When will Zoom Video release Q3 earnings?

Zoom will release third quarter earnings after US markets close on Monday November 22.

Zoom Q3 earnings preview: what to expect from the results

Zoom has come into its element over the past two years, emerging as a pandemic winner as businesses adopted its communication tools to keep employees talking as they were forced to adapt to remote working during lockdown.

However, the company is now facing a slowdown in growth as the global economy reopens, workers start to return to the office, and it comes up against tougher comparatives following the boom in demand last year.

For example, Zoom is forecast to add 9,441 customers with over 10 employees and 206 large enterprise customers in the third quarter, just a fraction of the peak additions added last year.

| Zoom | Q4 2020 | Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022E |

| Customers with over 10 employees | 81,900 | 265,400 | 370,200 | 433,700 | 467,100 | 497,000 | 504,900 | 516,173 |

| Net Adds (QoQ) | 7,800 | 183,500 | 105,000 | 63,500 | 33,000 | 30,000 | 7,900 | 9,441 |

| Customers: Over $100k trailing 12-month revenue | 641 | 769 | 988 | 1,289 | 1,644 | 1,999 | 2,278 | 2,479 |

| Net Adds (QoQ) | 95 | 128 | 219 | 300 | 355 | 355 | 279 | 206 |

(Source: Bloomberg)

There were hopes earlier this year that growth could be reignited by acquiring Five9 in a $14.7 billion all-stock deal that was announced in July. Zoom was hoping to add Five9’s Contact Center-as-a-Service offering to Zoom Phone to expand its addressable market by up to $24 billion. The deal was seen as particularly important in retaining appeal for large enterprise customers that need the broadest unified communications bundles to keep their businesses operating.

However, that deal collapsed in September after Five9 failed to secure enough support from its shareholders and Zoom was unwilling to increase the value of its offer. Instead, it is throwing its weight behind a new service named Zoom Video Engagement Center that will be launched in 2022.

Still, this has prompted questions about where Zoom’s future growth will come from and how it will stem the gradual slowdown in growth we have seen over the past year or so. Plus, there are fears that Zoom may have to spend more to acquire new customers and retain existing ones in absence of a deal, which could hurt profitability.

Zoom Video delivered over $1.0 billion in revenue for the first time in the second quarter and said it is expecting to generate between $1.01 and $1.02 billion in the third. Wall Street forecasts revenue will remain flat quarter-on-quarter at $1.02 billion and rise 31% from the $777.2 million the year before. That will have slowed from the 54% growth booked in the second quarter as it comes up against tougher comparatives.

Zoom has guided for third quarter adjusted income from operations of $340.0 million to $345.0 million compared to the $290.8 million booked the year before. Analysts believe Zoom will hit the bottom-end of that range with forecasts of $340.5 million.

Analysts expect net income attributable to shareholders to rise to $218.7 million from $198.6 million the year before, but down from the record $316.9 million booked in the second quarter. On a per share basis, net income is seen climbing to $0.72 from $0.66 last year but down from the $1.04 delivered in the latest quarter.

Watch for any changes to guidance for the full year. Zoom Video is currently targeting annual revenue of between $4.005 and $4.015 billion and adjusted income from operations of $1.50 to $1.51 billion. That compares to the $2.65 billion in revenue and income of $983.3 million delivered in the last financial year.

Zoom shares rocketed last year as it emerged as a pandemic favourite and peaked at $559 in October 2020. But the stock has gradually lost ground since then and shed over half of its value as growth slows and investors move out of hot pandemic stocks and into those that hold the greatest recovery potential as the global economy reopens.

Brokers believe the selloff seen over the past 13 months has been overdone and the 30 brokers that cover the stock have an average Buy rating and a target price of $371.74, implying there is over 40% potential upside from the current share price.

Where next for the Zoom share price?

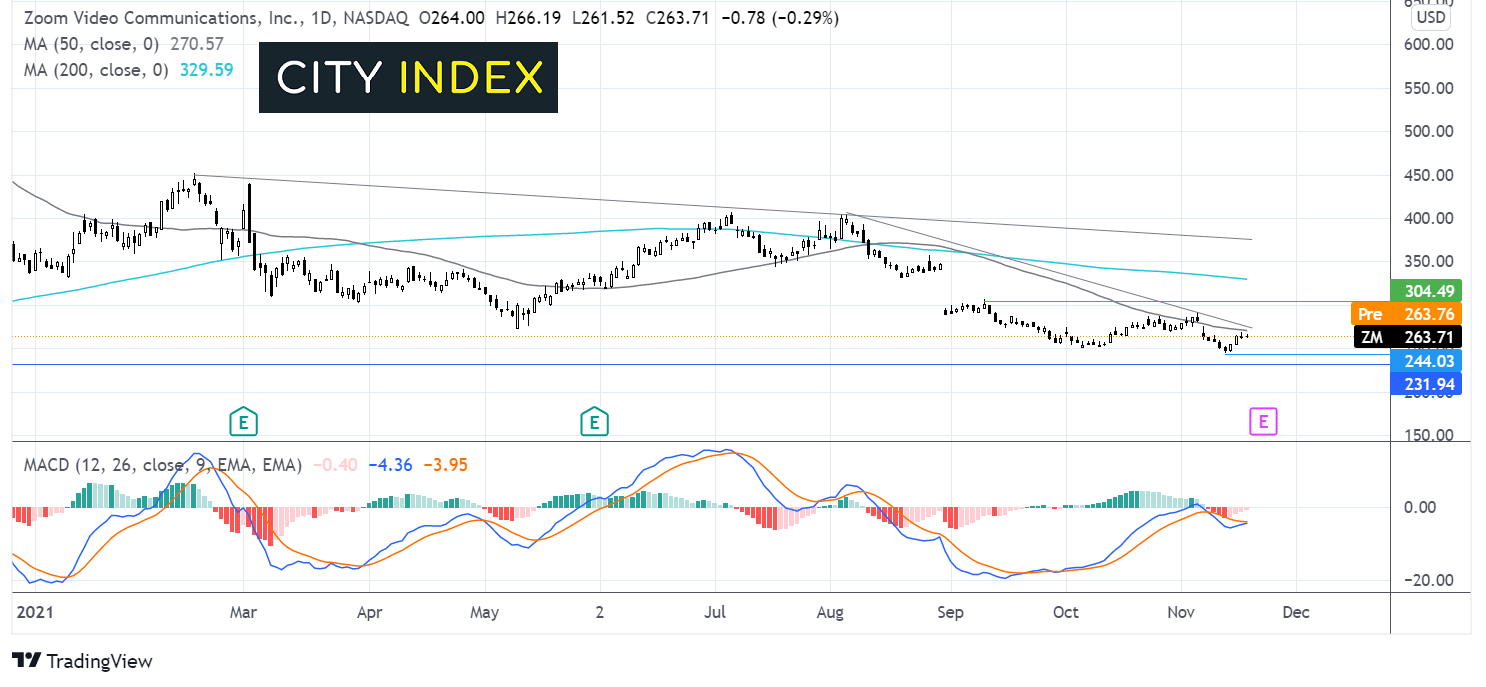

The Zoom share price rallied to an all-time high on October 19, 2020. Since then, the share price has been trending lower forming a series of lower highs and lower lows. The price hit a fresh 14 month low of $245 on November 8. However, the receding bearish bias on the MACD and a potential bullish crossover is keeping buyers optimistic.

The rebound from $245 is being capped by the 50 sma at $270. A move above here is required to bring $300 into play – it would take a move above this level to negate the near term down trend and expose the 200 sma at $332.

Failure to retake the 50 sma could see the price test the 2021 low of $245 before targeting $230 a level last seen in August last year.

How to trade Zoom shares

You can trade Zoom shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Zoom’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade