Uber Q2 Earnings Preview | Uber Share Price | Uber Shares

When will Uber release Q2 results?

Uber is scheduled to release results for the second quarter on Wednesday August 4.

Uber Q2 earnings preview: what to expect from the results

There is a cautiously optimistic mood ahead of Uber’s next update. The company was ‘firing on all cylinders’ in the first quarter as people started to travel again and the pandemic-induced uptick in demand for food and grocery deliveries showed signs of sticking. It performed better than anticipated and overall gross bookings were 24% higher than the pre-pandemic numbers booked the year before.

But new headwinds have surfaced that may limit Uber’s ability to full capitalise on the recovery in demand this year, primarily a shortage in drivers. It had around 3.5 million drivers and couriers in the first quarter. That was up a mild 4% from the previous quarter but remains 22% below pre-pandemic levels, demonstrating it is struggling to entice drivers that left when demand collapsed during the pandemic back to the platform.

Uber has therefore had to introduce more incentives in order to attract drivers, which comes at a cost. For example, Uber launched a $250 million stimulus to boost the earnings for American drivers back in April. Analysts are expecting take rates to suffer as a result, unless Uber can cut other costs to help offset it.

Profitability is key considering Uber has previously said it expected to be profitable at the adjusted Ebitda level by the end of the year and investors will want to see evidence that it is moving in the right direction. The fear is that the need to get back to pre-pandemic levels of activity will delay its journey to escaping the red.

Markets believe Uber can remain on the road to profitability in the second quarter by reporting narrower losses despite the cost headwinds it is facing. Analysts are expecting revenue to rise to $3.74 billion from $2.24 billion the year before, which represented the toughest financial quarter as the pandemic started to bring travel to a halt. The adjusted Ebitda loss is expected to narrow to $325.1 million from the $837.0 million loss booked last year, with the loss per share to follow to $0.51 from $1.02.

Uber shares have more than doubled since hitting lows in March 2020 as the coronavirus crisis erupted, but have lost over 27% since hitting all-time highs earlier this year. In addition to the concerns around driver shortages and cost headwinds, uncertainty continues to linger over the travel sector as the Delta variant spreads throughout key markets.

Still, brokers remain bullish on Uber’s recovery prospects and ability to escape the red, which will undoubtedly be a catalyst for shares considering it once said it may never turn a profit. The 44 brokers covering the stock have an average Buy rating on Uber and a target price of $69.11 – some 56% above the current share price and higher than the stock’s all-time high.

Notably, peer Lyft, which is exclusively focused on ride-hailing in the US, will set the stage for Uber when it releases its own quarterly results after US markets close on Tuesday August 3. The company is hoping to beat Uber in the race to profitability by achieving positive adjusted Ebitda by the end of the third quarter of this year. Analysts are expecting Lyft’s revenue to come in at $697 million and an adjusted Ebitda loss of just under $50 million. That would compare to revenue of $339.4 million and a loss of $280.3 million the year before.

Where next for the Uber share price?

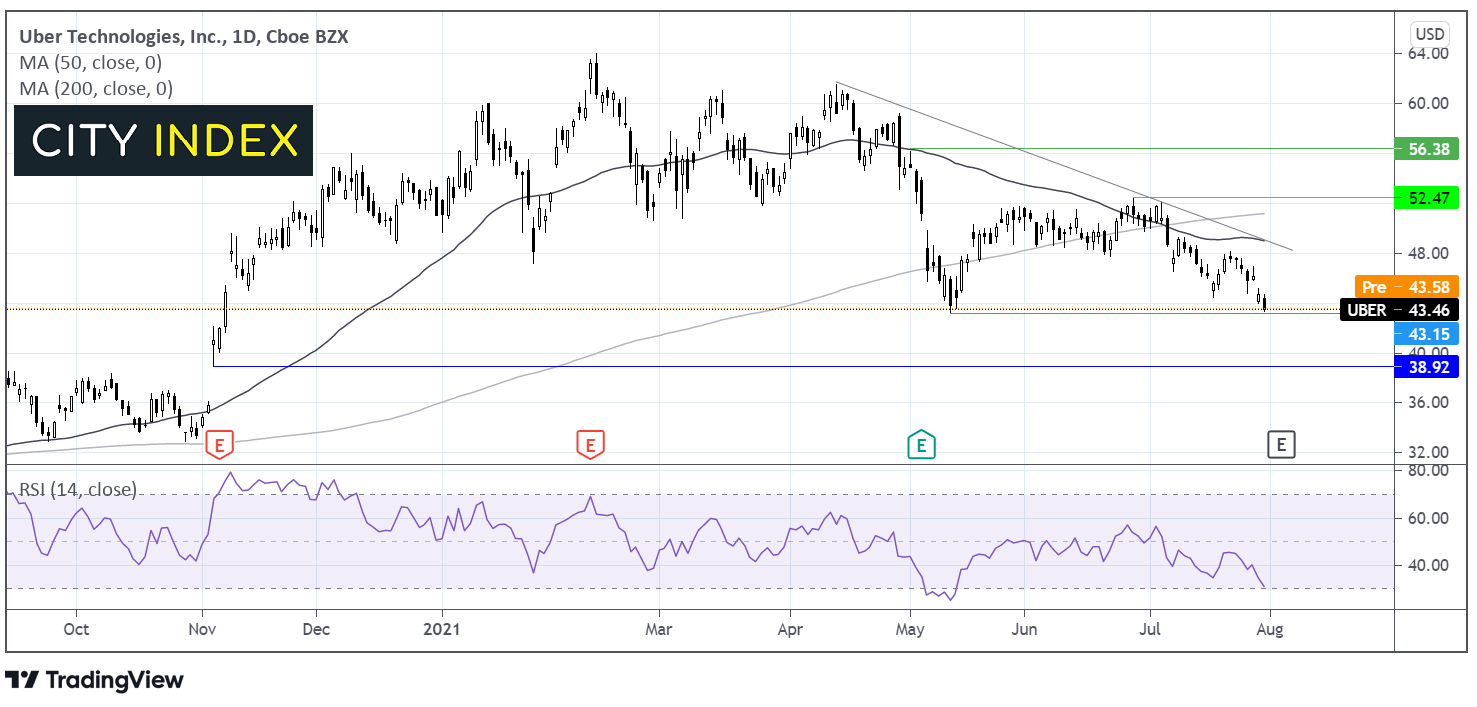

Uber share price traded broadly range bound between $50 and $60 across the first quarter of 2021 before heading southwards from April. The Uber share price trades below its descending trendline dating back to mid-April.

Uber trades below its 50 & 200 sma on the daily chart in an established bearish trend. The 50 sma crossed below the 200 sma in a bearish signal and the RSI is supportive of further downside whilst it remains out of oversold territory.

A breakthrough support at $43.1 the year-to-date low could see the sellers target $39.00 a level last seen in November 2020.

Any meaningful recovery would need to retake $49.30 the confluence of the 50 sma and the descending trendline. A move above $51 the 200 sma could see a brighter outlook for the share price and bring $52.50 the June high into focus.

How to trade Uber shares

You can trade Uber shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Uber’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade