When will XPeng release Q3 earnings?

XPeng will release third quarter earnings on Tuesday November 23.

XPeng Q3 earnings preview: what to expect from the results

XPeng has already revealed that it delivered 25,666 cars in the third quarter, marking a new quarterly record and rising by an impressive 48% from the second quarter. That was ahead of the 21,500 to 22,500 deliveries guided by the company. That means it has delivered 56,404 cars over the first nine months of the year, up over 300% from the year before. Meanwhile, monthly deliveries reached the 10,000 unit mark in September and that was also sustained in October.

XPeng said it was targeting revenue of RMB4,800 to RMB5,000 million in the third quarter but, having delivered more vehicles than anticipated, analysts forecast the firm will report revenue of RMB5,206 million, alongside a gross margin of 13.36% and a net loss of RMB1,177.3 million – with all metrics improving from the year before as well as the previous quarter, as demonstrated by the table below.

|

XPeng |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

Q3 2021E |

|

Deliveries |

8,578 |

12,964 |

13,340 |

17,398 |

25,666 |

|

Revenue (RMB, mns) |

1,990.1 |

2,851.4 |

2,950.9 |

3,761.3 |

5,206.0 |

|

Gross Margin |

4.60% |

4.38% |

11.18% |

11.93% |

13.36% |

|

Net Loss (RMB, mns) |

(2,025.8) |

(787.4) |

(786.6) |

(1,194.6) |

(1,177.3) |

|

Net Loss Per ADS (RMB) |

(2.53) |

(0.53) |

(0.50) |

(1.50) |

(1.03) |

(Source: Bloomberg)

Margins are expected to have improved as the significant increase in scale lowers the cost of producing each vehicle, as well as higher average prices thanks to a greater percentage of sales coming from its pricier P7 sedan. However, XPeng and the wider industry is also facing increased costs amid the pressure being applied to global supply chains, higher commodity prices and the global chip shortage that has hit the automotive industry hard this year.

While XPeng’s gross margin is on an upward trajectory, the company is expected to remain deep in the red as it continues to aggressively expand and release new models.

It opened 40 new stores, 10 new service centres and 72 charging stations in the first half of 2021 alone and that is expected to have accelerated in the second.

Meanwhile, it only started delivering its new G3 and G3i SUVs as well as its range of P5 family sedans in September, and it has just announced that it is launching its first car purposefully designed with the international market in mind. The new G9 flagship SUV was unveiled at the Guangzhou International Automobile Exhibition and is packed with XPeng’s latest software and hardware.

‘G9 is our first model to be conceived and developed from the ground up for both the international and Chinese markets, demonstrating our commitment to the international markets and bringing our most sophisticated designs to our customers worldwide,’ said co-founder and president Henry Xia.

XPeng shares have lost over one-third in value since peaking at all-time highs back in November 2020. That has been a steeper fall than fellow Chinese carmaker NIO has experienced over the past year, while BYD’s shares on the Shenzhen stock exchange have jumped over 55% during the past 12 months. It is also worth noting that XPeng shifted more vehicles in the third quarter than NIO, which delivered 24,439 cars, but that XPeng’s $40.5 billion valuation trails its rival’s market cap of over $58.0 billion. With that in mind, XPeng is forecast to grow revenue at a faster rate than NIO, BYD, and other major Chinese EV companies Li Auto and CATL both this year and next.

Plus, the likes of NIO and XPeng demand significantly lower valuations than the new wave of US EV companies to have hit the market this year such as Rivian (over $100 billion) and Lucid Group (over $77 billion) – despite the fact the Chinese automakers are starting to shift notable volumes while their US counterparts have only just started production.

The 20 brokers that cover XPeng are bullish on the stock and have a Buy rating with an average target price of $56.28, implying there is over 17% potential upside from the current share price.

Where next for the XPeng share price?

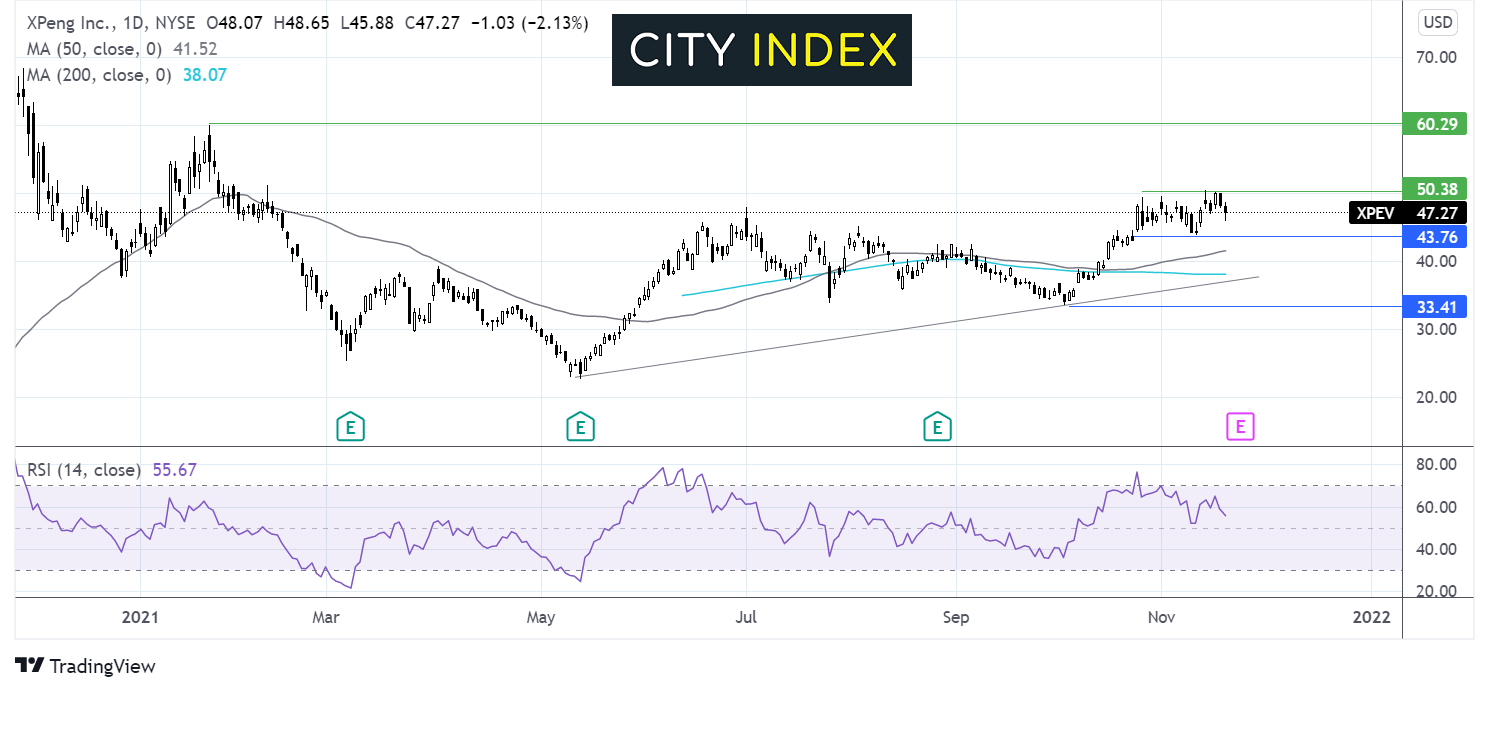

The XPeng ADR share price has been steadily rising since May 12. It trades above its 50 and 200 sma.

However, more recently, the share price has been trading range bound capped on the upper band by $50.40 and on the lower band by $43.75.

Traders might look for a breakout trade with buyers waiting for a move over $50.40 to target $60.00, the 2021 high.

Meanwhile sellers might look for a move below $43.75 for further downside. Support can then be seen at $41.50, the 50 sma, and $38.25, the 200 sma. It would take a move below $33.40, the October low, to negate the longer-term uptrend.

How to trade XPeng shares

You can trade XPeng shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘XPeng’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade