When will Walmart release Q2 earnings?

Walmart will publish second quarter earnings before US markets open on Tuesday August 17.

Walmart Q2 earnings preview: what to expect from the results

The pandemic has boosted Walmart’s revenue and profits over the past year. As an essential retailer, it was able to swallow up sales whilst rivals were forced shut during lockdown. But it also provided momentum to its online offering, which has seen US online sales more than double since the pandemic began.

But this means comparative periods are getting tougher as it moves through 2021, having seen demand boom last year as Walmart was used for heavy stockpiling among consumers amid the uncertainty as restrictions started to be introduced.

Although revenue and profits will remain comfortably above pre-pandemic levels, Wall Street is expecting second quarter revenue to fall to $136.75 billion from $137.74 billion the year before.

Walmart has said comparable sales growth in the US is set to grow by low single-digits in the quarter, with analysts expecting 2.5% growth. That would be markedly slower than the 9.9% growth delivered the year before when it benefited from stockpiling. Meanwhile, comparable sales growth at wholesale and bulk-buy unit Sam’s Club could be as high as 3% based on consensus estimates.

Continued growth in sales has been driven by pent-up demand as restrictions have eased and fuelled by stimulus cheques dished out to revitalise the economy. This could benefit non-grocery sales of things like homewares and garden furniture and could help Walmart deliver a potential surprise when it comes to US same-store sales.

Ecommerce sales in the US will also be closely-watched after jumping 37% in the first quarter, marking a doubling in sales since the pandemic began, with investors hoping the unit can keep driving forward even as tougher comparatives and increased competition comes into play. A report from Refinitiv yesterday suggested Walmart could post ecommerce growth of 16.3% in the second quarter.

The headline profit figure to watch is operating income, which Walmart said will fall by low single-digits in the second quarter. Analysts are anticipating it will fall to $6.38 billion from $6.51 billion the year before. Notably, the fall will be driven by international disposals and should be ‘up slightly’ when those discontinued operations are stripped out.

Brokers remain bullish on Walmart’s prospects going forward with an average Buy rating on the stock and a target price of $163.82, implying there is up to 9.9% potential upside to the current share price.

Where next for the Walmart share price?

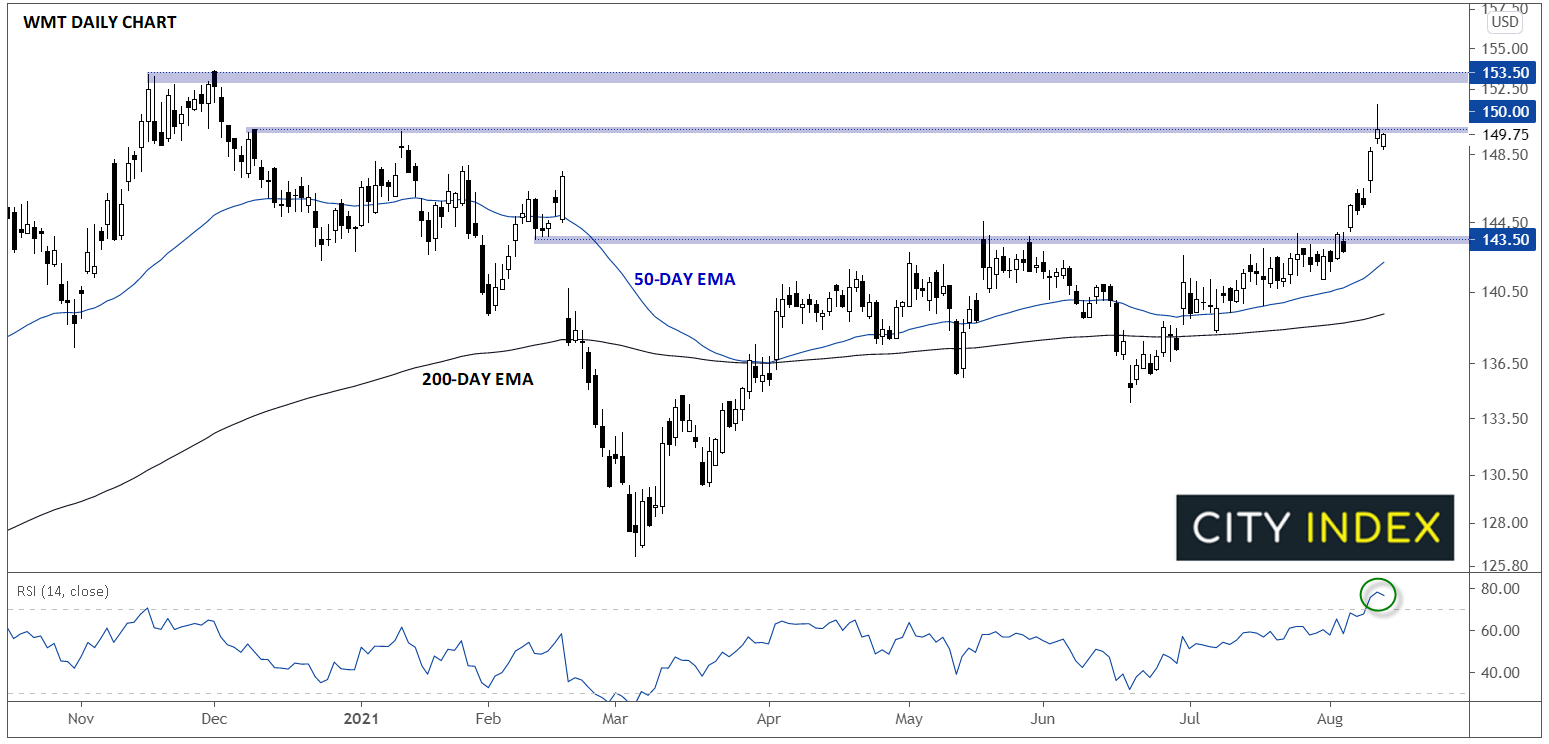

Looking at the chart, WMT has been on a bit of a tear over the last two weeks, with the gargantuan retailer rallying from the lower-$140s to about $150 as of writing; while it may not seem like a big move on a percentage basis, it still represents a $20B+ increase in market capitalization since the start of the month.

Heading into the earnings report, the stock is overbought on its 14-day RSI indicator and seemingly struggling to break conclusively above the $150 level, leaving prices vulnerable to a pullback if results fail to live up to expectations. Meanwhile, a strong report could certainly drive the stock higher, but with the previous record high looming in the 153.50 area, upside may be limited unless we see a truly stellar earnings report.

How to trade Walmart shares

You can trade Walmart shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Walmart’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade