Arcadia Group after they hit financial trouble.

Analysts are expecting Boohoo’s revenue to rise 28% to £1.05 billion in the first half from £816.5 million the year before, pacing ahead of its ambition to grow annual sales by 25% this year. We already know that revenue grew 32% in the first quarter (and was some 91% above pre-pandemic levels), with the forecasts implying growth slowed in the second.

Adjusted Ebitda is forecast to rise to £100.5 million from £89.8 million last year. Boohoo is aiming to deliver an adjusted Ebitda margin of 9.5% to 10% this year, broadly in-line with the 10% margin delivered last year.

Still, analysts are expecting pretax profit – its headline profit figure –to fall to £62.3 million in the first half from £68.1 million.

Margins will be closely-watched amid the widely-reported supply chain pressures hitting several industries, such as increased input and freight costs. Plus, return rates are also expected to normalise after a reduction in the amount of goods being shipped back by customers temporarily boosted profitability during the pandemic, while investment in relaunching its newer brands online could also push up operating costs.

Investors can expect to hear more about how Boohoo is continuing to implement change following the scandal over conditions in its supply chain. This has been lingering over the company for over a year now, despite Boohoo making strides toward addressing the issues. For example, Boohoo recently published its list of 1,100 global suppliers as promised after an extensive analysis launched last year, while Brian Leveson’s latest independent review into how the company is progressing said Boohoo deserved applause for its enthusiasm in how it has embraced suggested changes and embarked on a wider ethical programme. To date, Boohoo has met 28 of the 34 targets outlined in Alison Levitt’s independent review and the rest should be completed over the coming months, potentially removing one of the largest shadows hanging over the business.

Boohoo was among the swiftest recovery plays when markets unravelled when the pandemic started in February 2020, bouncing back and going on to hit new all-time highs by June 2020. However, shares have struggled to find higher ground since then and now find themselves trading some 19% below pre-pandemic levels.

With that in mind, analysts are extremely bullish on Boohoo and its prospects, believing the stock is highly undervalued. The 19 brokers that cover Boohoo have an average Buy rating on the stock and a price target of 444.94p – suggesting there is as much as 66% potential upside from the current share price.

Where next for the Boohoo share price?

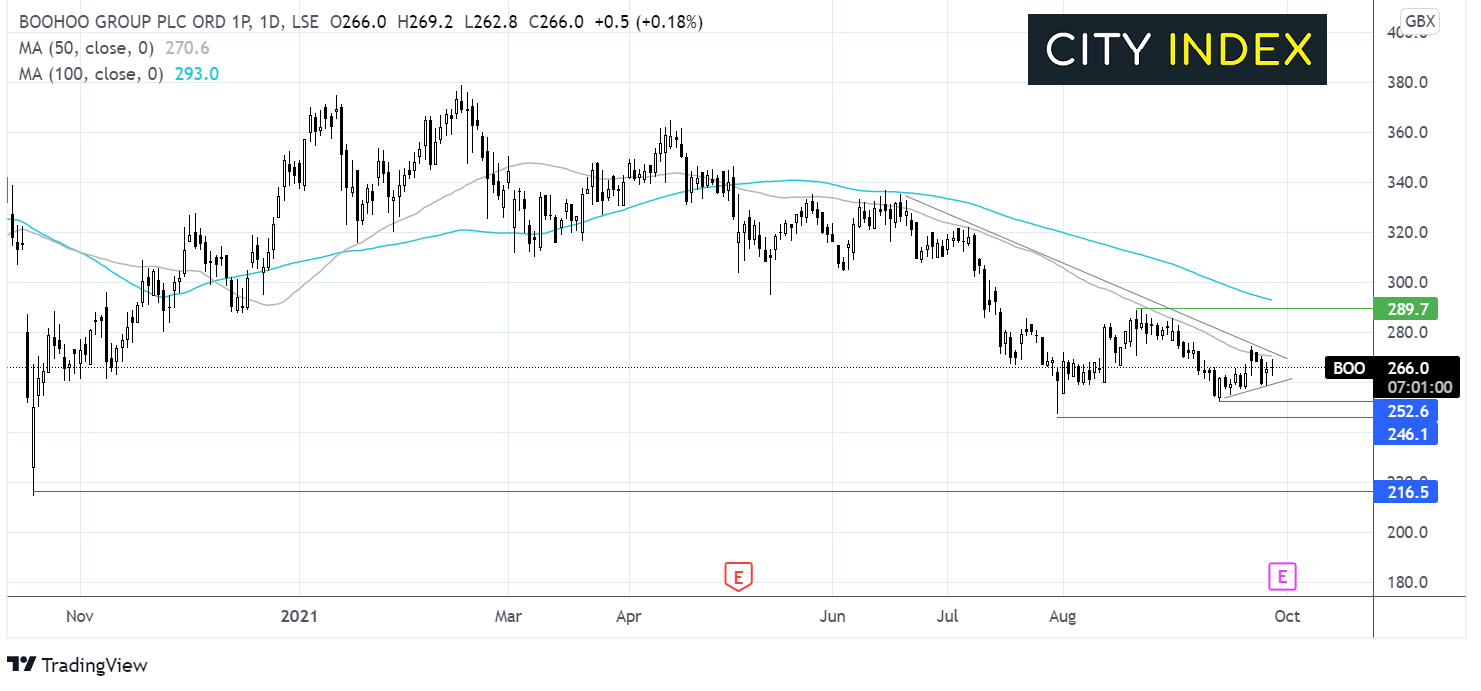

Boohoo share price hit a year to date high of 380p in mid-February and has been trending lower since.

The price trades below its 50 & 100 sma, and below a descending trendline dating back to mid-June. The price has recently rebounded off 250p forming a symmetrical triangle.

Buyers might look for a move above the falling trendline resistance and 50 sma at 270p to target a move higher to 290p the August high. A break above here could see the bulls gain traction.

Meanwhile sellers might look for a move below 259p the rising trendline support. A break below here could open the door to 253p the September low and 247p the year to date low. Beyond here 215p the October low last year could come into focus.

How to trade Boohoo shares

You can trade Boohoo shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Boohoo’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade